-

The Secured Overnight Financing Rate has benefited — amid the phaseout of Libor — from positive comments by regulators. Is a multirate environment, which some banks would prefer, still possible?

January 3 -

Mortgage performance in November was improving, coming close to crossing a key threshold for pandemic-era recovery, but Omicron raises questions about whether that trend will continue.

January 3 -

Even among the non-QM loans in the reference pool, pegged to the SOFR, most of their characteristics fall in line with what is considered prime.

January 3 -

Analysts expect loan growth and higher interest rates to drive up equity prices next year, even in the face of the omicron variant and other risks.

December 27 -

Debt issued by states to finance low-interest loans for first-time home-buyers or build affordable housing carry higher yields and are less volatile, so they typically perform better than other muni sectors when rates rise, said Peter DeGroot, head of municipal research and strategy at the biggest U.S. bank.

December 27 -

Average per-loan charges last year were little changed despite the addition of a new temporary fee for refinancing. Those for loan-to-value ratios above 80%, home-purchase financing and adjustable-rate mortgages only rose slightly.

December 27 -

ABS experts discussed new avenues for growth, and hindrances to innovation at the IMN ABS East conference in Miami.

December 22 -

Key retail vacancies, a drop in office occupancies, plus a combination of lower oil prices, a housing market oversupply — worsened by the coronavirus pandemic — caused loan-level performance issues.

December 21 -

The government-sponsored enterprise has 45 days to submit a plan on how it intends to meet the increased target for 2022 through 2024.

December 21 -

The Morgan Mortgage Trust platform has had a SOFR tranche on every previous 2021 deal, generally pricing with a spread of about 95 basis points over SOFR.

December 21 -

Just three months ago, U.S. banks were still using the expiring benchmark rate for the vast majority of their new loans. But regulators said Friday the transition to alternative rates has accelerated ahead of a year-end cutoff.

December 17 -

Under the Federal Housing Finance Agency rule, the GSEs would need to lay out how levels will change under a variety of stress tests, including required ratios separately proposed for amendment.

December 16 -

Since the pandemic began, there have been fewer active managers buying the less liquid types of securitized debt, creating big opportunities for bargain hunting in securities like mortgage bonds and collateralized loan obligations, hedge fund Ellington Management Group says in a new report.

December 16 -

Under Home Partners Holdings’ right to purchase (RTP) program, RTP prices exceed purchase valuations by about $33.2 million, and on 817 properties.

December 15 -

The AOMT 2021-8 waterfall will distribute principal to A-1 through A-3 certificates at all times, and notes are taking a Fitch haircut amid inflated home values.

December 14 -

Founded in the wake of the global financial crisis, KBRA has issued more than 51,000 ratings representing almost $3 trillion in rated issuance since 2010.

December 13 -

Credit enhancement includes subordination, shored up by excess spread generated from excess spread between the cash flow on the collateral and the certificates.

December 10 -

Bigger loans make mortgage bonds riskier for investors. When homeowners have larger loans, they become more likely to refinance even with relatively small declines in interest rates.

December 9 -

Velocity Commercial Capital, 2021-4 uses subordination and excess spread that will cover both current and cumulative realized losses.

December 9 -

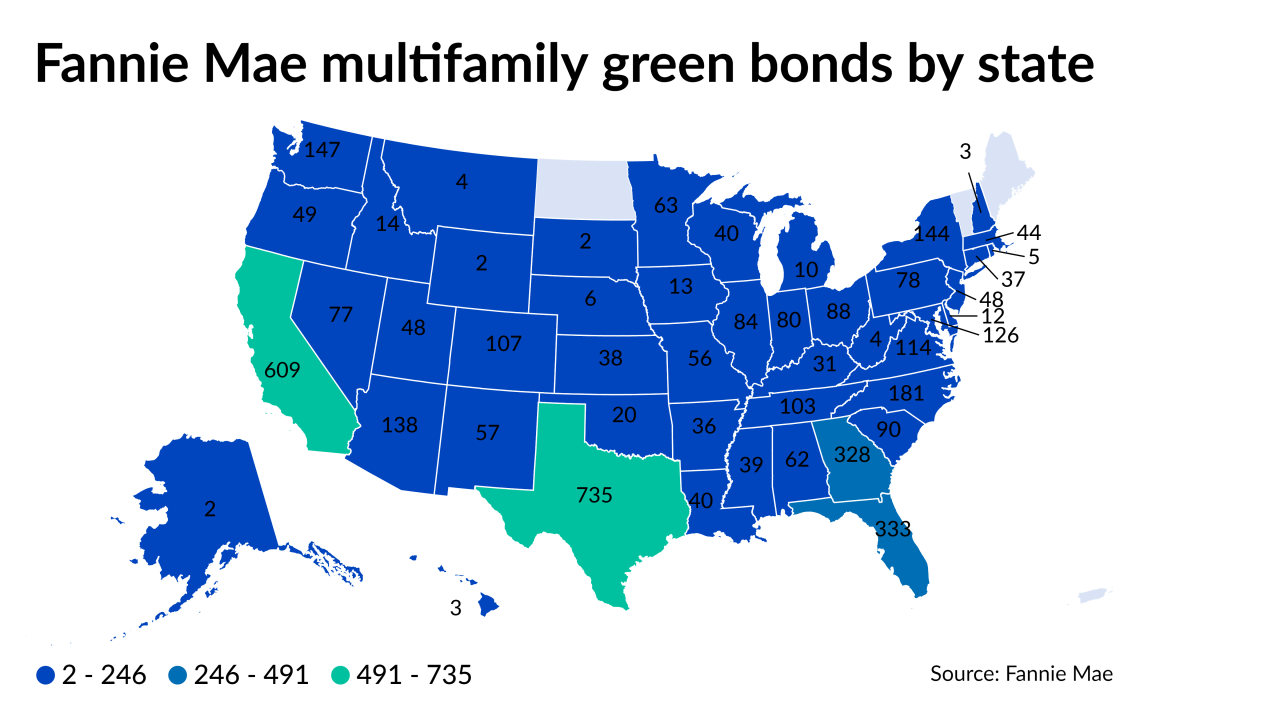

New securitizations of mortgages on energy-efficient rental housing totalled $12.7 billion during the first 11 months of this year, suggesting 2021’s total will come close to matching 2020’s $13 billion.

December 8