-

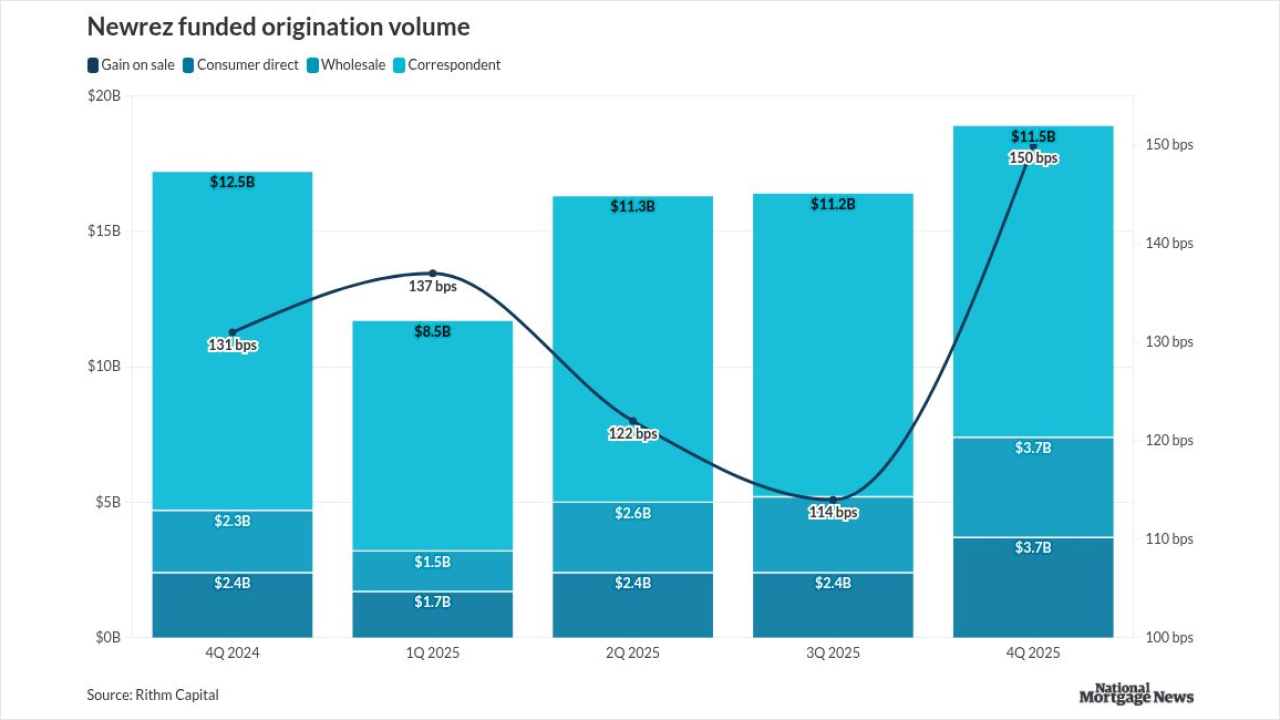

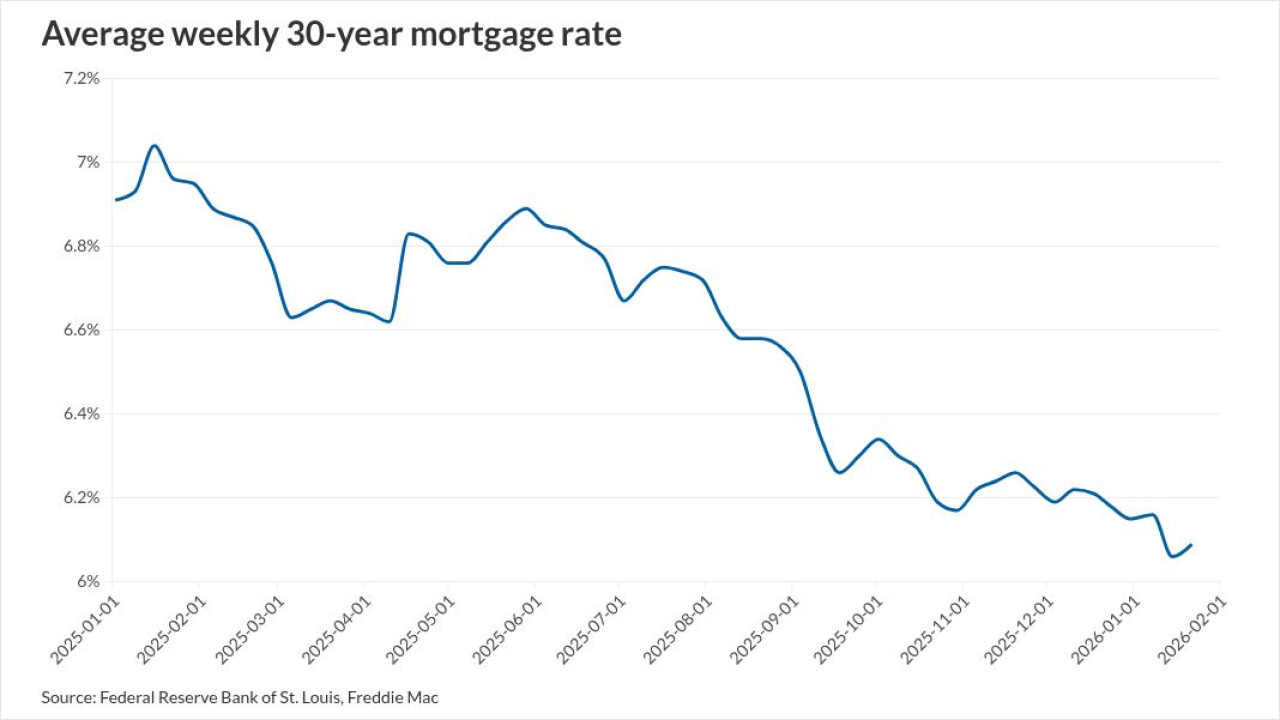

Mortgage rate trends in late 2025 led the lender into the red in the fourth quarter, even as Newrez originations picked up from the prior quarter and year.

February 3 -

The National Consumer Law Center is claiming the Credit Data Industry Association wants to suppress Consumer Financial Protection Bureau complaint filings.

February 2 -

Although investor properties, which are prone to higher chances of default, account for 58% of the pool, the strong borrower and collateral quality mitigate the credit stress.

February 2 -

Primelending produced a pretax loss of $5.2 million in the fourth quarter, significantly lower than the loss of $15.9 million in the same period a year earlier.

January 30 -

Fourth quarter pretax income of $900,000 and net income of $656,000 for the segment compared with year ago losses of $625,000 and $197,000 respectively.

January 30 -

DRMT 2026-INV1, is backed by a pool of 1,153 non-prime investment property mortgages, which have a moderate leverage levels of an original, combined loan-to-value (CLTV) ratio of 69.9%.

January 29 -

Competition that impacted margins and prepayments in excess of expectations were challenges during the period, but executives report first quarter improvement.

January 29 -

Analysts estimate Pennymac, Rocket, UWM and Loandepot will post an improved earnings per share and total loan origination volume than the same time a year prior.

January 29 -

Overall, three-quarters of those in a National Mortgage News survey believe loan production will increase during 2026, but just 15% felt strongly about it.

January 29 -

Supply chain attacks have doubled since 2021, with professional services firms increasingly acting as "stepping stones" to access bank data.

January 29 -

Respondents to an exclusive NMN survey lay odds on lower rates boosting housing despite stagflation and recession risks. Here's how the Fed's view compares.

January 28 -

As the Federal Open Market Committee announces its near-term interest rate plans Wednesday, market watchers expect the central bank to hold interest rates steady as policymakers seek greater clarity on the health of the economy.

January 28 -

The Tulsa, Oklahoma-based bank expects the pace of loan growth to quicken this year, driven in part by its nine-month-old warehouse lending business.

January 27 -

The estimated range for net income to common shareholders at the company formerly known as Ocwen rose in part due to a deferred tax asset valuation.

January 26 -

The government mortgage securitization guarantor flagged the goal back during the first Trump administration, warning then that it would be a long-term project.

January 26 -

On Jan. 26, use of the new Uniform Residential Appraisal Report shifts from limited production to the optional phase, giving lenders 10 months to get ready.

January 26 -

The moderate leverage reflects the quality of RMBS pools from recent issuance years. Borrowers have a non-zero WA annual income of $1 million, with liquid reserves of $594,348.

January 23 -

Many servicing metrics look weaker amid lower rates although valuations can vary depending on companies' models, operations and portfolio composition.

January 23 -

Reducing agency loan pricing adjustments and credit reports may help, a trio of industry groups wrote in a letter to the National Economic Council's director.

January 22 -

The company reported net income of $5.6 million in 2025, up 61.9% from the year prior, while mortgage banking revenue decreased by $120,000, or 39.5%.

January 21