-

KB Home attributed significant growth in its building and mortgage income to first-time homebuyer activity and new lending technology in its fiscal second quarter.

July 2 -

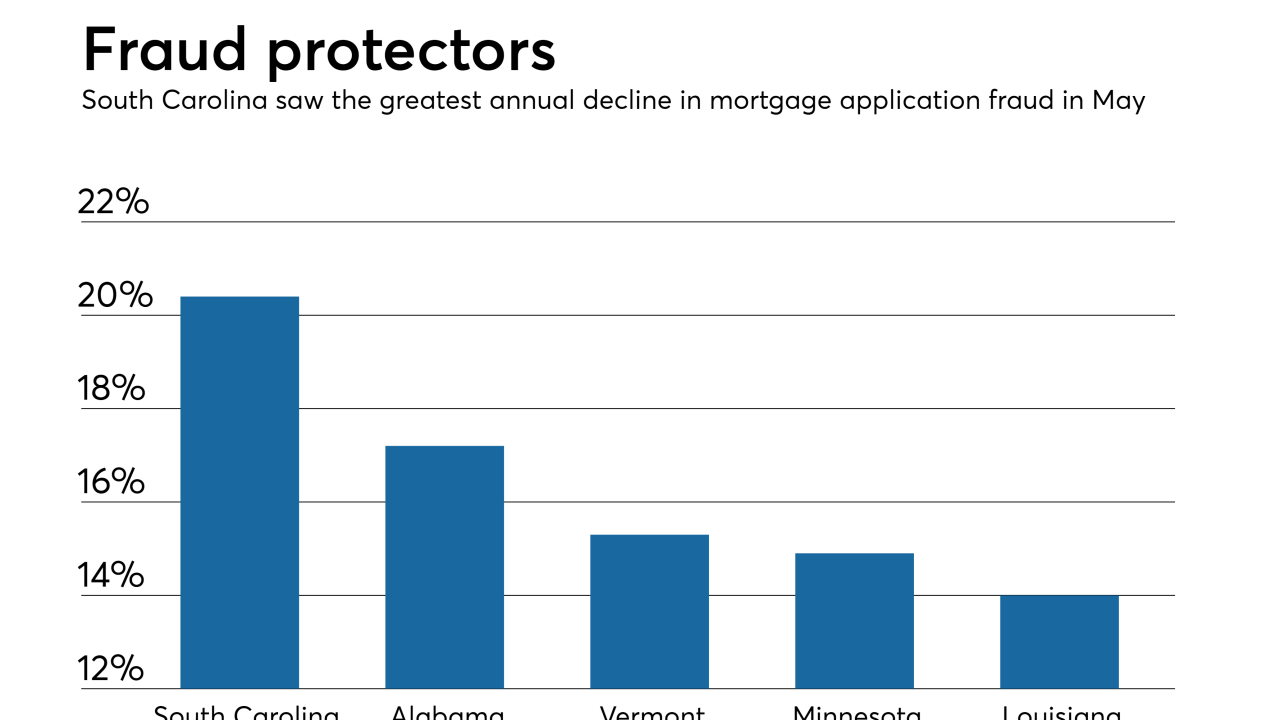

While purchase mortgages account for a growing share of overall volume, industrywide investments in more automated and efficient underwriting processes have helped lower instances of fraud.

June 28 -

While the digital mortgage movement has primarily focused on the originations side of lending, Black Knight's latest release seeks to apply those principles to servicing to help improve borrower retention and engagement.

June 25 -

Ginnie Mae is looking to start a pilot program to securitize digital mortgages as early as 2019, but issuers would not be able to commingle loans using traditional paper files in those deals.

June 20 -

Paycheck information gleaned from bank accounts is emerging as an alternative to verifying a mortgage applicant's income and employment with a 4506-T tax transcript request to the IRS.

June 20 -

With its acquisition of artificial intelligence and machine learning developer HeavyWater, Black Knight is turning to its Artificial Intelligence Virtual Assistant to streamline the mortgage process, with an immediate focus on the originations sector.

June 6 -

Black Knight has acquired HeavyWater, a developer of artificial intelligence and machine learning technology for the mortgage industry, and plans to incorporate the startup's borrower data verification and other automation capabilities into its existing product suite.

June 4 -

Promontory MortgagePath fills management roles for bank relations, technology and outsourced services opportunities.

May 31 -

Fannie Mae is warning mortgage lenders and servicers about possible fraud schemes in Los Angeles County involving "34 apparently fictitious employers being used on loan applications."

May 30 -

To make its technology more relevant to the mortgage industry, Fannie Mae is taking a new approach to developing tools that engages lenders earlier in the process and makes lending more efficient.

May 29 Fannie Mae

Fannie Mae -

A new integration between Blend and Ellie Mae seeks to improve the use and accessibility of electronic mortgage documents, the latest in an ongoing industry effort to create a more simplified and consistent borrower experience.

May 24 -

Digital mortgage efficiencies span from origination to the secondary market and beyond, but something as small as a low-quality image in the loan file can cause headaches with investors.

May 23 -

From the latest economic news to the latest developments in digital mortgages, here's a look at six things we learned at the MBA Secondary Conference 2018.

May 23 -

The Ginnie Mae 2020 report coming out this summer will reveal the path the agency is taking toward working with digital mortgages, an agency executive said at an industry conference.

May 22 -

Mick Mulvaney’s recent comments about the CFPB Qualified Mortgage rule have triggered a debate over whether regulators should take into account more than one underwriting model.

May 17 -

Acting CFPB Director Mick Mulvaney suggested that digital mortgages should be held to different standards than ones originated by credit unions and banks.

May 15 -

As the mortgage industry makes more strides with technology, the time it took millennials to close loans for new-home purchases shrank to its fastest time yet.

May 2 -

When it comes to purchasing a home, buyers have to put a lot of research and thought into any decision they make. From finding the best fit with a real estate agent, to how much work they are willing to do on move-in day, setting a budget and of course, picking the house itself.

May 1 -

Ellie Mae's first-quarter net income of a little over $2 million was lower than last year's due to some one-time expenses, but continuing operations numbers exceeded analysts' expectations.

April 27 -

From the latest developments in digital mortgages to information about agency technology implementation, here's a look at eight things we learned at the 2018 MBA Tech conference.

April 18