-

The 10-digit penalty marks an important milestone for the bank, but individual ex-bankers may still be at risk and grueling hearings lie ahead for current leadership.

February 21 -

A deferred-prosecution agreement with the Justice Department spares the bank a potential criminal conviction — provided it cooperates with continuing probes and abides by other conditions.

February 21 -

A new National Credit Union Administration proposal would raise the threshold for residential mortgages that require appraisals. However, the final rule is by no means a done deal.

November 21 -

The National Credit Union Administration has unveiled a proposal to address a federal judge's concerns that its 2016 field-of-membership overhaul could discourage lending in low-income areas.

October 24 -

Count Citizens Financial’s Bruce Van Saun among those who think interest rate cuts could halt by mid-2020. The key, he says, is to focus on delivering services customers are willing to pay fees for and to skillfully reprice deposits until then.

October 18 -

Charles Scharf’s most immediate priorities will be mending fences with regulators and getting the bank out from under a Fed-imposed asset cap. But he also must come up with strategies for spurring revenue growth and reining in expenses.

September 27 -

Business intelligence software from a compensation management technology provider and an auto-fulfillment service for disclosures were among new offerings introduced by companies at Digital Mortgage.

September 24 -

The industry has taken some steps to lower barriers to affordable housing, but some observers say that more can be done.

September 5 -

Syracuse Securities Inc., a family-run lender and servicer in New York, is planning to wind down and transfer its outstanding pipeline to Premium Mortgage Corp.

September 4 -

Sheila Bair, who holds board seats at several other organizations, will sit on Fannie's compensation, corporate governance and risk policy committees.

August 21 -

The Delaware company, best known for issuing prepaid cards, has ramped up commercial real estate securitizations. The shift promises to deliver big fees, but it could also cause headaches if defaults spike.

July 30 -

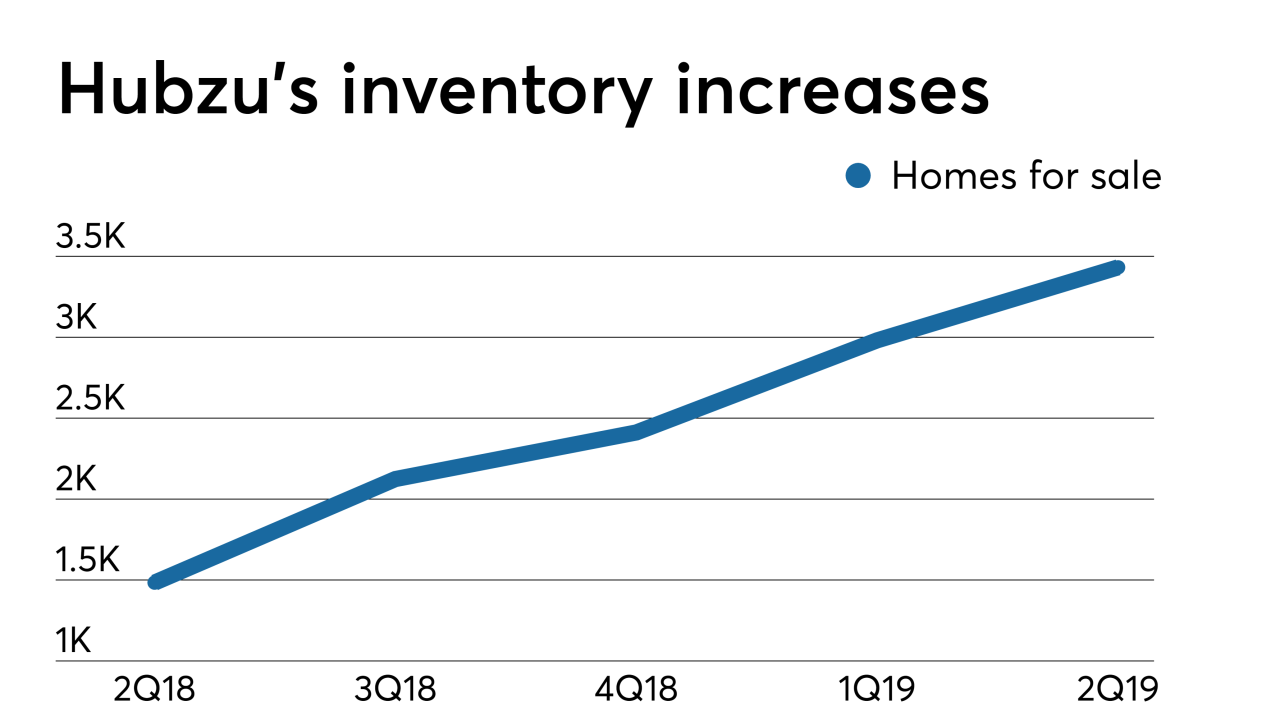

Altisource Portfolio Solutions cut its previous-quarter net loss by 49% in its most recent fiscal period, when property maintenance revenue and new Hubzu real estate auction site inventory increased.

July 25 -

While regulation and nonbank competition are spooking some banks, others believe low funding costs and the right relationships can help them succeed.

May 21 -

Americans continued to take on debt in the first quarter, though new mortgage borrowing slowed to the weakest level since late 2014, according to a Federal Reserve Bank of New York report.

May 14 -

Marianne Lake, seen in recent months as a leading candidate to replace CEO Jamie Dimon, got the post she may have needed to round out her resume — consumer lending chief. And Jennifer Piepszak, another rising star at the company, will take over as CFO from Lake.

April 17 -

Gateway Mortgage Group’s dream of being a national, diversified financial services player will hinge on its effort to turn a community bank into an online-only platform.

April 9 -

Tim Sloan couldn't hang on any longer. Here are insights about why he left now, what role policymakers played in the decision and will continue to have in the company's future, and who in the world would want to lead Wells Fargo.

March 28 -

Borrowers were more than twice as likely to use a lender they found online in 2018 as they were in 2017, making search engines the mortgage industry's top source of referrals.

March 12 -

Wells Fargo CEO Tim Sloan said that the megabank has worked to address past issues and is equally committed to preventing new problems from arising, despite reports suggesting otherwise.

March 11 -

The Federal Reserve Bank of New York is streamlining its Ginnie Mae holdings by combining mortgage-backed securities with similar characteristics into larger pass-through instruments.

February 25