-

A federal judge recommended that an enhanced real estate reporting requirement, which could send paperwork and costs soaring next year, remain intact.

December 11 -

This year Point has funded more than $2 billion in home equity investments to more than 20,000 homeowners nationwide.

December 10 -

With the Federal Reserve decision largely factored in, Jerome Powell's comments on future outlook is more likely to influence the housing market.

December 10 -

Charlie Scharf has a mostly optimistic take on Wells' consumer banking prospects entering 2026. But he's more downbeat about the company's once-dominant residential mortgage business.

December 10 -

Hartford, Connecticut, Rochester, New York, and Worcester, Massachusetts, headed the list of the 100 largest metro areas in the country, according to Realtor.com.

December 10 -

The terms of NRMLT 2025-NQM7 will not allow it to advance principal and interest on loans that are delinquent by 180 days or more.

December 10 -

The House Financial Services Committee discussed allowing banks to experiment with artificial intelligence with a waiver from regulatory penalties, including consumer protection laws, in a hearing.

December 10 -

Home equity is becoming a data-driven asset that demands sharper valuation and analytics as lending options expand, according to Clear Capital's EVP of Strategy and Growth.

December 10Clear Capital -

A senior advisor at NAIC, the association of state insurance regulators, told attendees of its fall meeting that the imminent FEMA Review Council report should answer questions about funding for disaster relief and flood insurance, as well as other related issues.

December 10 -

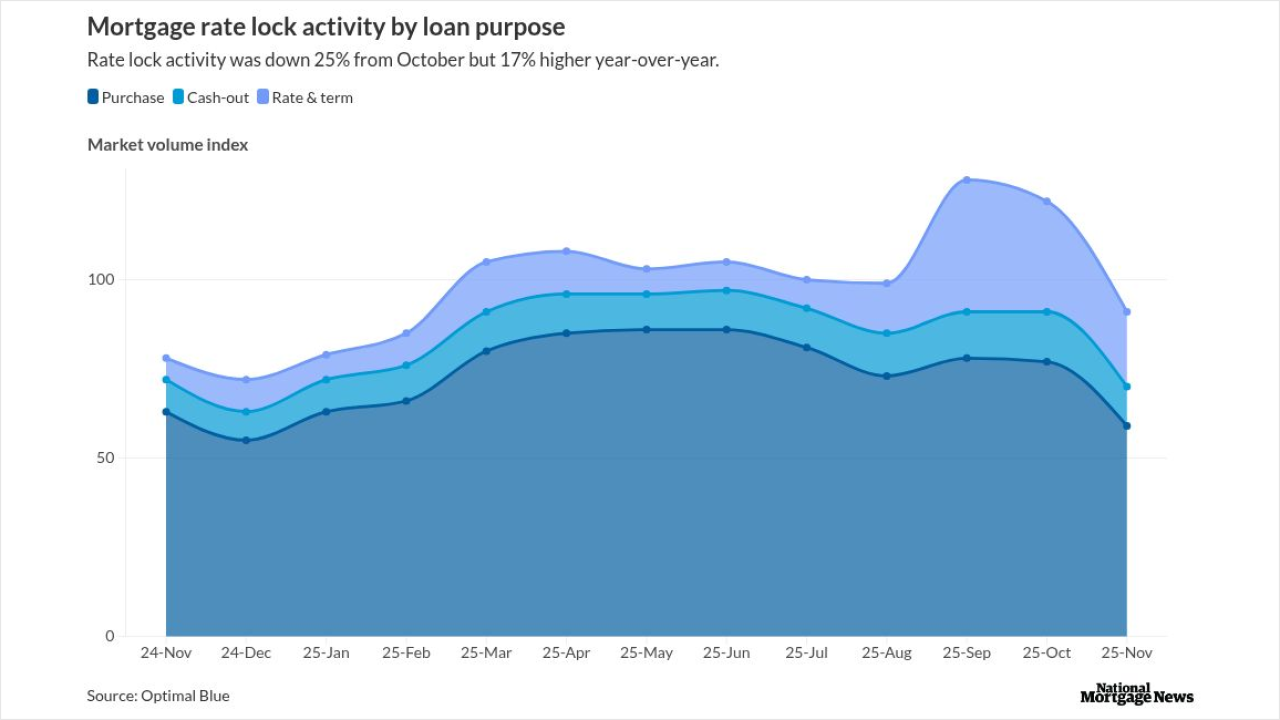

November rate locks fell seasonally but hit their strongest level since 2021, led by refis, while lenders shifted more loans to the GSE cash window.

December 10