Lower interest rates caused mortgage serving rights runoff plus a charge to the fair value of that portfolio and led to Ocwen Financial posting a first-quarter loss.

In addition to the MSR charges, the company also recorded $22 million of costs related to its re-engineering process.

The West Palm Beach, Fla.-based company lost $44.5 million in the first quarter, compared with a $2 million loss in

Closing of

The servicing business lost $57.5 million pretax versus its pretax income of $20.5 million one year prior. Ocwen recorded $31.1 million of

"Through continued strong execution, the pace of our MSR purchases is ahead of our expectations and we are on track with the objectives of our integration, cost re-engineering and other key business initiatives," said President and CEO Glen Messina in a press release. "I'm pleased with our progress to date and believe it demonstrates our commitment and focus to deliver on the objectives we have established to strengthen the company and return to profitability in the shortest time frame possible."

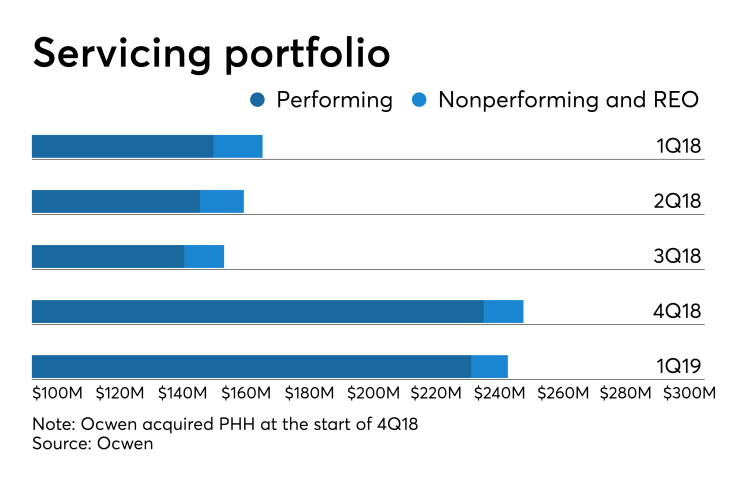

Ocwen's MSR portfolio fell to $251.1 billion in unpaid principal balance on March 31, compared with $256 billion on Dec. 31, 2018 and $173.4 billion on March 31, 2018.

However, the company restarted making bulk acquisitions of MSRs to combat runoff, picking up $5 billion in the first quarter and expects to close on an additional $26 billion in the second quarter.

Delinquencies fell to 4.7% from 4.9% at the end of the fourth quarter and 9% one year prior.

Its originations business had pretax income of $19.9 million, up from $8.8 million for the first quarter last year. This included its reverse mortgage lending business, which had $24 million of pretax income and recorded $17.3 million of interest rate and valuation assumption driven favorable fair value changes.

Ocwen originated forward and reverse mortgage loans with unpaid principal balances of $211.2 million and $141.3 million, respectively. For the first quarter of 2018, Ocwen originated $215.8 million of forward mortgages and $163.9 million of reverse mortgages. PHH had

Ocwen's corporate reporting segment had a $3.4 million pretax loss, driven by $22 billion in severance, retention and other re-engineering costs. When all is said and done, the re-engineering process should end up with costs between $55 million and $65 million.