-

The company’s six acquisitions since last March will contribute to increased revenue in both of its software and data and analytics segments.

November 8 -

More aggressive pursuit of government-related agencies’ affordable housing mission is expanding product availability, but government intervention can be a double-edged sword.

November 8 -

All six companies, however, remained highly profitable, as the delinquency and forbearance outlook is favorable for the possibility of rising claims payments.

November 5 -

Delinquencies fell in nearly every commercial-loan category, at trend anticipated to continue.

November 5 -

A greater share of the company's future earnings are likely to come from servicing as rates rise, Chief Operating Officer Andy Chang said.

November 5 -

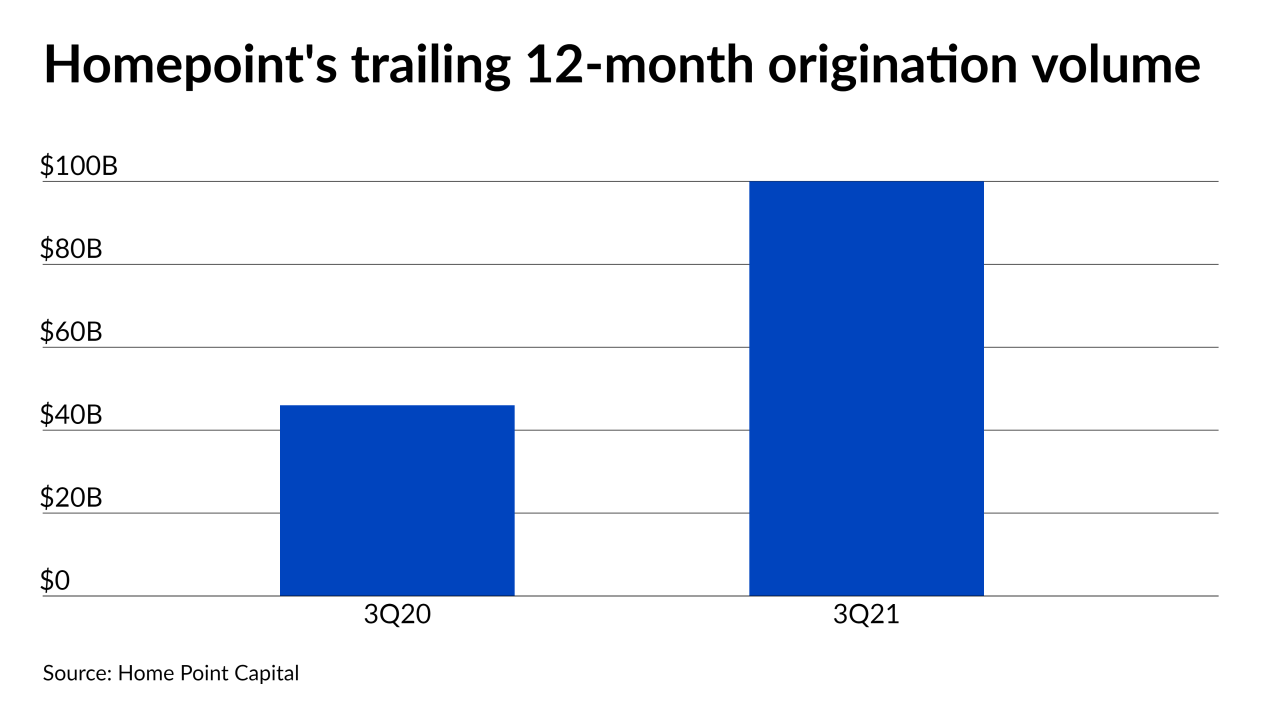

While the company produced $88 billion during the period, it had a major margin squeeze in its TPO Pro channel.

November 5 -

The seasoning clock for securitization eligibility restarts when a modification takes place, the government agency said.

November 4 -

The company is repositioning its secondary market sales of loans and servicing and implementing cost-cutting measures as the market normalizes.

November 4 -

The partnership with Esusu, which the athlete’s venture capital firm invested in earlier this year, could help renters build credit histories, broadening their housing options, improving loan performance and incentivizing originations.

November 3 -

The Fed said it would reduce Treasury purchases by $10 billion and mortgage-backed securities by $5 billion, marking the beginning of the end of the program aimed at shielding the economy from Covid-19.

November 3 -

Applications related to Zillow Offers made up 70% of the mortgage lender's purchase business in the third quarter.

November 3 -

Stronger collateral and less credit enhancement reflect lessening pandemic risk.

November 3 -

After closing its merger with Caliber, the company also hopes to pare down expenses by at least 10%.

November 2 -

The company, which was accused of cutting corners in originations by a former top executive, produced $32 billion in the third quarter and is guiding between $26 billion and $31 billion in the fourth.

November 1 -

When added to other staffing and acquisitions additions since year-end 2019, the mortgage services provider has more than tripled the company’s headcount.

November 1 -

The mortgage giant’s net worth of $42 billion at the end of the quarter was more than double what it was a year earlier. CEO Hugh Frater said that financial strength puts the company on better footing to support affordable housing goals outlined by the Federal Housing Finance Agency.

October 29 -

The move by the agency, which is an arm of the Department of Housing and Urban Development, will help further efforts to give servicers more leeway to modify mortgage terms.

October 29 -

Rocket, already the nation's No. 1 lender, is looking to increase market share

October 29 -

The combined refinance and purchase total was nearly double the average quarterly volume logged before the pandemic, the company said in its third-quarter earnings call.

October 29 -

Benchmark will issue 21 classes of certificates, with 13 entitled to principal and interest payments. Six classes will receive interest only.

October 28