-

Craig Phillips, who has been developing the Trump administration's plan to help free Fannie Mae and Freddie Mac from conservatorship, will leave Treasury next month.

May 16 -

The Consumer Financial Protection Bureau proposed steps to ease Home Mortgage Disclosure Act requirements, just days after announcing it was retiring a platform to let users analyze raw mortgage data.

May 2 -

In the face of tough questioning from House members, CFPB Director Kathy Kraninger appeared mostly unfazed and tried to strike a balance between heeding concerns about the agency’s power and supporting its mission to help consumers.

March 7 -

Sen. Sherrod Brown, D-Ohio, said "the best place for me to continue fighting for Ohio and for the dignity of workers ... is to stay in the U.S. Senate."

March 7 -

House Financial Services Chairwoman Maxine Waters said the merger is a direct result of a regulatory relief bill that was signed into law in May.

February 7 -

The Consumer Financial Protection Bureau has published a new "frequently asked questions" tool to help mortgage lenders with TILA-RESPA integrated disclosures compliance.

February 1 -

The same TILA-RESPA integrated disclosure errors continue to plague mortgage lenders, though those documents have been required for over three years, a report from MetaSource said.

January 29 -

As required by the Dodd-Frank Act, the bureau released long-awaited "look-back" reviews to assess the impact of mortgage underwriting and servicing rules on the industry and the credit markets.

January 10 -

The Massachusetts progressive said in a New Year's Eve email and video message to supporters that she’s launching an exploratory committee for a 2020 bid, which could give her an early edge in fundraising among several potential rivals for the Democratic Party nomination.

December 31 -

Rep. Maxine Waters, D-Calif., will take the gavel on the Financial Services Committee next term.

December 24 -

Kathy Kraninger's first official action as head of the Consumer Financial Protection Bureau is to reverse course on acting chief Mick Mulvaney's effort to rename it the Bureau of Consumer Financial Protection, which consumer groups and others had sharply criticized as confusing and costly.

December 19 -

A proposal allowing more lenders to skip outside appraisals could remove a hurdle to quick closings, but appraisers say they could be collateral damage.

December 17 -

A motion to limit debate on the nominee to run the consumer bureau passed along strictly party lines, setting the stage for her to be confirmed as early as next week.

November 29 -

Ginnie Mae officials are concerned about unusual activity with Department of Veterans Affairs cash-out refinances and are investigating the causes, as well as whether predatory lenders are taking advantage of veterans.

November 12 -

Regulators typically write rules before applying them. But the CFPB is attempting the reverse.

November 11 -

The consumer bureau’s interim chief told an industry conference that “regulation by enforcement is done.”

October 15 -

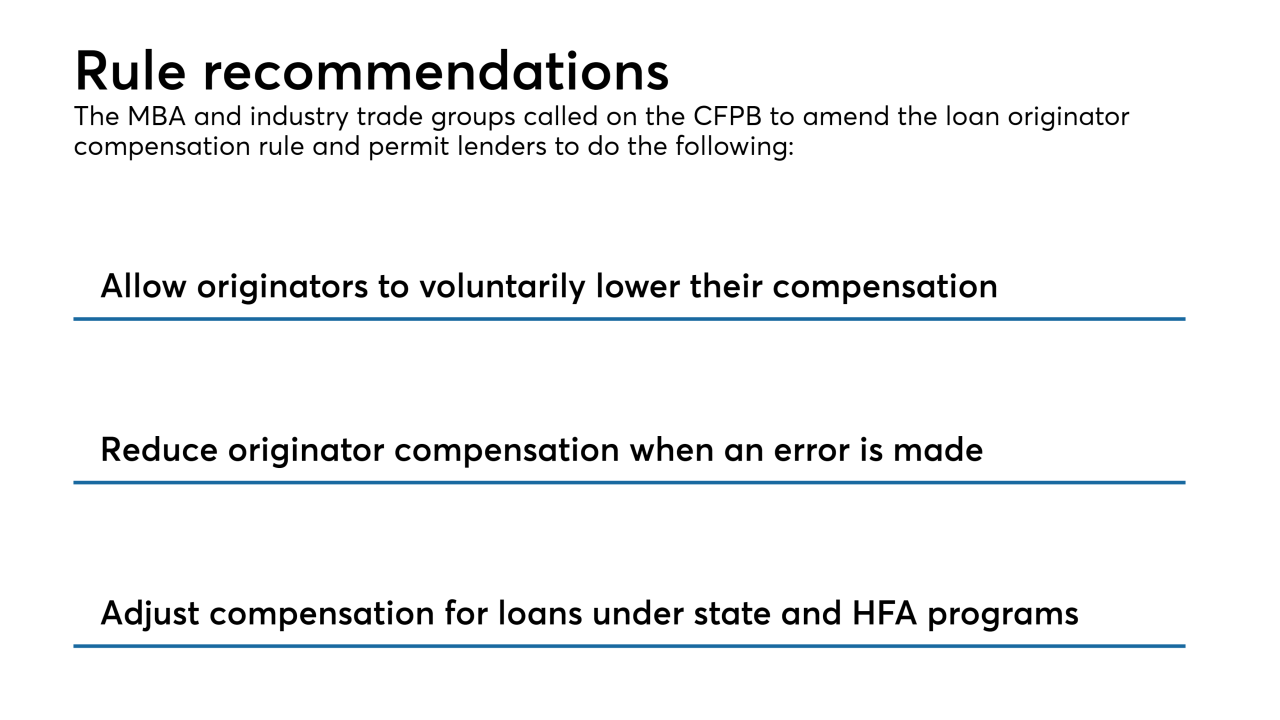

The mortgage industry is calling on the Consumer Financial Protection Bureau to revise its Loan Originator Compensation rule in favor of better protection for consumers and lesser regulatory burdens for lenders.

October 1 -

The central bank said the proposal is intended to eliminate duplication of rules for entities covered by the Secure and Fair Enforcement for Mortgage Licensing Act of 2008.

September 21 -

In its proposed “disclosure sandbox,” the bureau has eased restrictions on firms seeking a safe harbor from liability.

September 17 -

The central bank, which received broad authority after the crisis to supervise big banks, is expected to get more attention from lawmakers over its discretion to ease banks’ burden.

September 10