-

Electronic signatures and remote online notarization can now be used for mortgages that previously were signed in person, subject to certain restrictions.

November 16 -

The company was able to generate a relatively higher margin than the previous quarter, in contrast to broader industry trends, bringing its bottom line back into the black.

November 12 -

The company’s servicing operations also reported a quarterly profit, with its portfolio increasing by 20% annually.

November 11 -

The company increased and diversified its income streams beyond the mortgage sector but expenses associated with stock-based compensation and a recent acquisition outweighed these gains.

November 11 -

Amid its first post-IPO securitization of loans made outside a regulatory definition for standard products, the company has seen purchases accelerate, but it underperformed by some analysts’ estimates.

November 10 -

Nearly half of the company’s revenue comes from sources outside of the traditional home lending market, CEO Patricia Cook told analysts during the company’s earnings call.

November 10 -

However, it remains 30% tighter than pre-pandemic levels, according to the Mortgage Bankers Association.

November 9 -

The wholesale lender's net income of nearly $330 million factored in a $170.5 million hit from a reduction in its mortgage servicing rights fair value.

November 9 -

Acting FHFA Director Sandra Thompson's decision to act immediately rather than taking the time to examine the impact likely harmed private-label securitizations in the short term, but issuance is still on course for a record year.

November 9 -

The company’s gains, which far exceeded analysts’ expectations, were partially offset by thinner production margins.

November 8 -

The company’s six acquisitions since last March will contribute to increased revenue in both of its software and data and analytics segments.

November 8 -

More aggressive pursuit of government-related agencies’ affordable housing mission is expanding product availability, but government intervention can be a double-edged sword.

November 8 -

All six companies, however, remained highly profitable, as the delinquency and forbearance outlook is favorable for the possibility of rising claims payments.

November 5 -

Delinquencies fell in nearly every commercial-loan category, at trend anticipated to continue.

November 5 -

A greater share of the company's future earnings are likely to come from servicing as rates rise, Chief Operating Officer Andy Chang said.

November 5 -

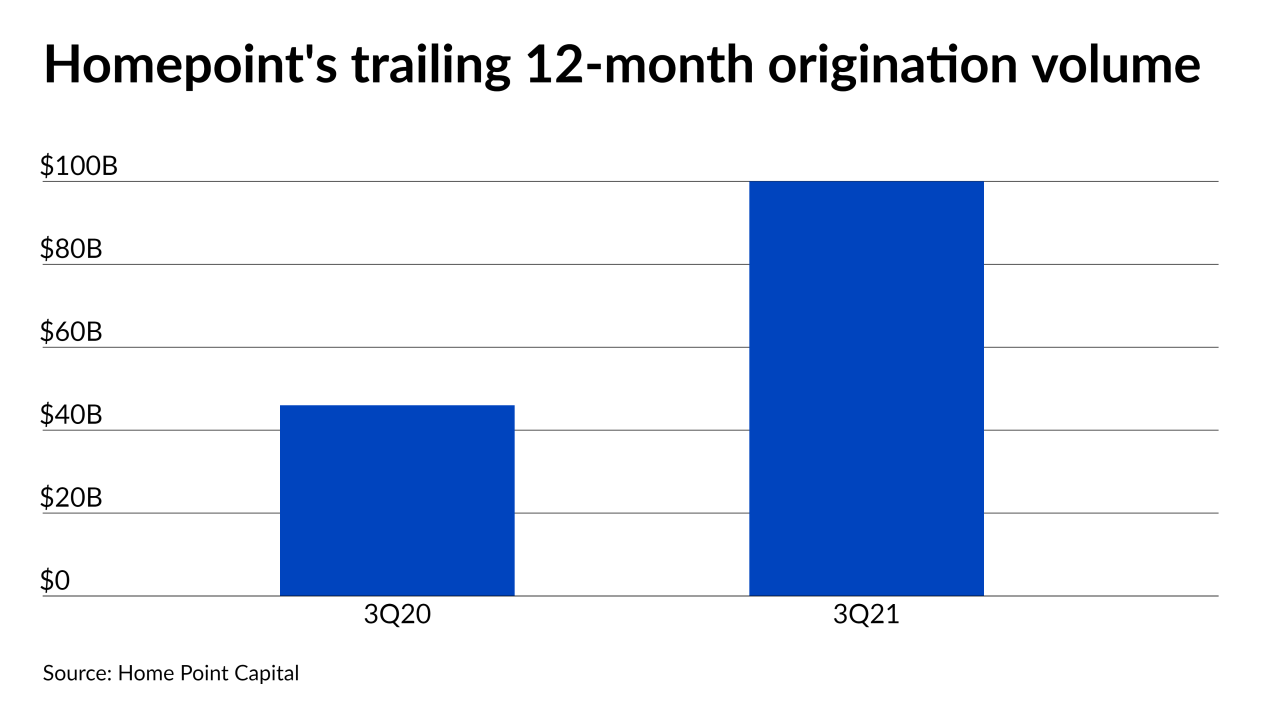

While the company produced $88 billion during the period, it had a major margin squeeze in its TPO Pro channel.

November 5 -

The seasoning clock for securitization eligibility restarts when a modification takes place, the government agency said.

November 4 -

The company is repositioning its secondary market sales of loans and servicing and implementing cost-cutting measures as the market normalizes.

November 4 -

The partnership with Esusu, which the athlete’s venture capital firm invested in earlier this year, could help renters build credit histories, broadening their housing options, improving loan performance and incentivizing originations.

November 3 -

The Fed said it would reduce Treasury purchases by $10 billion and mortgage-backed securities by $5 billion, marking the beginning of the end of the program aimed at shielding the economy from Covid-19.

November 3