-

The Federal Housing Administration's loan limits will generally increase 5% next year, but changes in the composition of statistical areas will lead to decreases in 11 counties.

December 4 -

October's deceleration in housing values could be followed by acceleration in 2020, but a growing subset of millennials nevertheless plan to become homeowners in the new year, according to CoreLogic.

December 3 -

In light of the Federal Housing Administration's strong financial performance, now is not the time to "reduce the FHA's footprint," but rather to broaden the critical access to credit role it plays.

December 3 Kellum Capital Group and Kellum Mortgage

Kellum Capital Group and Kellum Mortgage -

The supply of homes for sale in Atlanta continued to fall, which helped push prices higher last month, according to several reports.

November 29 -

Sales of previously owned homes increased in October as buyers responded to falling mortgage rates, extending a recovery in the residential real estate market this year that’s providing a modest boost to economic growth.

November 21 -

The two newest private mortgage insurance companies had their best quarters ever for new insurance written, aided by the increase in consumers refinancing with less than 20% home equity.

November 8 -

Faced with higher property prices and piles of student debt, Americans are getting older and older before they buy a home.

November 8 -

From the Tennessee-Kentucky border through coastal North Carolina, here are the 15 metro areas where millennial VA purchase-loan activity increased the most over the past fiscal year.

November 5 -

Inventory shortages, favorable tax policies and a dearth of affordable options caused homeowners to increase the number of years lived in their home, according to a Redfin report.

November 4 -

Apple will contribute $2.5 billion toward easing the housing crisis in California, joining other technology companies in helping alleviate a problem they are often blamed for exacerbating.

November 4 -

Sales of previously owned homes declined in September to the slowest pace in three months as higher prices limited the recent progress in residential real estate that has been aided by low mortgage rates and consistent wage gains.

October 22 -

Millennial homeownership rates declined between 2009 and 2016 before picking up in 2017, even as the number of households under the age of 35 dropped by over 1 million, a ValuePenguin study found.

October 10 -

Weaker-than-expected economic data led to a decline in mortgage rates this week, although consumer attitudes remain strong, and should continue to drive increased home purchase demand, according to Freddie Mac.

October 10 -

From Texas to Ohio, here's a look at the top 15 housing markets providing the shortest timelines for renters to buy a home, according to SmartAsset.

October 8 -

Fannie Mae is cracking down on homebuyer education requirements, particularly for first-time homebuyers and purchasers utilizing high loan-to-value mortgages.

October 4 -

With housing affordability still a prominent hurdle to homeownership, prospective buyers — especially millennials — now get creative in order to find suitable homes, according to Chase and the Property Brothers.

October 4 -

The majority of first-time homebuyers participating in a recent survey preferred online or phone interactions when receiving counseling that is a prerequisite for some loan programs.

October 3 -

Millennials took advantage of mortgage rates falling to near three-year lows in August, increasing their refinance share to the highest percentage since December 2015, according to Ellie Mae.

October 2 -

Millennials — now more than ever — dictate the direction the housing market is moving in, and with the deceleration of starter home prices, more should become homeowners soon, according to CoreLogic.

October 1 -

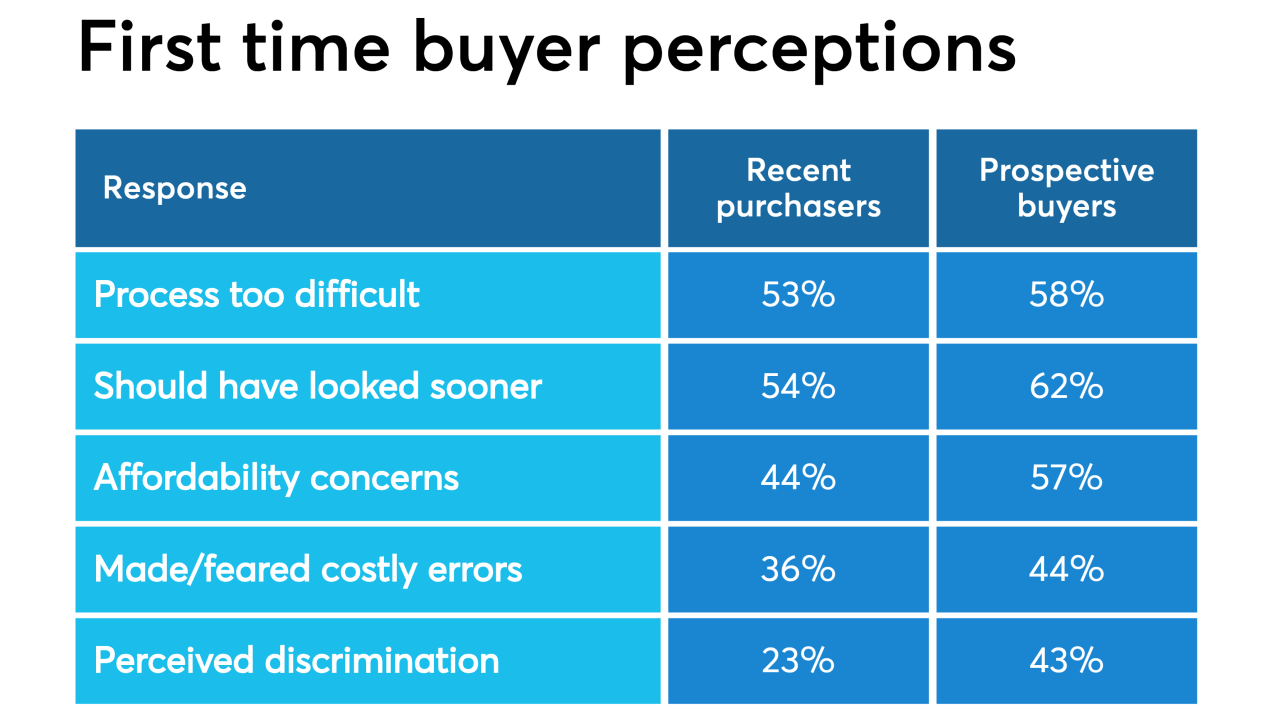

More than half of recent, as well as prospective, first-time homebuyers said purchasing a house was more difficult than it should be, according to a survey for Framework.

September 25