-

An increase in millennials making home purchases is a call to the mortgage industry for a quicker, more efficient digital process.

August 1 -

Loan defect risk rose in only three states and a handful of metropolitan regions in June thanks to the continuing spread of digital mortgage initiatives that improve data quality.

July 31 -

As the mortgage industry continues evolving digitally, MISMO is developing standards for business-to-consumer transactions on mobile devices, according to the Mortgage Bankers Association.

July 25 -

Startup LoanSnap, a company funded in part by Virgin Group founder Richard Branson, has launched artificial intelligence that matches consumers with mortgages based on a complex analysis of their financial situation.

July 20 -

As purchase mortgages continue to dominate overall industry volume, lenders aren't letting the extra work required to close these loans affect their productivity.

July 18 -

Bank of America's residential mortgage origination volume fell short of last year's in its second-quarter earnings despite gains from digital sales and seasonal home buying, and broader consumer lending strength.

July 16 -

Optimal Blue is expanding its reach in the secondary mortgage market by acquiring Resitrader, a whole-loan trading marketplace that has integrations with Fannie Mae and Freddie Mac.

July 10 -

KB Home attributed significant growth in its building and mortgage income to first-time homebuyer activity and new lending technology in its fiscal second quarter.

July 2 -

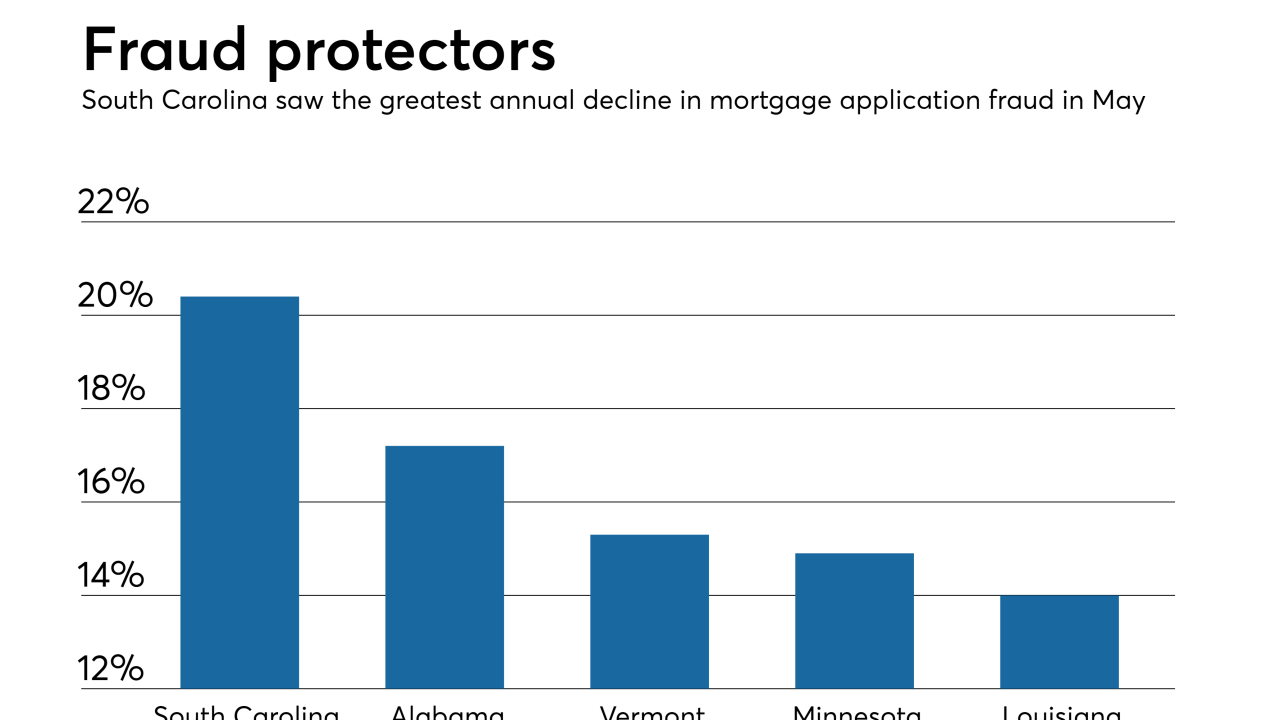

While purchase mortgages account for a growing share of overall volume, industrywide investments in more automated and efficient underwriting processes have helped lower instances of fraud.

June 28 -

While the digital mortgage movement has primarily focused on the originations side of lending, Black Knight's latest release seeks to apply those principles to servicing to help improve borrower retention and engagement.

June 25