-

Equifax reported earnings that were 27% lower and mortgage services revenue was 2% lower on a year-to-year basis after revealing a major breach and taking steps to improve security.

November 10 -

Fannie Mae is considering a series of pilot programs to address an issue that has plagued the real estate market for years: a lack of affordable homes.

November 9 -

So long as the current monetary regime survives, homeowners — present and potential — can expect higher average prices interspersed with wild rides up and down.

November 8 Mitsubishi UFJ Securities International

Mitsubishi UFJ Securities International -

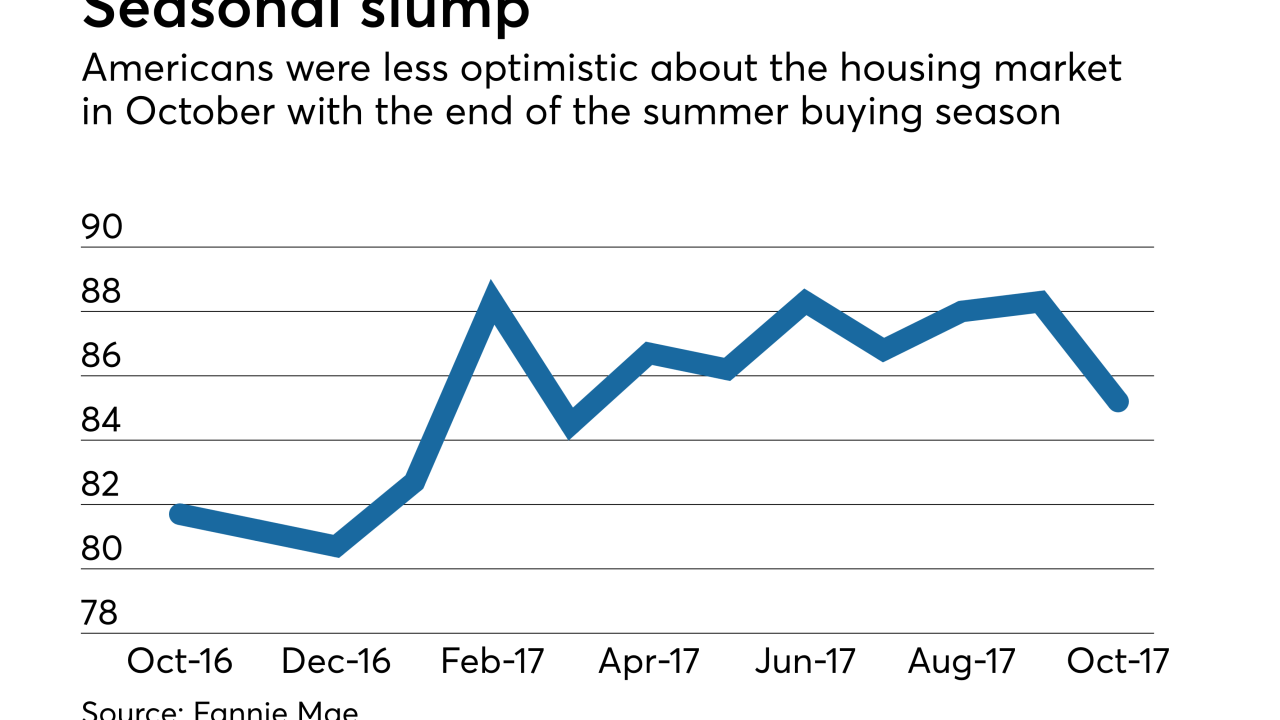

With the end of the summer home buying season, consumers were less optimistic that it was a good time to purchase or sell a home in October.

November 7 -

From Secretary Carson easing lending concerns to Fannie Mae announcing its expansion of Day 1 Certainty, here's a look at seven things we learned at the 2017 MBA Annual.

November 3 -

Growth in loans with higher debt-to-income ratios is reviving focus on a regulatory exemption for Fannie Mae, Freddie Mac and other federal agencies that back mortgages.

November 3 -

The Federal Housing Finance Agency must set fees equal to the cost of capital that private banks hold against similar risk, not just the amount of capital that Fannie and Freddie think are right for themselves.

November 3

-

Nonbank mortgage employment took its biggest drop since January following the recent hurricanes, according to the Bureau of Labor Statistics.

November 3 -

Fannie Mae servicers are facing pressure from the recent hurricanes, but so far are bearing up under the strain.

November 2 -

Mark Calabria, the chief economic adviser to Vice President Mike Pence, said the administration is focused for now on more pressing issues than GSE reform, including addressing housing damage from recent hurricanes.

November 1 -

Fannie Mae is allowing in some situations where mortgage payments are made by someone other than the borrower for the full monthly housing expense to be excluded from debt-to-income calculations.

November 1 -

Fannie Mae is testing a conforming loan product that makes use of a New Hampshire law that lets manufactured housing in resident-owned communities get treated like units in a co-operative building.

October 27 -

Most secondary market outlets, along with the non-qualified mortgage lenders, remain reluctant to lend to legal cannabis workers because of the source and nature of their compensation, but opportunities are beginning to emerge.

October 25 -

Fannie Mae is staging more pilot projects with lenders and vendors, including one that consolidates submissions of different types of loan data potentially eligible for immediate representation and warranty relief.

October 23 -

Cannabis businesses are legal in 29 states, but compliance questions on the federal level are keeping mortgage lenders from making loans to the industry's workers.

October 23 -

Fannie Mae is authorizing additional suppliers of reports that can give lenders immediate representation and warranty relief on certain data, diversifying beyond an exclusive partnership with Equifax in one category.

October 23 -

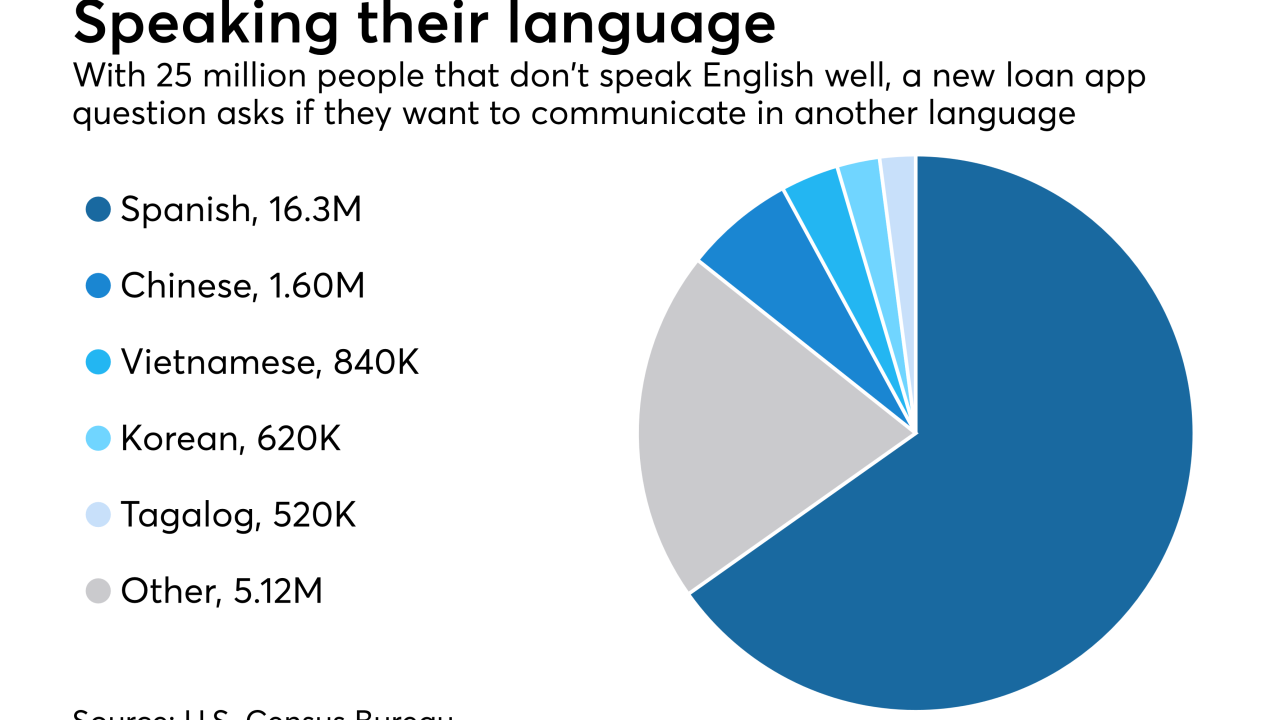

The Federal Housing Finance Agency added a language preference question to the loan application, rejecting the mortgage industry's wishes.

October 20 -

Originators and real estate agents are considered more trustworthy and credible by home purchasers than online sources about mortgage information, a Fannie Mae study found.

October 19 -

In a moment of rare unity, the Independent Community Bankers of America and National Association of Federally-Insured Credit Unions sent a joint letter to FHFA arguing to stop the GSEs' profit sweep.

October 19 -

Called Structured Agency Credit Risk Securitized Participation Interests, the new securities are backed by mortgage loans, and are not general obligations of the government-sponsored enterprise.

October 18