-

-

What the initiation of the California Consumer Privacy Act means for the mortgage industry.

December 2 -

In a recent interview, Plaza Home Loans CEO Kevin Parra discussed why he likes certain underutilized loan products, thinks online lending will be limited, and is bullish on third-party originations.

December 2 -

In a recent interview, Plaza Home Mortgage CEO Kevin Parra discussed why he likes certain underutilized loan products, thinks online lending will be limited, and is bullish on third-party originations.

December 2 -

The former head of the Office of Federal Housing Enterprise Oversight explains why he thinks the mortgage industry is closer than ever to having a truly paperless process, and weighs in on GSE reform.

November 22 -

Roostify is working with Level Access — a software provider enabling disabled people access to technology — to offer Americans with Disabilities Act compliant websites and mobile applications.

November 15 -

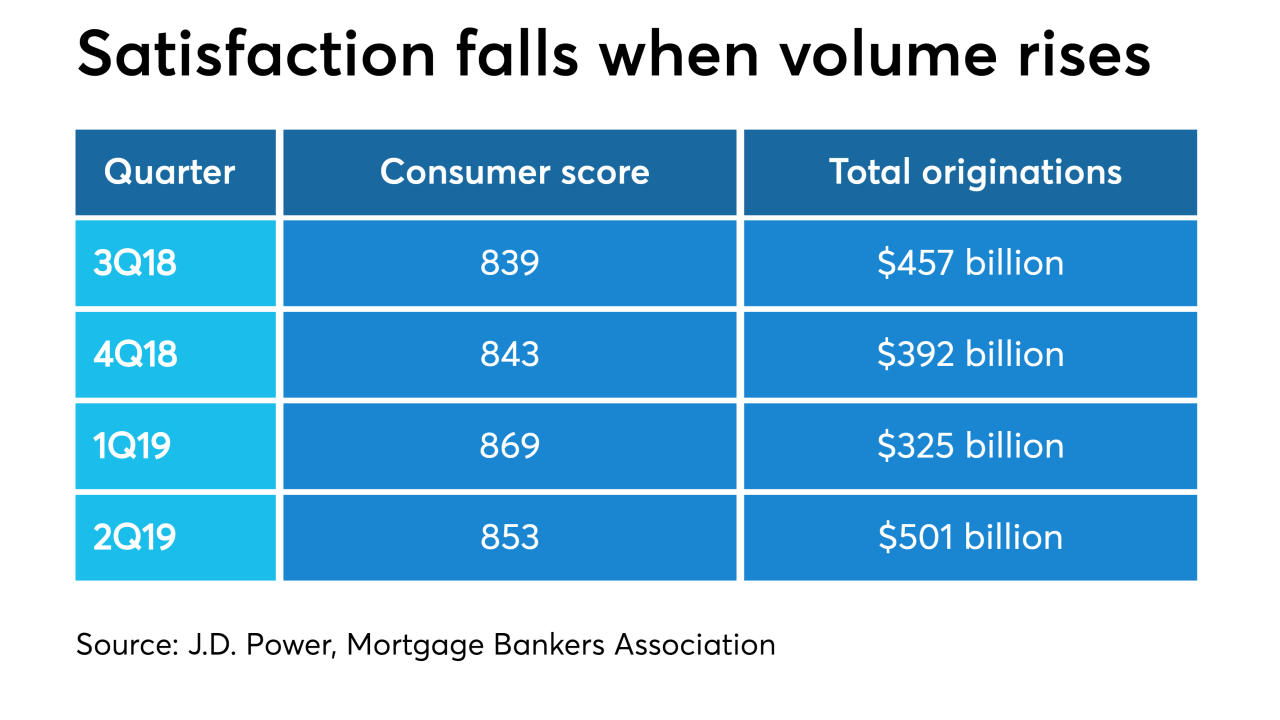

Consumer mortgage originator satisfaction scores fell in the second quarter as lenders had to work through the increase in application activity, a J.D. Power report said.

November 14 -

-

In the latest example of a new wave of mortgage-related fintech investment, Snapdocs will boost its artificial-intelligence capabilities with its new $25 million funding round.

November 7 -

-

Brent Chandler of FormFree, Tim Mayopoulos of Blend and Tamra Rieger of Evergreen Home Loans share their Digital Mortgage 2019 highlights

November 7 -

Rick Lang of Freddie Mac, Tim Mayopoulos of Blend and Tamra Rieger of Evergreen Home Loans discuss the key objectives – from customer experience to system integrations – that mortgage companies are pursuing through digitalization.

November 7 -

Aaron King of Snapdocs, Brent Chandler of FormFree, Tim Mayopoulos of Blend, and Chris Backe of Ellie Mae talk about system fragmentation, data access issues, personnel management and other hurdles that still stand between the industry and comprehensive digitalization.

November 7 -

-

Black Knight and PennyMac Financial Services are suing each other in separate disputes linked respectively to the latter's creation of a servicing platform and the former's dominant position in the market.

November 6 -

-

The Mortgage Bankers Association's annual convention rolled through Austin, Texas, this year, leaving behind important announcements and implications for the future of the mortgage industry.

October 30 -

Ginnie Mae is looking for input on its proposed guidelines for electronic promissory notes and other mortgage documents that it plans to test through a digital collateral pilot.

October 28 -

PointPredictive has rolled out IncomePASS, which uses machine learning technology to determine if the borrower's income as stated on the application is realistic.

October 25 -

Denver beat out Salt Lake City to snag another technology firm looking to escape the Bay Area's escalating costs.

October 24