Earnings

Earnings

-

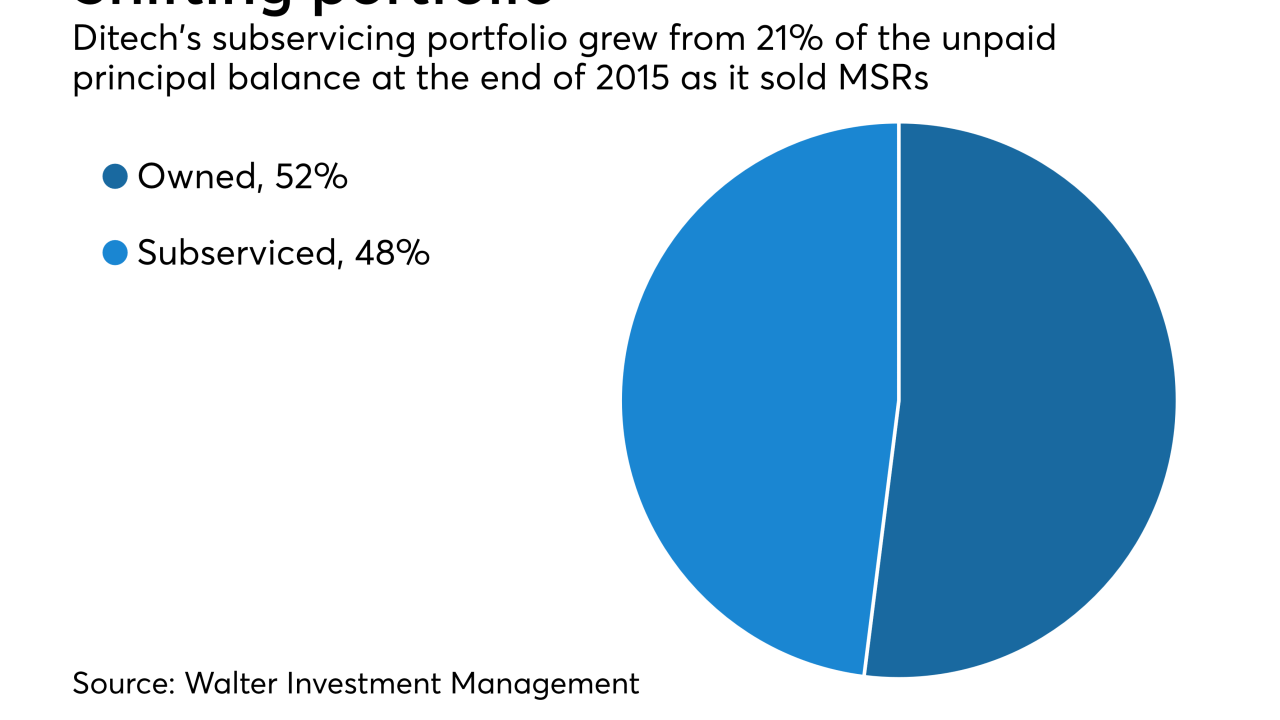

Walter Investment Management Corp. pushed back the date it would emerge from bankruptcy to no earlier than Feb. 2 from the originally planned Jan. 31.

January 31 -

The company, which has been actively curbing growth to avoid becoming a systemically important financial institution, reported lower loan balances and reduced fee income after exiting the residential wholesale mortgage business.

January 31 -

The strong housing economy in 2017 led to an increase in premiums earned and lower claims costs for Old Republic International's title insurance business.

January 25 -

Net interest income has surged thanks to rising rates, but noninterest income has lagged as trading revenue has weakened, refi demand has softened and fees from deposit service charges have barely budged. Is this the new normal?

January 24 -

The Oregon company's commercial and consumer lending grew even though fee income declined sharply.

January 23 -

Flagstar Bancorp swung to a fourth-quarter loss as the company took an $80 million noncash charge to earnings because of the tax reform bill.

January 23 -

The Illinois company reported strong loan growth, an wider net interest margin and a one-time net tax benefit of nearly $8 million tied to recently passed tax reform.

January 22 -

The Honolulu bank reported strong loan growth in the fourth quarter, but one-time charges related to the new tax law suppressed its profit.

January 22 -

The new tax law helped boost fourth-quarter results at SunTrust Banks in Atlanta, while the recent rate hikes led to gains in spread income.

January 19 -

The Arkansas company has spent two years trying to reassure nervous investors and analysts that it can rapidly book real estate loans using conservative practices.

January 18