-

Esusu, a financial technology company that aims to help bridge the racial wealth gap by reporting rent payments to credit agencies, has become one of only a few Black-owned startups to reach a valuation of $1 billion after closing a Series B round led by SoftBank Vision Fund 2.

January 27 -

Multifamily and specialty finance loans, which were highlights during the fourth quarter, should increase further in 2022, company executives said.

January 26 -

Among the mortgage industry investors in the product and pricing engine provider are Movement Mortgage and First American Financial.

January 26 -

Performing and re-performing loans are in the pool, as well as fixed, adjustable-rate and step-rate loans, and fully-amortizing balloon and interest-only mortgages.

January 26 -

The company will leverage its diversified consumer-finance model while optimizing a traditional mortgage business with thinner margins as the business cycle turns, CEO Patti Cook said.

January 26 -

Due to the rollback in stimulus and uncertainties related to other mortgage policy measures and rates, servicers are moving into uncharted waters, according to a Fannie Mae economist.

January 25 -

Collateral characteristics are slightly weaker than previous deals, due to a higher proportion of loans underwritten to alternative income documentation.

January 25 -

Office properties account for 60.8% of the pool, above the 41.2% average for 2020 deals, and above the 36.5% average for 2021.

January 24 -

The change aims to streamline the processing of certain pandemic-related loan options that accommodate lower monthly payment amounts for borrowers with long-term economic hardships.

January 24 -

The researchers found that the disparities that emerged from the analysis of 1.8 million appraisals from 2019 and 2020 were statistically significant.

January 21 -

Treasury dealers and investors are busy trying to predict exactly when the Federal Reserve might pull the trigger on cutting the size of its balance sheet and how big that drawdown could be when it does.

January 21 -

In addition to being almost entirely composed of investment-purpose mortgages, about 100% of the pool’s 2,175 mortgages are agency eligible.

January 19 -

Home valuation professionals have had mixed feelings about automation out of concern that some forms could result in less accurate assessments.

January 19 -

The equity commitment by M&G Investments adds to signs that the MSR market is heating up as mortgage rates rise and some buyers have become more confident in their prepayment rate projections.

January 18 -

Despite that year-over-year decline, the company beat analysts' expectations with fourth-quarter net income of $5.8 billion. Stronger commercial lending and lower expenses cushioned the blow in consumer credit.

January 14 -

The company's fourth-quarter trading revenue declined notably more than analysts had expected, while its business and consumer lending each dropped 1% year over year.

January 14 -

In a Senate confirmation hearing, the acting Federal Housing Finance Agency director echoed her predecessor’s view that restructuring of Fannie Mae and Freddie Mac should fall to Congress, and pointed to measures aimed at mitigating risk for the agencies.

January 13 -

The SEC claims Morningstar put investors at a risk when rating $30 billion in CMBS deals from 2015-2016. Morningstar defends its integrity and independence.

January 13 -

The portfolio of MSRs from three types of government-related loans has a particularly large California concentration, and could be sold on a component basis, according to the Mortgage Industry Advisory Corp.

January 12 -

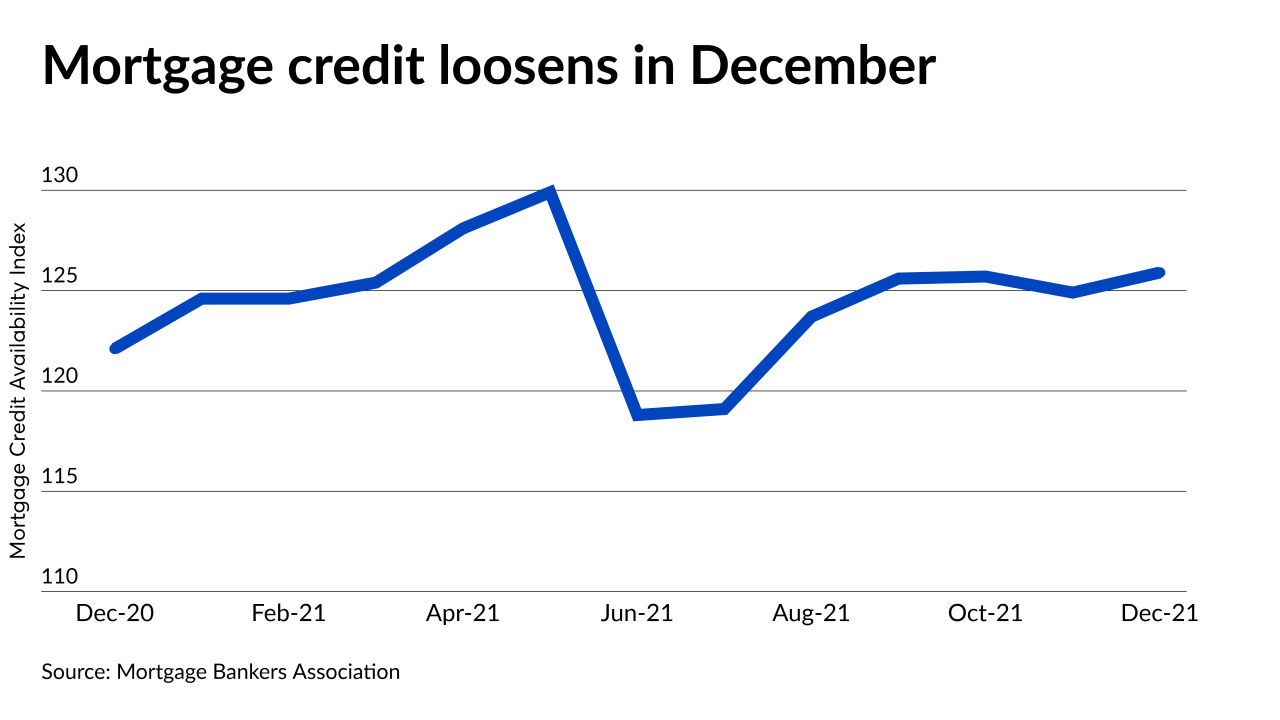

December was the fifth month out of the last six in which credit conditions loosened, the Mortgage Bankers Association reported.

January 11