-

Only a fraction of mortgage borrowers return to their servicers to originate or refinance a mortgage loan, and it may be the industry's fault for not exhausting enough effort to keep them around.

February 27 -

Fewer mortgage borrowers are falling behind on their payments, and consumers' broader borrowing habits indicate an increased willingness to turn to nontraditional sources like fintechs for their lending needs, according to TransUnion.

February 22 -

With its latest round of funding, the mortgage fintech company will continue to build its digital platform, with a goal of reducing the complexities and costs of home buying.

February 21 -

The company will shutter the offices it inherited when it bought EverBank in 2017 and focus on lending to existing customers through digital channels. U.S. Bank will assume the leases on about 25 properties.

February 21 -

Through digital validation and intelligent data automation, borrowers will know if their loan would be approved in as little as seven minutes and be able to close in eight days, according to loanDepot.

February 20 -

A digital mortgage startup called Brace is using machine learning to automate loss mitigation and has lined up backing from several venture capital sources, including a fund with high-profile investors like Amazon founder Jeff Bezos.

February 19 -

With a growing market share of home sales and wider breadth of services, Redfin posted significant annual revenue gains.

February 15 -

The private equity acquisition of the fintech vendor Ellie Mae will give it some breathing room in a declining originations market because it will have a more patient and strategic investor than its myriad shareholders as a public company.

February 13 -

Black Knight reported lower net earnings, but higher revenue in the fourth quarter compared with the previous year, driven by growth in the company's software segment.

February 13 -

The mortgage loan origination system developer Ellie Mae is going private, agreeing to be acquired by the private equity firm Thoma Bravo in an all-cash transaction valued at $3.7 billion.

February 12 -

Ellie Mae's latest update to the Encompass loan origination system includes templates to help mortgage lenders with Americans with Disabilities Act compliance.

February 11 -

SunTrust’s merger with BB&T is the largest bank deal since the financial crisis, and mortgages will play a critical role in the execution of this transaction.

February 7 -

To bring millennials to the table, mortgage lenders must overcome misconceptions about the role technology plays in the way this generation buys homes.

February 6 Blend

Blend -

A significant percentage of consumers are willing to turn to technology companies for their financial needs, including applying for a mortgage, although they have trust issues with them, a Fannie Mae report said.

February 5 -

Community banks generally make digital a consumer play, but TransPecos Bank, with its BankMD brand, is focusing on doctor practices, which tend to weather economic downturns well.

February 1 -

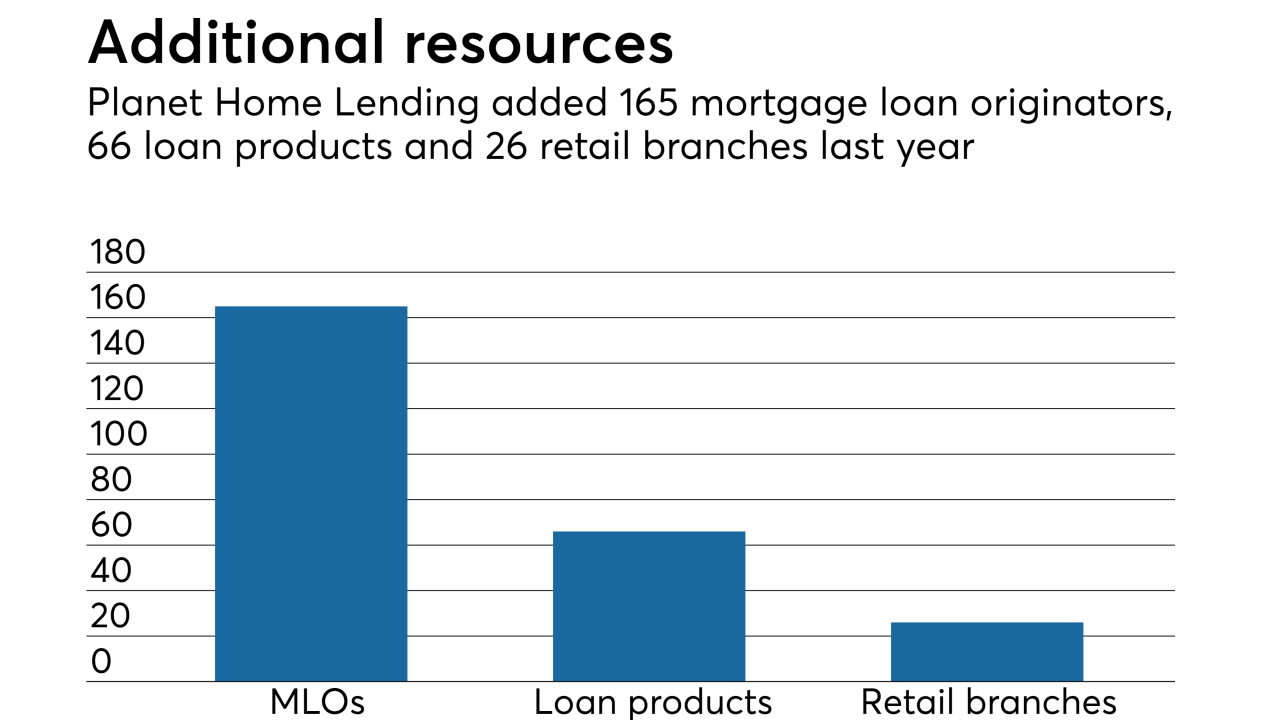

Planet Home Lending is finding ways to grow in an uncertain rate environment by diversifying its products and expanding its retail branch network.

January 30 -

With its new round of funding, the mortgage fintech company will look to expand its geographic reach and reduce the mortgage closing process to a week in 2019.

January 29 -

As suspense builds over which firm will be the first to seek the special-purpose charter, a side discussion has emerged over which financial services sector has the most to gain — or lose — from the new option.

January 27 -

Timothy Mayopoulos is back in the mortgage industry, becoming the new president of the digital mortgage technology developer Blend, months after leaving his post as Fannie Mae’s CEO.

January 22 -

MGIC Investment Corp. responded to the broad-based roll out of "black box" pricing engines from the other mortgage insurers by bringing its version to market.

January 17