-

Revenue at the fintech company grew from prior periods without even taking into account any contributions from the Title365 acquisition at the end of the quarter.

August 20 -

Refinancing, high home prices, the concentration of pandemic-related hardships in the FHA market, and the lingering impact of last year’s market disruption all likely played a role in the intensified discrepancy.

August 20 -

The lending technology provider currently has 37,741 decisioning steps or pivot points on its platform.

August 18 -

The home purchase target for Fannie Mae and Freddie Mac would set a new 10% benchmark for qualified single-family lending in census tracts that meet certain demographic and income targets.

August 18 -

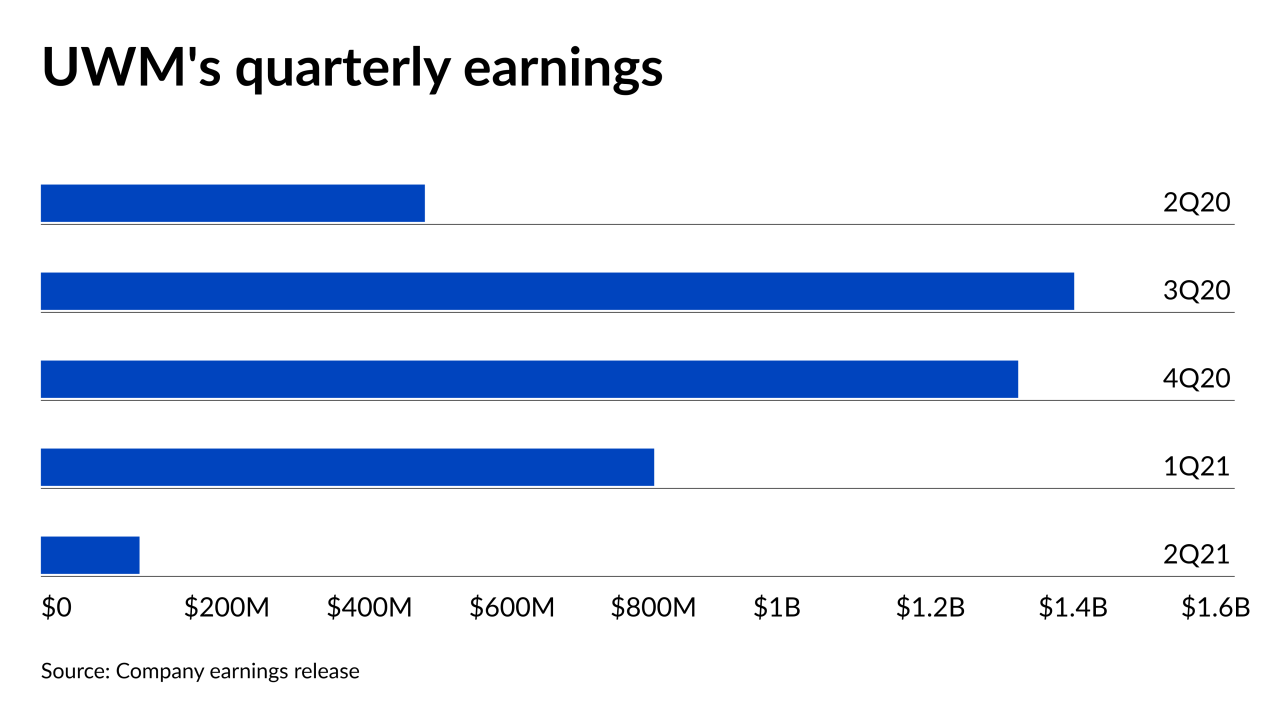

The wholesale lender has a cost structure aimed at beating the competition in a rising rate environment, Chairman and CEO Mat Ishbia said on the second quarter earnings call.

August 17 -

Depressed margins and a $219 million hit to its servicing rights fair value translated to a lower bottom line at the wholesaler.

August 16 -

Originations of loans to the self-employed and other outside-the-box borrowers had better margins than mainstream mortgages in the second quarter, but rebuilding after the niche market’s temporary disruption last year generated significant expenses.

August 13 -

Financial institutions will have until early October to weigh in about new risk-based capital requirements for nonbanks.

August 13 -

While the company's mortgage originations saw a 46% annual drop in gain on sale margin, it anticipates that annual volumes will exceed 2020 levels.

August 13 -

This year's assessment for Fannie Mae and Freddie Mac is the first to take into account a January agreement between the Federal Housing Finance Agency and the Treasury Department that allowed the companies to retain more earnings.

August 13 -

Shrinking gain-on-sale margins also ate into earnings, with growth expected to slow for the rest of 2021.

August 12 -

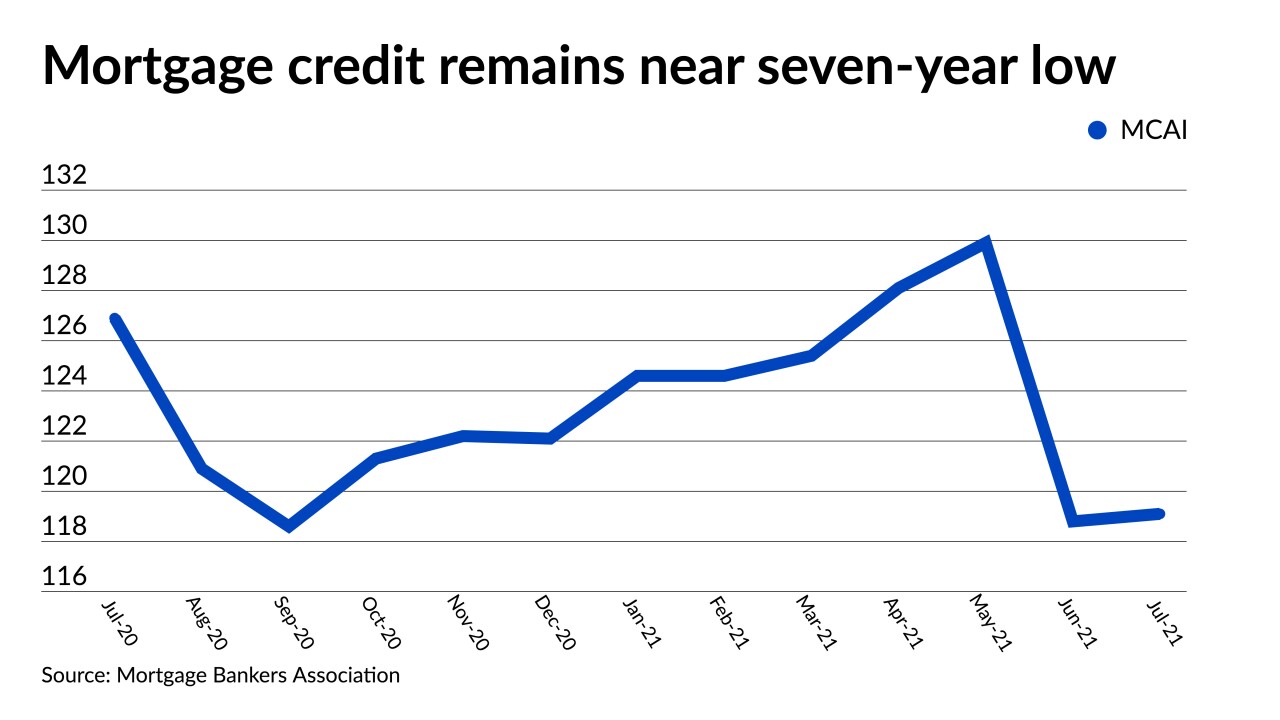

A jump in jumbo loan programs was countered by lenders dropping high loan-to-value conforming products.

August 12 -

The company attributed its second quarter loss to competitive pricing pressures and GSE-imposed charges.

August 10 -

Total investment property lending this year should be 31% above 2020's pandemic-affected activity.

August 10 -

The company’s $204 million in net income was down from unusual highs seen recently but still historically strong thanks to the balance between its loan channels and servicing operation, representatives said.

August 6 -

Delinquency concerns continue to wane as the end of forbearances is not expected to lead to a massive wave of foreclosure activity.

August 6 -

The company's expanded portfolio through its acquisition spree drove revenue, representatives said.

August 5 -

The company has been making investments in correspondent originations and servicing and “reverse” loans used by borrowers age 62 and up to withdraw home equity.

August 5 -

Many banks reported sharp declines in income from home loans during the second quarter. The large gains they enjoyed last year thanks to a surge in refinancing activity are unlikely to return, according to bankers and analysts.

August 4 -

The gain on sale in the retail channel dropped by more than half annually, as the wholesale and joint venture channel endured an even tighter squeeze due to competitive pressures

August 3