Consumer banking

Consumer banking

-

Minorities are still charged more for mortgages when all other applicable credit factors are equal — both in person and online, according to a new study by the University of California, Berkeley.

November 26 -

The effort to raise the threshold for transactions excused from appraisal requirements responds to concerns that the current threshold is outpaced by real estate prices.

November 20 -

Online personal lending pioneer Prosper is developing a home equity line of credit product that it will offer in partnership with banks. The embrace of traditional depositories marks a departure from fintech lenders that typically seek to disrupt and displace legacy institutions.

November 14 -

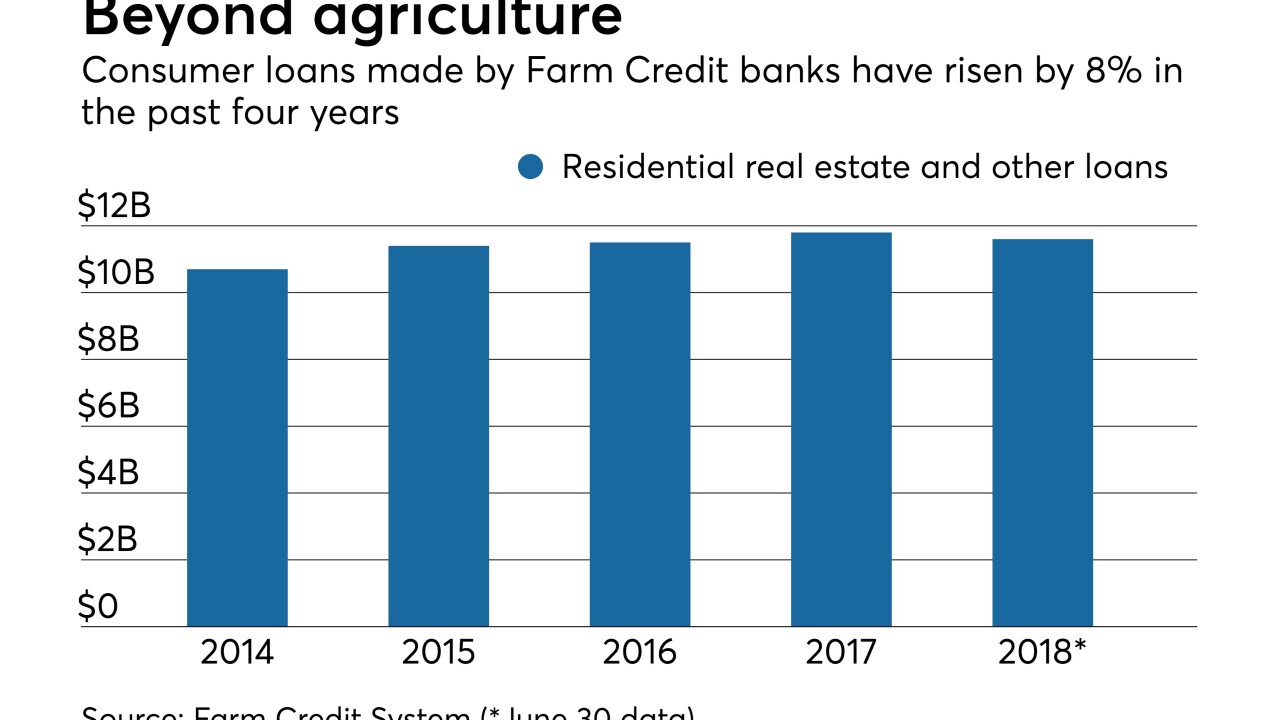

Bankers complain that the quasi-governmental system's new program designed to make more residential loans in four states goes well beyond its original mission.

October 31 -

A deal between TD Bank and a Vermont nonprofit is just one example of how banks are getting creative in addressing affordable housing needs while reaping financial and regulatory benefits.

October 30 -

City National Bank said the foundation will buy houses and hold onto them until the buyer lines up financing.

October 25 -

In a move designed to improve access to financial products for consumers with low credit scores and short credit histories, Experian, FICO and Finicity are developing an "UltraFICO" score that lets individuals share checking and savings account data and help lenders better assess risk.

October 22 -

The company is facing criticism after a big chargeoff on two properties, showing that investors have little patience when a risky business model shows signs of distress.

October 19 -

The Providence, R.I., company reported a 27% gain in profits thanks partly to a boost in fee income from its purchase of Franklin American Mortgage in August.

October 19 -

The Office of the Comptroller of the Currency lowered the $14 billion-asset thrift in Cleveland to “needs to improve” from "satisfactory."

October 3 -

Bank of America is taking what consumers are accustomed to on the banking side and applying that to its lending division to offer a consistent digital experience, says John Schleck, the bank’s senior vice president.

October 2 -

First Foundation sold loans to Freddie Mac to free up space for higher-yielding credits. It then bought the securities that were formed to replace other, lower-yielding assets through an often overlooked program.

October 1 -

The cuts are part of a broader effort to trim expenses by roughly $3 billion a year by 2020.

September 20 -

The changes mandated by the recent regulatory relief law would narrow the definition of "high-volatility commercial real estate" exposures that get a higher risk weight.

September 18 -

Casey Crawford, CEO of Movement Mortgage, bought First State Bank in Virginia last year. He has since injected more capital into the bank in an effort to reinvent it.

September 10 -

The Ohio company agreed to buy TransCounty Title Agency, which has five offices around Columbus.

September 4 -

A number of banks have stepped up efforts to lend to residential developers, though they are mindful of missteps made before the financial crisis.

August 20 -

The Michigan company had been operating under the supervisory agreement since 2010.

August 17 -

Steve Calk, the head of The Federal Savings Bank, was a "co-conspirator" in an effort to defraud the Chicago bank, a prosecutor said at the trial of former Trump campaign chair Paul Manafort. Could Calk be charged with a crime?

August 13 -

Stephen Calk, the CEO of The Federal Savings Bank, expedited approval of a mortgage to the onetime Trump campaign chair in hopes of winning a job as Treasury secretary or housing secretary, a former bank employee testified Friday.

August 10