-

A risk management model revision that decreased single-family loan-loss allowances and a strong mortgage lending environment contributed to consistent earnings results at Fannie Mae in the third quarter.

October 31 -

Recent Fannie Mae and Freddie Mac activities are “not the kind of day-to-day behavior that you would expect from companies” under federal control, the head of the Federal Housing Finance Agency said.

October 31 -

A lower court “erred” when it sided with Fannie Mae and Freddie Mac’s investors, the Justice Department said in its petition to the high court.

October 30 -

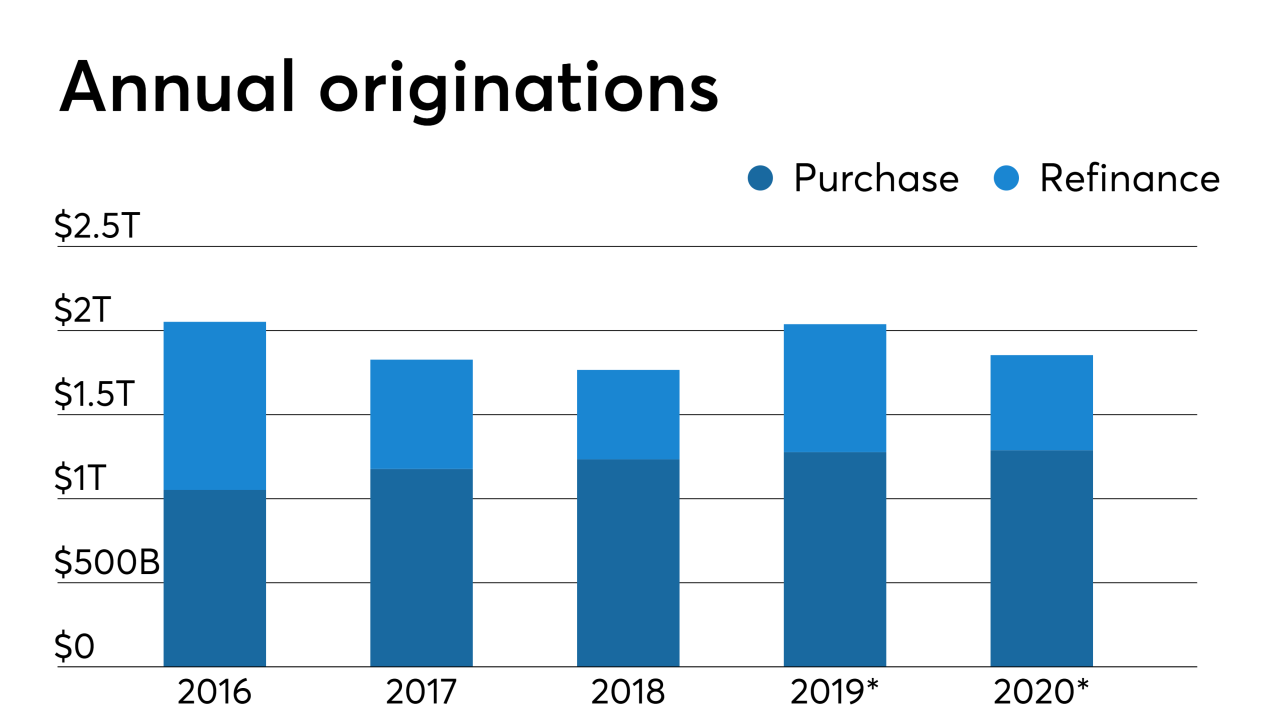

Home lenders will benefit from elevated refinance activity through the first half of next year, but volume may then fall off quickly, according the Mortgage Bankers Association's latest forecast.

October 30 -

VantageScore totaled 12.3 billion scores across consumer credit loan categories over a 12-month period between 2018 and 2019 with minimal mortgage volume, leaving potential for a major ramp up.

October 29 -

There are many ways to mark the economic progress since the Great Recession: over 100 months of job gains, record low unemployment and a long bull run on Wall Street.

October 29 -

When it comes to possible new competitors in the secondary market, the heads of the two current outlets more than welcomed the possibility of additional players in their space because of housing finance reform.

October 28 -

The regulator of Fannie Mae and Freddie Mac discussed steps the companies have already taken to limit their risk, as well as efforts to prevent housing market “overlap” with the FHA.

October 28 -

The government-sponsored enterprises are moving ahead with a new mortgage application that omits a previously planned language question, but are looking to serve limited English proficiency borrowers in another way.

October 24 -

BSI Financial's chief executive weighs in on changes in the interest rate environment, the evolution of digital mortgage servicing and natural disasters.

October 21 -

Single-family mortgage production this year is expected to be 3% higher than anticipated last month, according to Fannie Mae, which revised its estimates based partly on a stronger housing outlook.

October 17 -

Mortgage lenders prefer to invest in improvements to their consumer-facing technology because it offers a better return than similar spending on back-end processes, according to Fannie Mae.

October 16 -

The developer of the newly constructed Washington, D.C., headquarters for Fannie Mae is securitizing part of its $525 million, 10-year mortgage through a single-asset, mortgage-backed transaction.

October 10 -

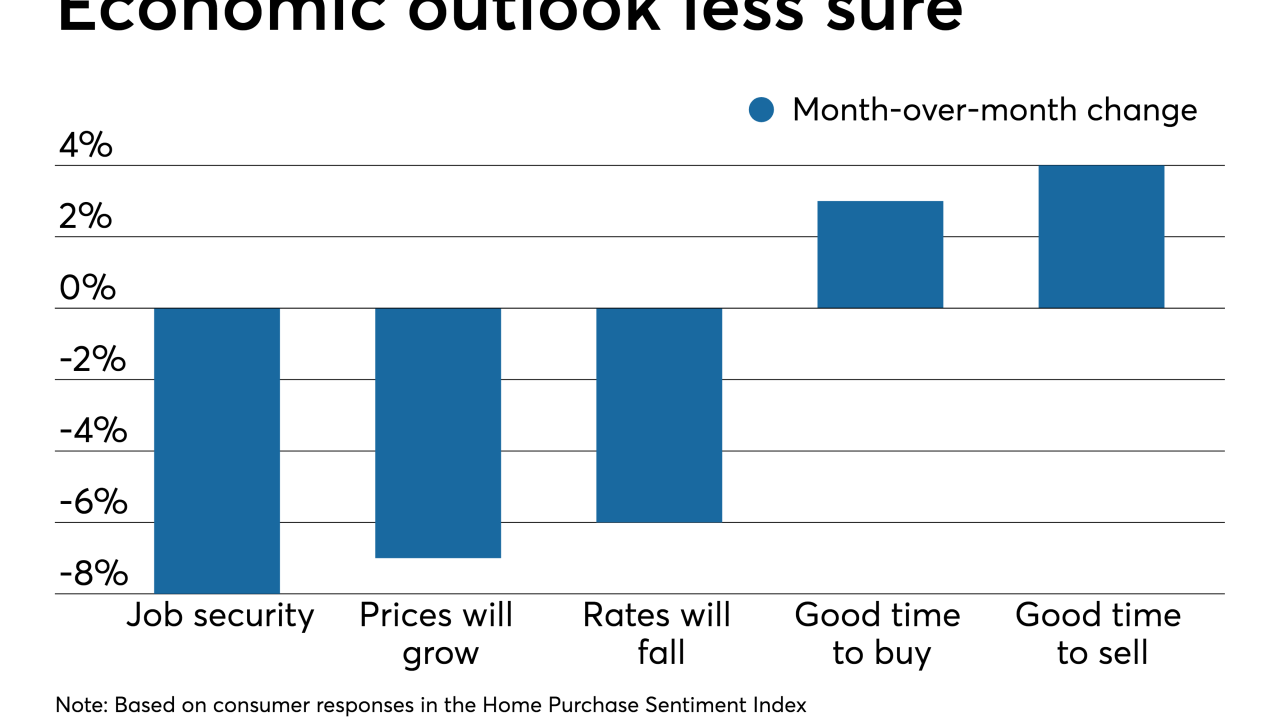

Consumer confidence in the housing market remains relatively strong, but economic uncertainty is testing its resiliency, according to Fannie Mae.

October 7 -

Fannie Mae is cracking down on homebuyer education requirements, particularly for first-time homebuyers and purchasers utilizing high loan-to-value mortgages.

October 4 -

Allowing the mortgage giants to retain profits resolves a short-term capital shortfall, but how much capital they would need after exiting conservatorship is still the bigger question.

October 4 -

The Trump administration's thinking on housing is filled with conflicts and contradictions, a quilt work of at times irrational proposals that seem to be at odds with the real world of mortgage finance.

October 2 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Guild Mortgage, which originated loans on some of the first manufactured homes eligible for new lower-rate Fannie Mae financing, anticipates demand for this housing type will continue to grow this year.

October 1 -

The move to alter the government's preferred stock purchase agreements is the first major one under FHFA Director Mark Calabria's tenure to wind down the conservatorship of the government-sponsored enterprises.

September 30 -

The shareholders' claims against Fannie Mae and Freddie Mac's regulator mirror arguments in cases challenging the Consumer Financial Protection Bureau.

September 26