-

The 30-year average passed the 4.5% mark for the first time since January 2019 as the labor market tightened and prices rose.

March 31 -

Current deputy general counsel Wendell Chambliss steps up to the newly created officer position, with the appointment coming after a similar recent hire by Fannie Mae.

March 22 -

In addition to the Russia-Ukraine conflict, persistent inflationary pressures and expected monetary policy moves are contributing to volatility.

March 10 -

The effect of the conflict and upcoming Fed announcements have left much of the industry guessing about what happens next.

March 3 -

These standalone properties make up nearly half of all rental units and the financing of them by Fannie Mae and Freddie Mac should reflected in the Federal Housing Finance Agency's affordable housing goal calculations, writes Manchester.

March 2 Federal Housing Finance Agency

Federal Housing Finance Agency -

Fannie Mae and Freddie Mac have used the classic FICO score since 2003.

March 2 -

Its modifications aim to help two government-sponsored mortgage investors manage risk and rebuild capital while retaining enough flexibility to fulfill their affordable housing missions, said the Federal Housing Finance Agency’s acting director, Sandra Thompson.

February 25 -

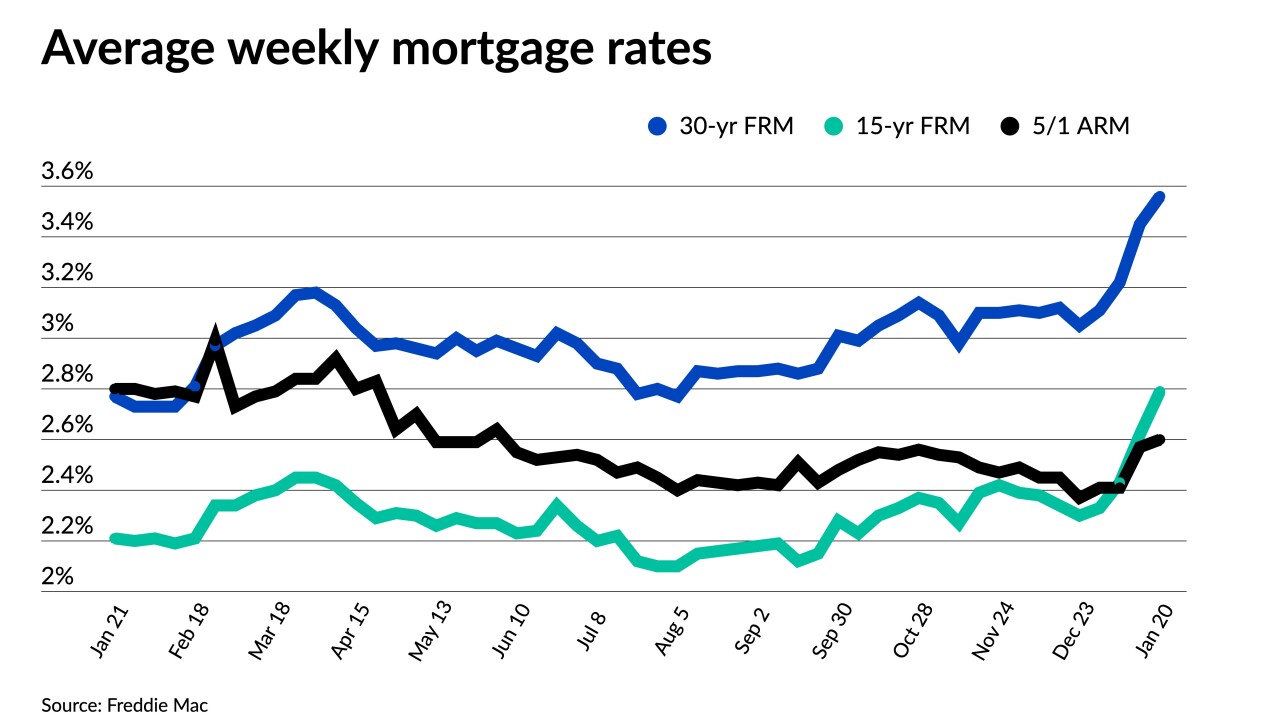

Strong economic data was countered by international political developments, sending the 30-year rate lower for the first time in a month.

February 24 -

The 30-year average increased by 23 basis points on inflation, geopolitical news.

February 17 -

Heidi Mason takes over as head attorney of the government-sponsored enterprise from Jerry Weiss, who had been in the position on an interim basis.

February 14 -

However, leadership noted that 2021 was the second record year for new single-family mortgages and also discussed how the government sponsored-enterprise plans to further rebuild its capital.

February 10 -

Inflation data showing a 7.5% increase in consumer prices will likely lead to Federal Reserve moves that apply continued upward pressure.

February 10 -

But the current lack of movement is likely only a temporary reprieve, according to Freddie Mac.

February 3 -

Former principal economist at the Federal Housing Finance Agency Paul Manchester breaks down how the targets have been calculated and discusses the implications for the set determined for 2022 to 2024.

January 31 Federal Housing Finance Agency

Federal Housing Finance Agency -

The co-founder of Arch Capital Solutions reviews the changes made to reporting disclosures on mortgages for condominiums and units located in HOAs that were part of a response to the tragic condo collapse in Surfside, Florida.

January 28 Arch Capital Solutions

Arch Capital Solutions -

But economists predict upward pressure in the coming months after comments from Federal Reserve Chair Jerome Powell.

January 27 -

All major averages have risen to start 2022, with the 15-year surpassing the ARM.

January 20 -

The delta variant added uncertainty to markets, leaving investors cautious about moves that would lead to upward movement.

August 5 -

This is the third major executive hire at the company amid an industry-wide push to attract more minorities to its ranks.

August 2 -

The government-sponsored enterprise's single-family credit reserve release caused earnings to spike.

July 29