-

Home price modeling changes hurt FOA's third-quarter interim results but it was in the black between January and September on a continuing operations basis.

November 4 -

While FHFA reduced most of the single-family low-income goals, the MBA wants the refinance target for Fannie Mae and Freddie Mac cut as well, its letter said.

November 4 -

Most of the pool of 1,011 residential mortgages, 69.7%, are considered non-prime mortgages, primarily due to the documentation and styles of underwriting.

November 3 -

Now that quantitative tightening is ending, the debate on who should be the MBS buyer of last resort, Fannie Mae and Freddie Mac, or the Fed, is taking hold

November 3 -

In her first public appearance since President Trump moved to fire her from the Federal Reserve Board of Governors, Fed Gov. Lisa Cook reiterated her commitment to bringing inflation under 2% and said that the labor market remains "solid."

November 3 -

Vic Lombardo, new head of mortgage services, has identified growth ideas and new revenue streams for Motto Mortgage and Wemlo, Remax CEO Erik Carlson said.

October 31 -

Zillow Home Loans originated 57% more purchase mortgages versus the third quarter of 2024, with production and segment revenue growth beating estimates.

October 31 -

The head of the government-sponsored enterprise's oversight agency said the cuts were made to positions that weren't central to mortgages and new home sales.

October 30 -

Rocket Companies lost $124 million on a GAAP basis, but its management celebrated milestones regarding its Redfin and Mr. Cooper acquisitions.

October 30 -

The tech giant provided context around Flagstar and Pennymac's moves, as it reported more Encompass and MSP clients and greater mortgage income.

October 30 -

FFIN 2025-3's average loan balance, $16,366 was lower compared with the 2025-2 deal, when it was $19,993, and the WA interest rate on the current deal is 12.15%, down from 12.56%.

October 30 -

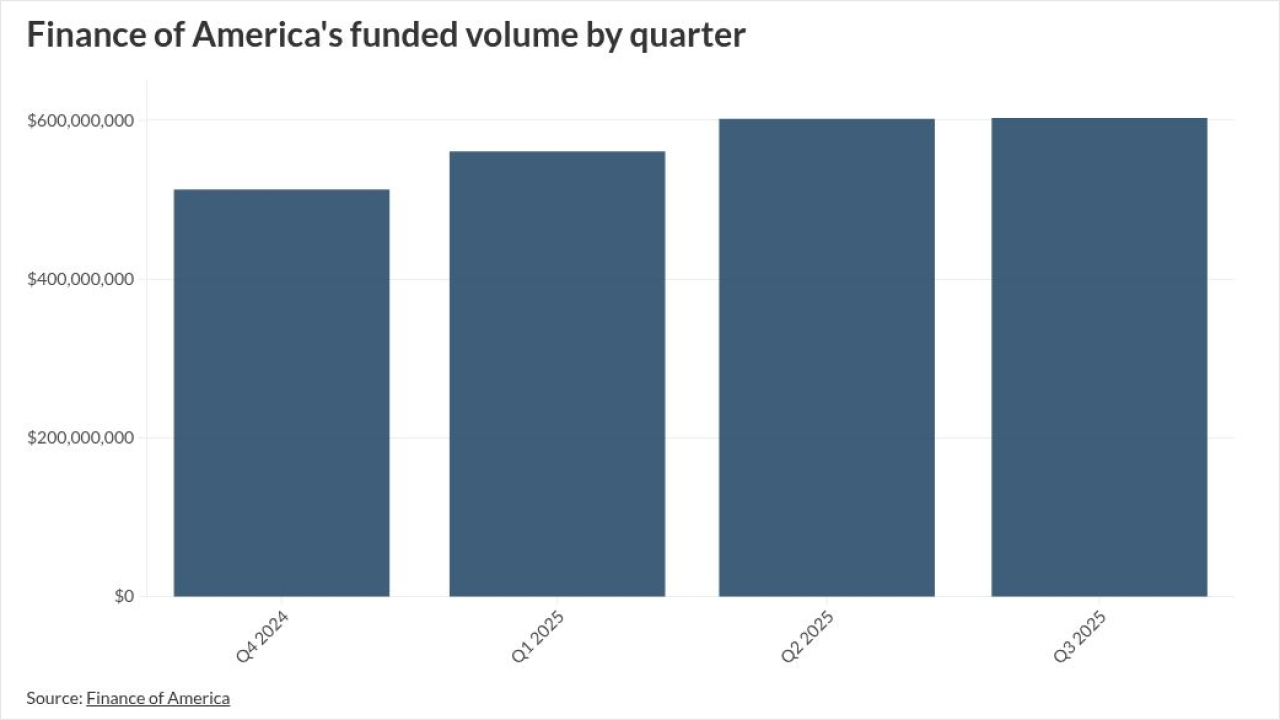

Company officials credited recent mortgage rate pullbacks, a nonagency servicing partnership and Improvements in technology behind recent momentum.

October 30 -

The government-sponsored enterprise's bottom line results, like Fannie Mae's, came in above the previous quarter's but below year-ago numbers.

October 30 -

The Federal Open Market Committee voted to reduce interest rates by 25 basis points Wednesday, but the emergence of dissents on the committee makes the chance of another quarter-point cut in December less certain.

October 29 -

Mortgage groups want GSEs to buy MBS to lower rates, but the Chairman of Whalen Global Advisors writes that the plan is risky, unnecessary, and poorly timed.

October 29 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The Federal Reserve's interest rate-setting body is expected to announce a 25 basis point cut and provide guidance on the trajectory of its balance sheet Wednesday afternoon.

October 29 -

Shareholders' equity topped $105 billion as net income rose 16% from the previous quarter and nearly matched year-ago results.

October 29 -

The Federal Open Market Committee is expected to announce guidance on the end of its quantitative tightening program later Wednesday. As that process draws to a close, experts are questioning when and how the central bank should use its balance sheet to smooth economic stress in the future.

October 29 -

RoundPoint's corporate parent generated positive comprehensive income with the legal expense excluded and expanded its subservicing activity.

October 28 -

The influential nonbank mortgage company is calling for a "do no harm" approach to housing and finds comfort in officials' stated guardrails to that end.

October 28