-

Steve Daines of Montana, Bill Hagerty of Tennessee and Cynthia Lummis of Wyoming are joining the panel for the 117th Congress.

February 4 -

Following similar decisions by big banks, the Consumer Bankers Association and Mortgage Bankers Association said they will halt all political contributions to elected officials as some lawmakers face harsh criticism for comments that incited the storming of the U.S. Capitol.

January 11 -

The organizations renewed pledges to work with the incoming Biden administration.

January 7 -

Treasury Secretary Steven Mnuchin has all but ruled out letting Fannie Mae and Freddie Mac exit U.S. control before he steps down, leaving it to the Biden administration to decide the fates of the mortgage giants.

December 15 -

The head of the House Financial Services Committee is already exerting influence by handing the president-elect a laundry list of Trump regulatory policies that she wants the incoming administration to reverse.

December 10 -

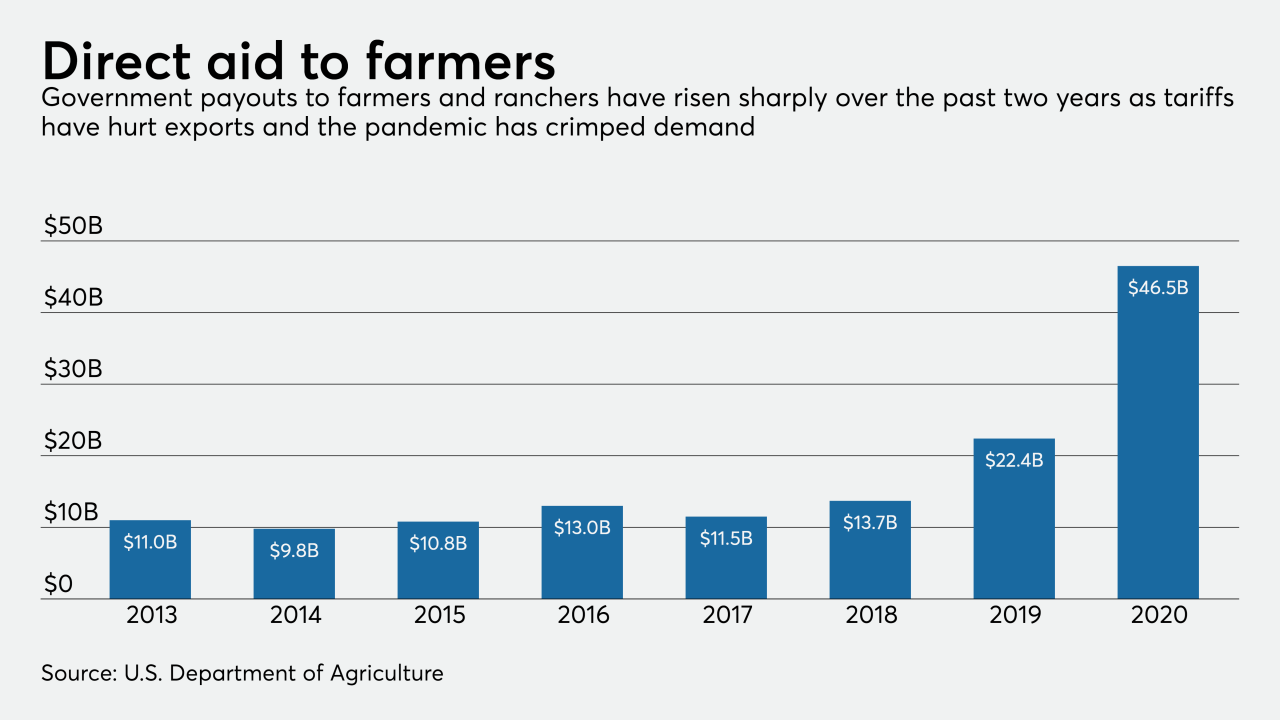

The Biden administration could curtail federal support for farmers, even with bankruptcies and requests for loan workouts on the rise. Banks are hoping that increases in crop prices and exports to China could help avert a credit crisis.

December 10 -

The president-elect has legal backing to fire Director Kathy Kraninger thanks to a recent court ruling, but Republicans are prepared to challenge his ability to choose her successor.

November 23 -

If the GOP can hold its majority in the chamber, Sen. Pat Toomey, R-Pa., will likely become the panel's chairman. His ardent support for free-market principles could set up partisan clashes with Democrats over pandemic relief, money laundering rules and more.

November 16 -

Rates could be 50 basis points steeper than the MBA’s current projections, which anticipate the 30-year mortgage will average 3.3% next year, up from nearly 3% this year.

November 16 -

The teams include people who previously worked for the Treasury and the Federal Housing Finance Agency as well as HUD.

November 13 -

With many Americans and members of Congress questioning the results of the presidential election, financial services trade associations quickly vowed to work with the incoming administration.

November 11 -

A moderate pick with financial sector ties could upset progressives, while the likely GOP majority in the Senate could balk at a nominee seen as too liberal. Here are some of the candidates.

November 10 -

Plans for a first-time homebuyer tax credit and expanded affordable housing opportunities may be attractive to lenders, but they’re wary of increased regulation.

November 10 -

If Republicans keep their majority, the incoming administration will likely have to pick moderates over progressives to have any chance of getting its nominees approved.

November 9 -

With a Democrat set to take the White House in January, the agenda for agencies like the CFPB could undergo a rapid transformation, housing finance reform could be turned on its head and progressive banking ideas that were unthinkable over the past four years could gain traction.

November 7 -

The ballot measure, which would allow local jurisdictions to expand rent control, had concerned mortgage companies who worried the law would result in a patchwork of different policies that could complicate underwriting and discourage lending.

November 4 -

While Rocket reaches near $1 per share, Fannie Mae and Freddie Mac are seeing declines as their planned exit of conservatorship remains tied to the presidential race.

November 4 -

The race enters a complicated phase that could impact financial markets.

November 4 -

A Democratic victory in Tuesday's election would likely produce new leaders at the CFPB and OCC who could take bank regulation in a sharply different direction. Here are some names potentially under consideration.

November 2 -

With the real estate market in desperate need for more housing stock, some industry leaders are pinning their hopes on governmental policies to make building more affordable. But how the two presidential candidates may approach these issues varies greatly.

October 27