Earnings

Earnings

-

Bank of America says rate cuts could reinvigorate mortgages and that its digital and cards strategies will help it grab more market share to offset shrinking margins.

July 17 -

The second quarter continues to shape up as a good one for bank mortgage lenders — and one ancillary service provider — that are benefiting from a spike in volume.

July 17 -

The Minneapolis bank reported growth across several lending and noninterest income categories in the second quarter, which offset net interest margin pressures and declining deposit service fees.

July 17 -

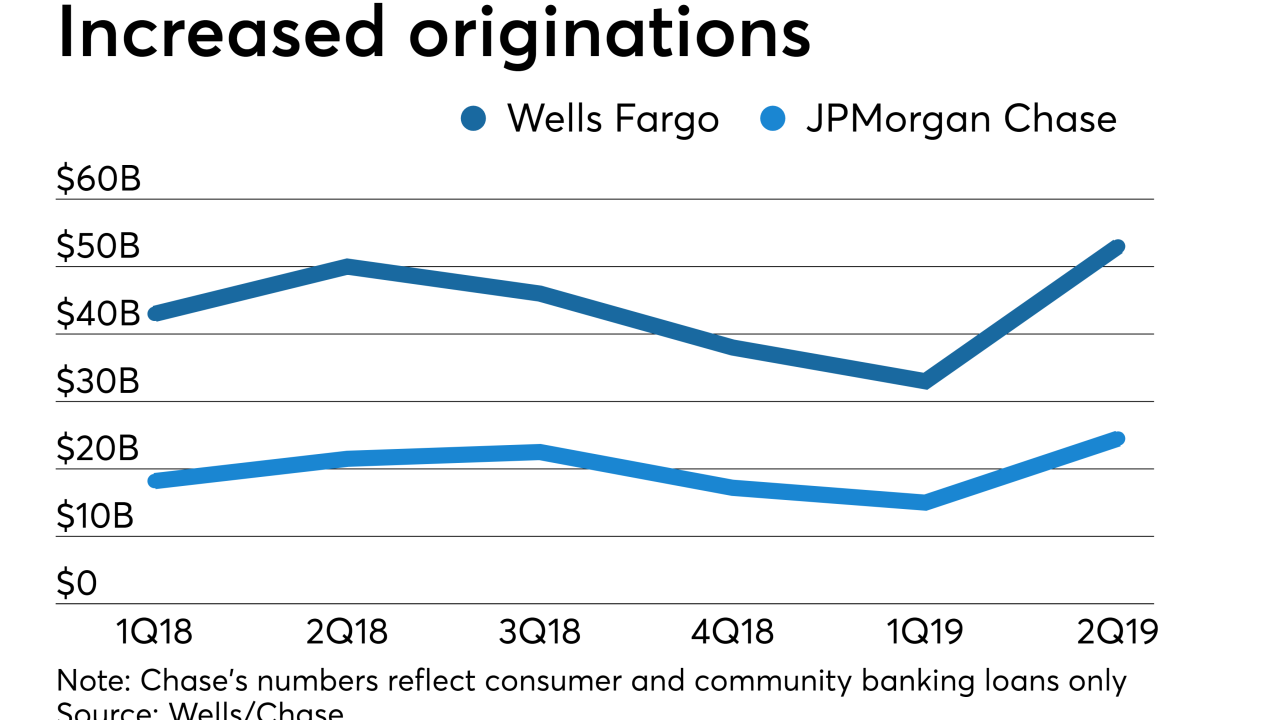

Wells Fargo and JPMorgan Chase recorded stronger mortgage originations in the second quarter as rates fell, but profits from single-family loans were lower than a year ago due to decreased servicing revenue.

July 16 -

Despite a significant rise in first-mortgage production due to lower interest rates, profits from home lending in Citigroup's retail banking division fell slightly in the second quarter.

July 15 -

Builder MDC Holdings' preliminary numbers for net new home orders registered their highest quarterly increase in years, adding to signs of growing demand for housing.

July 8 -

FB Financial is selling its correspondent lending channel to Rushmore Loan Management Services, which will complete the bank holding company's restructuring of its mortgage business.

June 27 -

The two lenders are bucking the trend for the overall industry, which saw year-over-year mortgage growth slide to a 17-year low in March, according to the Bank of Canada.

May 23 -

First-quarter operating revenue in Equifax's Mortgage Solutions unit was the lowest it's been for the fiscal period since 2016, and the company anticipates declines in this division will remain a concern.

May 13 -

Zillow's mortgage division experienced better customer demand in the first quarter than it expected, but its revenue was outweighed by expenses that led to a pretax loss of $9.6 million.

May 10 -

Lower rates hurt the value of Impac Mortgage Holdings' servicing rights and overall earnings in the first quarter, but they could help improve the company's second-quarter results.

May 10 -

Lower interest rates caused mortgage serving rights runoff plus a charge to the fair value of that portfolio and led to Ocwen Financial posting a first-quarter loss.

May 7 -

Intercontinental Exchange's proposed acquisition of Simplifile will enhance its MERS unit's growing presence in handling electronic notes.

May 2 -

Freddie Mac will keep building on the financial reforms that produced profitability during conservatorship as broader government-sponsored enterprise proposals take shape, according to departing CEO Don Layton.

May 1 -

Fannie Mae is considering sharing more risk with the private sector to reduce future strain on its earnings from the implementation of the Current Expected Credit Loss accounting standard next year.

May 1 -

First-quarter year-over-year results declined at a pair of mortgage bankers active in the acquisitions market as well as at the provider of the most used servicing technology.

May 1 -

In a long-term attempt to stabilize its earnings from the cyclical nature of home loans, HomeStreet took a loss in the opening quarter of 2019.

April 30 -

The Boston company gained the mortgage platform when it bought First Choice in 2017.

April 30 -

Title underwriters and other vendors reported year-over-year declines in business activity (although some reported improved profitability), but lower interest rates made them optimistic about their prospects going forward.

April 26 -

Even after integrating the 52 Wells Fargo branches acquired in December as part of its efforts to diversify beyond home lending, Flagstar Bancorp's first-quarter earnings were driven by increased mortgage revenue.

April 23