Consumer banking

Consumer banking

-

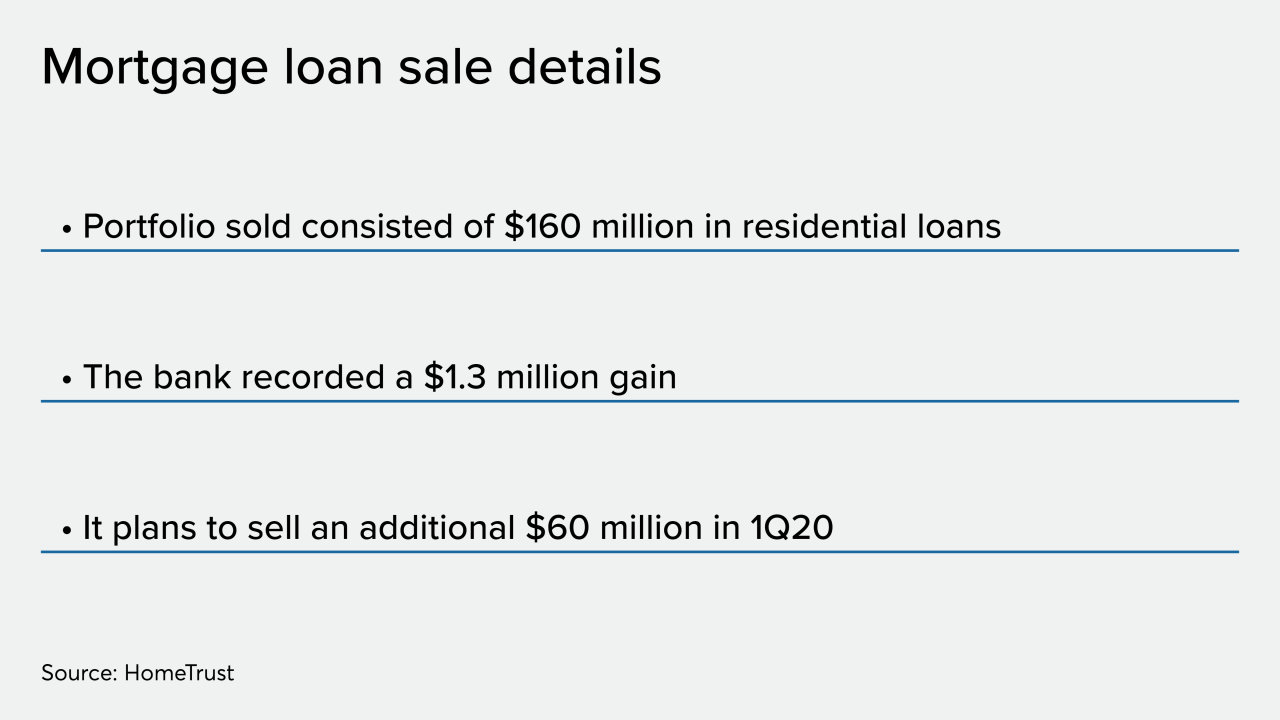

HomeTrust Bancshares in Asheville, N.C., sold a portfolio of residential mortgages as part of a balance sheet restructuring, with plans to sell more.

December 20 -

The company will hold off on making loans under the Advantage Loan program as it conducts an audit and implements new policies and procedures.

December 9 -

The percentage of farm lenders losing money hit a six-year high in the third quarter, according to the FDIC.

December 5 -

Yale researchers have recommended several consumer banking products and services that could help those with mental health challenges manage their money.

November 26 -

David Becker, who founded First Internet Bank two decades ago, says traditional banks' digital-only ventures are only making his bank look more mainstream.

November 26 -

In recent months federal regulators have been speaking out on the risks that extreme weather events pose to the financial system, something their European counterparts have been doing for some time.

November 18 -

Stephen Calk, who faces a bribery charge in connection with loans his bank made to former Trump campaign chair Paul Manafort, is asking a judge to suppress evidence that prosecutors obtained from his mobile phone.

November 18 -

Such credits, which reflect borrowers with financial challenges, increased significantly during the third quarter.

November 13 -

The FDIC ordered the Seattle bank to pay a nearly $1.4 million fine tied to improper agreements with real estate brokers and homebuilders.

November 6 -

Prosper hopes to do for lines of credit what it did for unsecured personal loans, while BBVA hopes to provide a better experience for customers.

November 4 -

CIT Group has agreed to lend and invest the money mostly in California as well as in the eight states where Mutual of Omaha Bank has branches.

November 1 -

The Dallas company said it should be able to avoid restating past financial results. It also reported higher quarterly earnings helped by increased mortgage activity.

November 1 -

Startups are increasingly expanding into new areas with their bank partners in an effort to broaden their customer base and bring products to market faster.

October 29 -

The National Credit Union Administration has unveiled a proposal to address a federal judge's concerns that its 2016 field-of-membership overhaul could discourage lending in low-income areas.

October 24 -

Malaga Financial has no intention of diversifying its portfolio despite heavier competition and potential funding challenges.

October 20 -

The four prudential agencies, which will enforce the new credit loss methodology developed by the Financial Accounting Standards Board, said they want to promote consistency.

October 17 -

The Minneapolis company attributed the uptick to new tech tools, additional loan officers and other process improvements — not to mention the refi boom fueled by lower rates. It’s a formula other banks are expected to copy.

October 16 -

The Minneapolis bank says recent investments in its retail operation contributed to strong improvement in home lending and mortgage banking fees.

October 16 -

The court passed up a recent opportunity to clarify confusion about Americans with Disabilities Act requirements for business websites, raising concerns among bankers that they could become an even more inviting litigation target.

October 9 -

Charles Scharf’s most immediate priorities will be mending fences with regulators and getting the bank out from under a Fed-imposed asset cap. But he also must come up with strategies for spurring revenue growth and reining in expenses.

September 27