-

The Federal Housing Finance Agency agreed to rework and improve procedures for regulatory communication about issues like servicing lapses in response to a recent inspector general audit.

September 29 -

CIM is secured by home loans making the most of second chances, and borrowers retaining their homes throughout several economic dips.

September 29 -

Many banks are still making loans tied to the scandal-plagued benchmark despite years of preparation for its demise. The end of 2021 could prove hectic as bankers scramble to implement changes and explain them to commercial borrowers.

September 28 -

Sara Avery previously worked for Common Securitization Solutions, which manages the issuance of the two government-sponsored enterprises’ bonds, including their uniform mortgage-backed security.

September 28 -

But the amount of forborne loans packaged into Ginnie Mae securities was up by 3 basis points on a consecutive-week basis, suggesting a concentration of distress there, amid broader declines.

September 27 -

The transaction is also the first securitization for ACREC. The entity is also taking on multiple roles, acting as sponsor, issuer and collateral manager.

September 27 -

Despite the increase, adjustments to single-family loan terms aimed at making payments more affordable remain historically low at the government-sponsored enterprises. But they could grow in line with forbearance expirations soon.

September 24 -

The move marks one of the first actions the two government-sponsored enterprises and the Federal Housing Finance Agency have taken to make a pandemic-related loss mitigation option open-ended.

September 24 -

The difference between purchase contract prices and valuations was consistently wider than in white neighborhoods, according to a recent analysis of 12 million appraisals from the Uniform Collateral Data Portal.

September 21 -

The company will return to selling pieces of its credit exposure to private investors during the last three months of the year, but is still evaluating its strategy for 2022.

September 20 -

Sequoia Mortgage Trust is among the first to include a distributed ledger agent in its reporting processes.

September 17 -

Changes proposed this week stand to reverse the effect of the Trump-era rule, which disincentivized Fannie Mae and Freddie Mac from making such deals, according to critics.

September 17 -

While the loss coverage is subsequently lower for the notes, totaling $194.2 million, it is expected to be sufficient to cover required rating multiples.

September 17 -

The Department of Housing and Urban Development increased the share of reverse mortgage assets it will give community organizations a first crack at, in line with goals of the Biden administration.

September 16 -

Required use of the Federal Housing Administration’s Catalyst platform may accelerate data collection on valuations from a government agency that’s insuring nearly one-fifth of all purchase loans.

September 16 -

The move generally gets a thumbs up from industry participants, but what can happen in the long-term is uncertain.

September 15 -

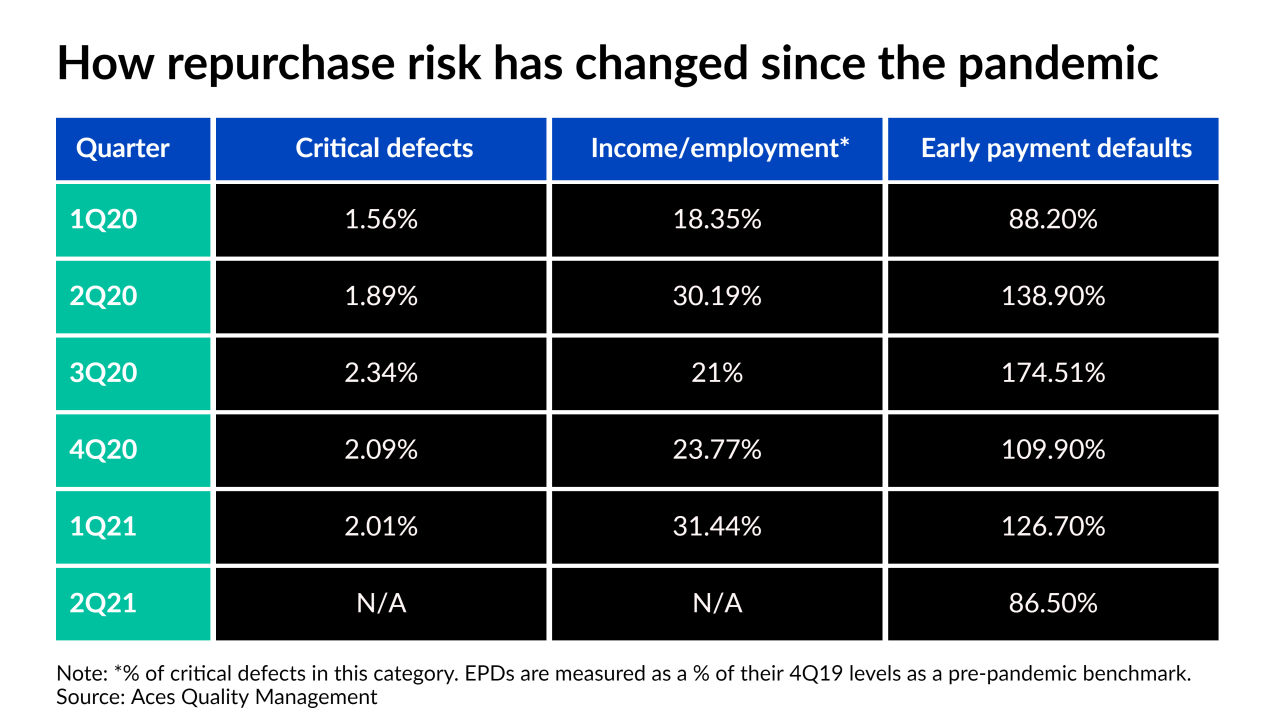

Critical defects fell as well, but the percentage that are related to income or employment concerns set a new record, surpassing the one set in the second quarter of last year.

September 15 -

Rather than add debt through a HELOC, the company’s product allows clients to get cash in exchange for a portion of the property's value.

September 14 -

Fitch Ratings’ second quarter numbers suggest even those facing some of the highest repayment hurdles may have been motivated enough by economic improvement to exit before many expirations were due.

September 14 -

The fintech projects the Series C capital will enable $10 billion in annual housing transactions through its system and expansion to half the U.S.

September 14