-

Treasury dealers and investors are busy trying to predict exactly when the Federal Reserve might pull the trigger on cutting the size of its balance sheet and how big that drawdown could be when it does.

January 21 -

In addition to being almost entirely composed of investment-purpose mortgages, about 100% of the pool’s 2,175 mortgages are agency eligible.

January 19 -

Home valuation professionals have had mixed feelings about automation out of concern that some forms could result in less accurate assessments.

January 19 -

The equity commitment by M&G Investments adds to signs that the MSR market is heating up as mortgage rates rise and some buyers have become more confident in their prepayment rate projections.

January 18 -

Despite that year-over-year decline, the company beat analysts' expectations with fourth-quarter net income of $5.8 billion. Stronger commercial lending and lower expenses cushioned the blow in consumer credit.

January 14 -

The company's fourth-quarter trading revenue declined notably more than analysts had expected, while its business and consumer lending each dropped 1% year over year.

January 14 -

In a Senate confirmation hearing, the acting Federal Housing Finance Agency director echoed her predecessor’s view that restructuring of Fannie Mae and Freddie Mac should fall to Congress, and pointed to measures aimed at mitigating risk for the agencies.

January 13 -

The SEC claims Morningstar put investors at a risk when rating $30 billion in CMBS deals from 2015-2016. Morningstar defends its integrity and independence.

January 13 -

The portfolio of MSRs from three types of government-related loans has a particularly large California concentration, and could be sold on a component basis, according to the Mortgage Industry Advisory Corp.

January 12 -

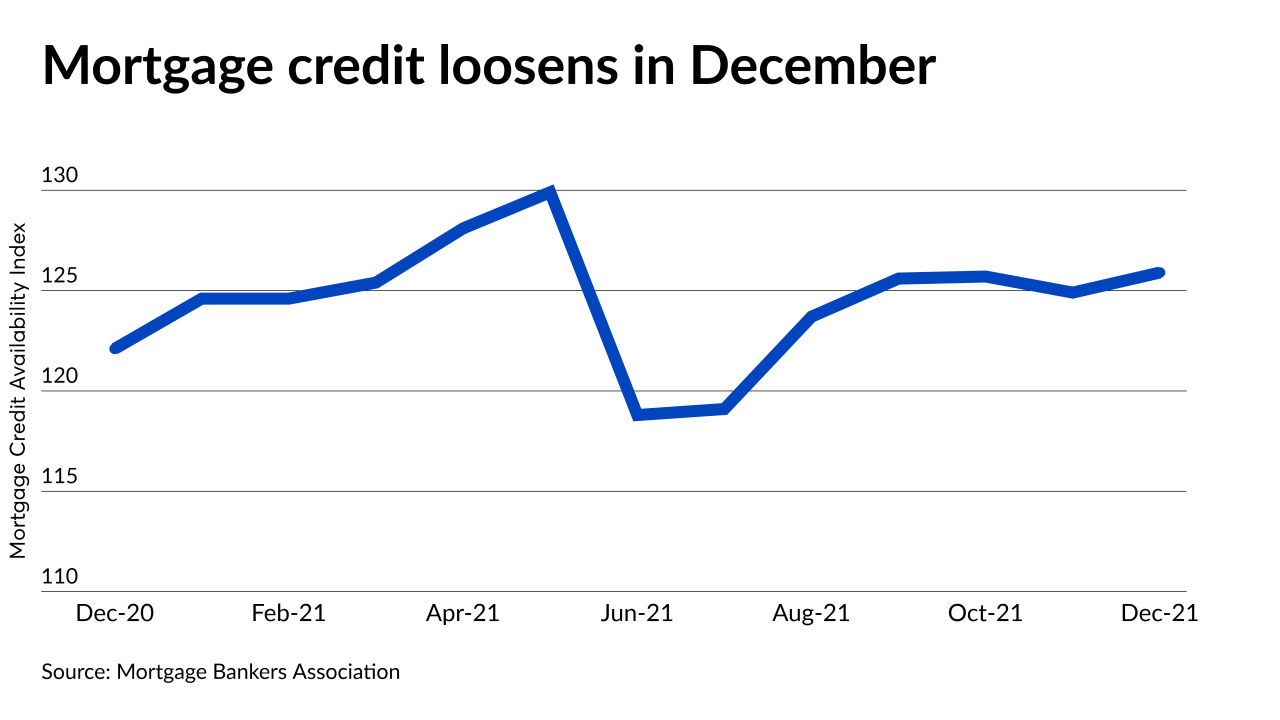

December was the fifth month out of the last six in which credit conditions loosened, the Mortgage Bankers Association reported.

January 11 -

The second year of the pandemic unleashed unprecedented exogenous challenges for financial companies heading into 2022. What core trends will shape the industry moving forward?

January 11 -

The change reflects a growing focus on an emerging banker segment that sells loans to the company on a non-delegated basis and includes a greater focus on servicing retention.

January 10 -

The loans in the portfolio on offer have nearly 11 months of seasoning, indicating they were amassed during a loan production boom that has contributed to higher average servicing deal sizes.

January 7 -

The Duty-to-Serve goals currently under review drew some objections from a coalition of affordable housing groups last year.

January 6 -

The government-sponsored enterprise also unveiled two new tranche slices for investors to purchase.

January 6 -

The selloff worsened after minutes from the Federal Reserve’s latest meeting showed officials considering earlier and faster interest-rate increases than expected.

January 5 -

Treasury yields rose a second day amid increasing conviction that the Federal Reserve will raise rates at least three times beginning in May.

January 4 -

The company plans to hire an unspecified number of people in servicing as a result of the shift, with a particular focus on recruiting people for “customer-facing” positions.

January 4 -

The metric’s imminent end after more than 40 years means servicers need to put replacement plans in motion if they haven’t already.

January 3 -

The new leader, who officially joined the government mortgage-bond insurer on Jan. 3, is the first Senate-confirmed holder of the post in close to five years.

January 3