-

While the US military operation in Venezuela didn't hit sentiment on American financial markets, the action reminded investors how tenuous any trading thesis can be in a world undergoing geopolitical changes.

January 6 -

With limited seasoning and primarily a clean payment history, OBX 2026-NQM1 had a seasoned probability of default of 33.3% among the AAA stresses and 11.4% among the B.

January 6 -

Late last year, commercial bank holdings of mortgage paper reached the highest level since 2023 as these depositories are flush with deposits.

January 6 -

Keefe, Bruyette & Woods attributes Fannie Mae and Freddie Mac portfolio growth for the narrower spreads, but other reasons include lower volatility.

January 5 -

Minneapolis Federal Reserve President Neel Kashkari said on CNBC that both sides of the central bank's dual mandate show signs of imbalance, with the labor market appearing more vulnerable.

January 5 -

A definitive move could occur as early as fiscal year 2026 or take until 2033, depending on what the government is willing to do, according to one analyst.

January 2 -

For 2026, most Wall Street interest-rate strategists expect stable-to-higher Treasury yields as the Fed's rate-cutting cycle comes to an end.

January 2 -

A significant portion of the loans in the pool by balance, 44.5%, are designated at non-QM, according to DBRS, adding that about 50% of the loans in the pool were made to investors for business purposes.

December 29 -

Some action items could make a big difference for both mortgage lenders and consumers, but the Trump Administration is not yet focused on these concerns.

December 29 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

National Mortgage News takes a look back at some of the major or unique transactions which went on, or in some cases didn't happen, in the past 12 months.

December 29 -

Rialto Capital allegedly engineered a way to keep it in default so that the company could win extra fees over time, according to a lawsuit filed Tuesday.

December 26 -

Three Democratic Senators say Demotech's assessments "raise profound governance and reliability concerns" in letters to Fannie Mae and Freddie Mac.

December 26 -

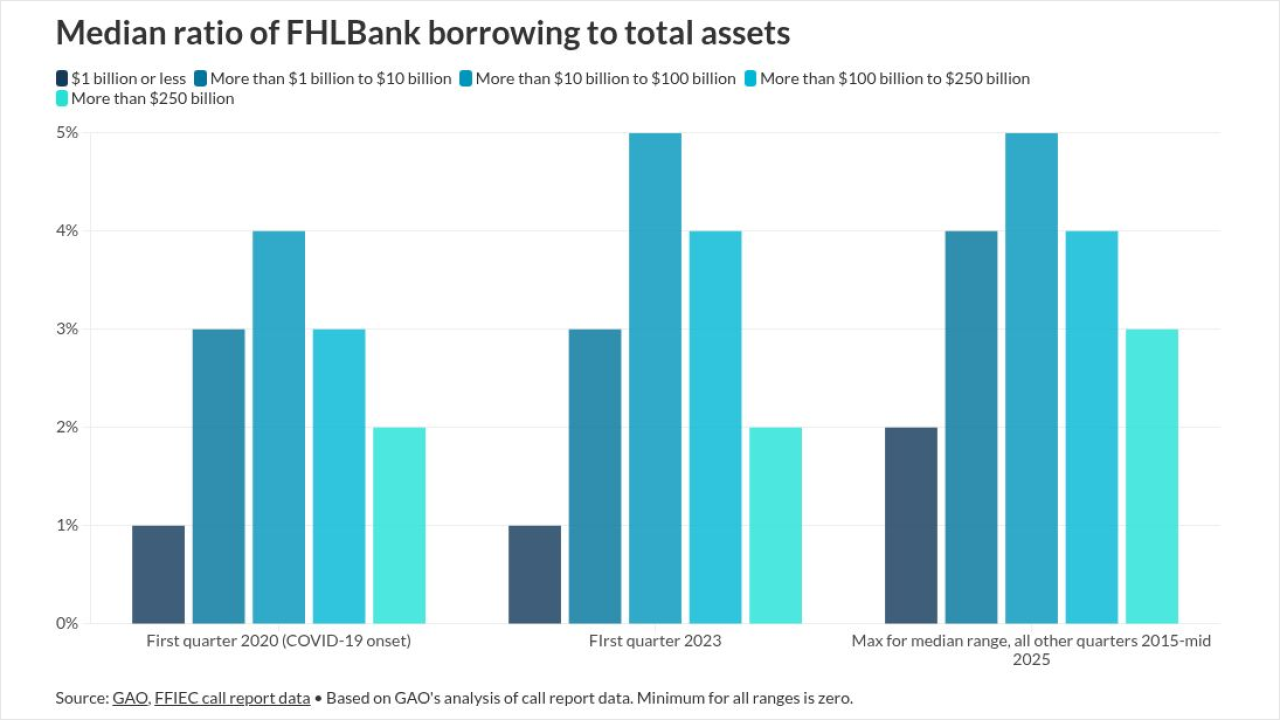

Fewer than 1% of members reported surges relative to total assets outside the normal range, making Silvergate's experience unusual, according to the GAO.

December 26 -

Fannie Mae sees growth in refinance activity pushing volumes upward, but flattening purchases will temper lender momentum, according to its December report.

December 24 -

A rise in issuance of nonqualified mortgages and seconds is in the forecast but home prices, credit and the GSEs may impact private-label bonds' trajectory.

December 24 -

Principal will be distributed pro rata among the senior A1 through A3 certificates, and subordinate bonds will not receive any principal until all senior classes are reduced to zero.

December 19 -

The move formalizes acting leadership roles both have had in different segments of the government-backed mortgage market serving many first-time homebuyers.

December 19 -

Monthly excess spread will confer credit enhancement to the notes, KBRA said, and while it will be released it will not be available as credit enhancement in future payment periods.

December 18 -

The option for holders of older government-sponsored enterprise bonds that predated the move to uniform mortgage-backed securities now has a deadline.

December 18 -

A coalition of mortgagees said the zombie seconds law negatively impacts 1.2 million junior liens statewide, despite just over 500 potential "zombie" loans.

December 18