Earnings

Earnings

-

Amid its first post-IPO securitization of loans made outside a regulatory definition for standard products, the company has seen purchases accelerate, but it underperformed by some analysts’ estimates.

November 10 -

The wholesale lender's net income of nearly $330 million factored in a $170.5 million hit from a reduction in its mortgage servicing rights fair value.

November 9 -

The company’s gains, which far exceeded analysts’ expectations, were partially offset by thinner production margins.

November 8 -

The company’s six acquisitions since last March will contribute to increased revenue in both of its software and data and analytics segments.

November 8 -

All six companies, however, remained highly profitable, as the delinquency and forbearance outlook is favorable for the possibility of rising claims payments.

November 5 -

A greater share of the company's future earnings are likely to come from servicing as rates rise, Chief Operating Officer Andy Chang said.

November 5 -

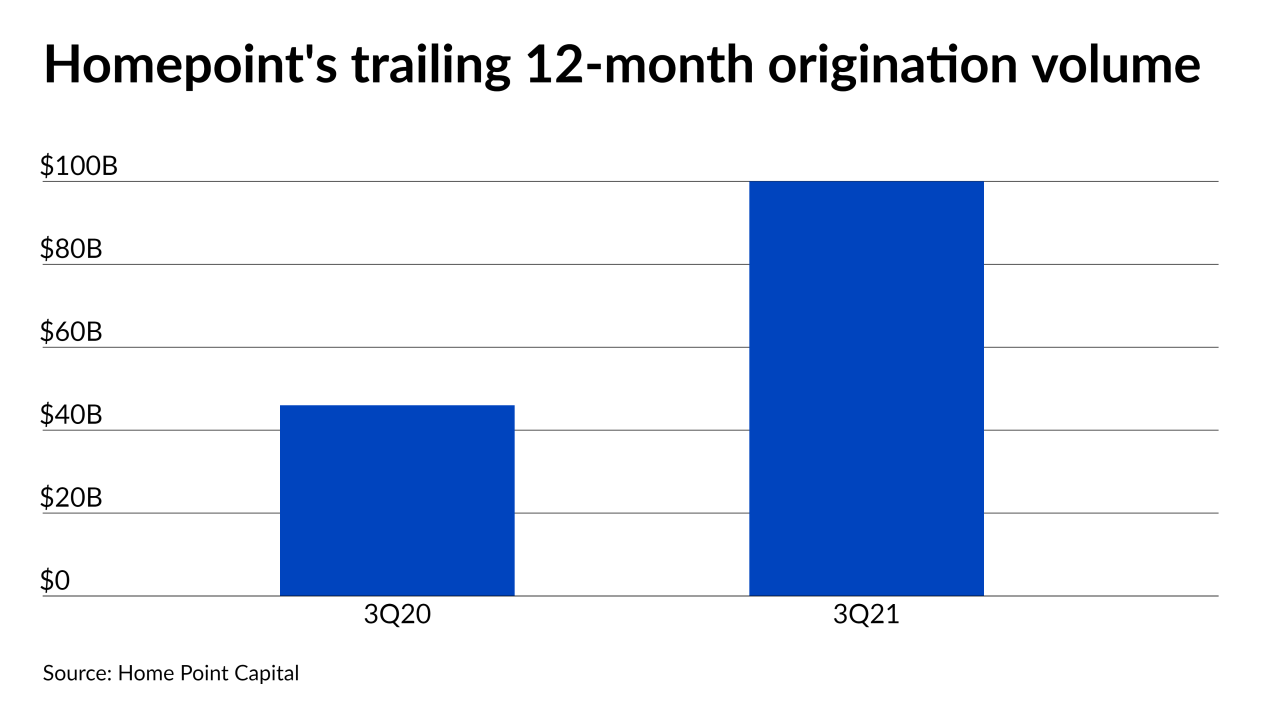

While the company produced $88 billion during the period, it had a major margin squeeze in its TPO Pro channel.

November 5 -

The company is repositioning its secondary market sales of loans and servicing and implementing cost-cutting measures as the market normalizes.

November 4 -

Applications related to Zillow Offers made up 70% of the mortgage lender's purchase business in the third quarter.

November 3 -

After closing its merger with Caliber, the company also hopes to pare down expenses by at least 10%.

November 2 -

The company, which was accused of cutting corners in originations by a former top executive, produced $32 billion in the third quarter and is guiding between $26 billion and $31 billion in the fourth.

November 1 -

The mortgage giant’s net worth of $42 billion at the end of the quarter was more than double what it was a year earlier. CEO Hugh Frater said that financial strength puts the company on better footing to support affordable housing goals outlined by the Federal Housing Finance Agency.

October 29 -

The combined refinance and purchase total was nearly double the average quarterly volume logged before the pandemic, the company said in its third-quarter earnings call.

October 29 -

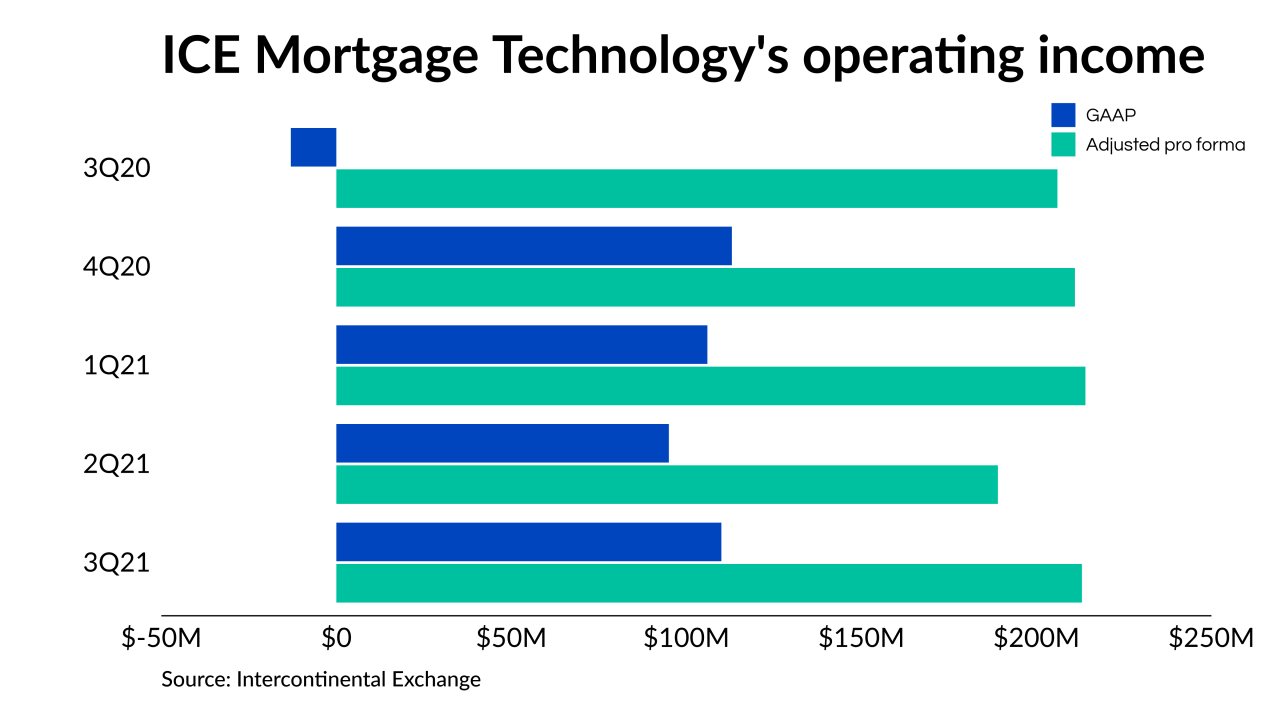

The company is making progress on a focus shift to recurring revenues from transactional activities.

October 28 -

The company sees an opportunity as its competitors have to sell to make up for lost income due to tighter origination margins.

October 28 -

The company also locked a record $4.7 billion in jumbo loans and significantly increased its business purpose lending from a year ago as its revenue mix shifted toward its taxable subsidiary.

October 28 -

The deal for Michigan-based Flagstar Bancorp, announced in April, was originally expected to be completed by the end of the year. The New York bank’s CEO expressed optimism that it will still get regulatory approval.

October 27 -

The Alabama company agreed to buy two nonbank lenders earlier this year. It’s still on the lookout for possible deals, potentially in corporate finance or wealth management, its chief financial officer told American Banker.

October 22 -

Earnings are up from the second quarter, but originations slip at Wells Fargo and Citi.

October 14 -

The San Francisco bank reported a 26% increase in its third-quarter earnings, thanks to robust single-family, multifamily and commercial real estate loan activity in New York, Boston and its home city.

October 13