-

Ellie Mae's latest update to the Encompass loan origination system includes templates to help mortgage lenders with Americans with Disabilities Act compliance.

February 11 -

SunTrust’s merger with BB&T is the largest bank deal since the financial crisis, and mortgages will play a critical role in the execution of this transaction.

February 7 -

To bring millennials to the table, mortgage lenders must overcome misconceptions about the role technology plays in the way this generation buys homes.

February 6 Blend

Blend -

A significant percentage of consumers are willing to turn to technology companies for their financial needs, including applying for a mortgage, although they have trust issues with them, a Fannie Mae report said.

February 5 -

Community banks generally make digital a consumer play, but TransPecos Bank, with its BankMD brand, is focusing on doctor practices, which tend to weather economic downturns well.

February 1 -

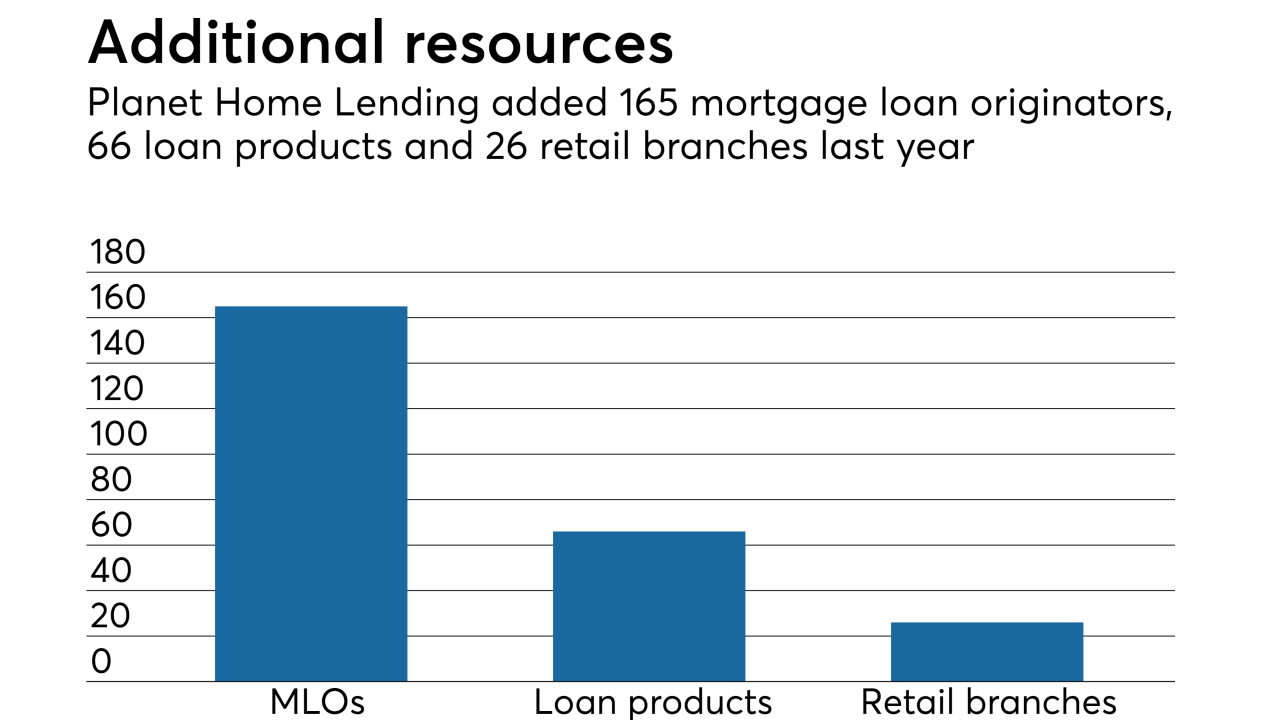

Planet Home Lending is finding ways to grow in an uncertain rate environment by diversifying its products and expanding its retail branch network.

January 30 -

With its new round of funding, the mortgage fintech company will look to expand its geographic reach and reduce the mortgage closing process to a week in 2019.

January 29 -

As suspense builds over which firm will be the first to seek the special-purpose charter, a side discussion has emerged over which financial services sector has the most to gain — or lose — from the new option.

January 27 -

Timothy Mayopoulos is back in the mortgage industry, becoming the new president of the digital mortgage technology developer Blend, months after leaving his post as Fannie Mae’s CEO.

January 22 -

MGIC Investment Corp. responded to the broad-based roll out of "black box" pricing engines from the other mortgage insurers by bringing its version to market.

January 17 -

As the industry shuffles closer to completely digital mortgages, the next wave of technology aims to usher in total automation and uniformity.

January 16 -

Radian and Essent will make their "black box" mortgage insurance pricing methods live on Jan. 21, leaving MGIC as the only company yet to announce its adoption.

January 14 -

The mortgage industry faces myriad questions and challenges in 2019. Here's a look at 12 executives who will be behind the waves being made this year.

January 8 -

Mr. Cooper Group is buying servicing rights on $24 billion in mortgages, a subservicing contract for an additional $24 billion in home loans and the Seterus platform from IBM.

January 3 -

A new marketing tool lets consumers start the mortgage prequalification process by sending a text message, providing would-be borrowers with credit and loan program details and offering lenders a low-cost source of leads.

January 3 -

The expected decline in conventional mortgage volume may open the door for more non-qualified mortgage lending as secondary market investors seek new opportunities to deploy capital, says Tom Millon, CEO of Capital Markets Cooperative.

December 28 -

Mortgage technology is rapidly advancing, with incumbents and new entrants scrambling to take advantage of developments in artificial intelligence and automation. The goal? Beat the customer expectations set by Amazon and Uber, not just other lenders, says KPMG Managing Director Teresa Blake.

December 28 -

As the mortgage industry braces for even more market uncertainty in 2019, emerging technologies that improve the borrower experience and streamline back-office tasks may provide a glimmer of hope to beleaguered lenders.

December 26 -

Mortgage servicing assets are poised for gains in 2019. But as higher average mortgage rates spur lenders to sell servicing rights and diversify their loan offerings, servicers' work will also get more complicated and costly.

December 24 -

A year ago, National Mortgage News made five predictions regarding how the mortgage industry would fare in 2018 — and we got four of them right.

December 21