The 30-year fixed rate flattened after

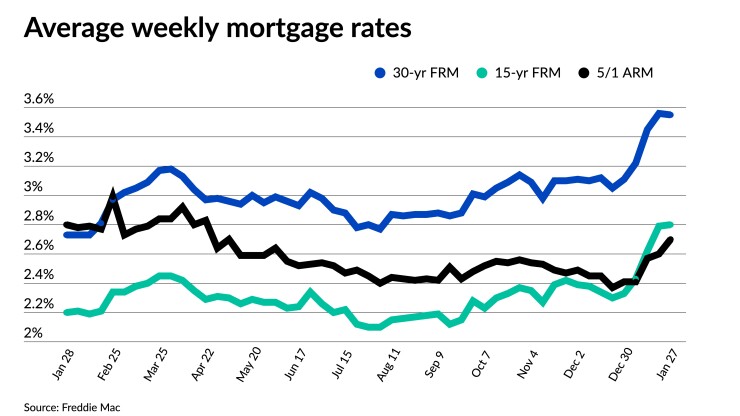

The 30-year average inched down a single basis point to 3.55% from 3.56% for the weekly period ending Jan. 27, according to Freddie Mac’s Primary Mortgage Market Survey. In the same week a year ago, the average had fallen to 2.73%.

“Equity market indices continued to significantly decline all last week, while mortgage-backed securities reversed a large selloff early to end the week basically flat,” said Paul Thomas, Zillow’s vice president of capital markets, in a research blog.

A relatively quiet week of data releases as well as comments from

“The Federal Reserve is pointing toward a more hawkish stance to address very high inflation rates and may take more aggressive action as needed,” Thomas said.

The central bank hinted it would begin a reduction of its balance sheet and introduce the first increase of the federal funds rate since 2018 in March, following an accelerated finish to its asset-purchase program introduced at the beginning of the coronavirus pandemic. Continued record inflation and speeding economic growth led to a more assertive approach intended to slow the pace of a potentially overheating economy. On Thursday, the Bureau of Economic Affairs reported that

Those vectors likely mean increases in mortgage interest rates lie ahead, albeit at a more gradual pace than what occurred to start the year, according to the

“MBA is holding on to our forecast that the combination of a stronger economy, persistent inflation and the reduction of monetary policy accommodation will all push towards somewhat higher mortgage rates, with the 30-year fixed rate hitting 4% by the end of 2022,” said Mike Fratantoni, the association’s chief economist.

Fratantoni also noted that the Fed’s plans to return to a balance sheet that is primarily Treasuries in the future adds some additional pressure on

While the rapid rise of interest rates has the attention of the mortgage industry, it has not yet made a huge dent in recent demand, according to Sam Khater, chief economist at Freddie Mac.

“Recent rate increases have yet to significantly impact purchase demand, as history demonstrates that potential homebuyers who are on the fence will often enter the market at the start of rate-increase cycles,” he said.

While the 30-year average edged downward for the week, the 15-year fixed rate increased by a basis point to 2.8% from 2.79%. A year ago, the 15-year average came in at 2.2%.

The 5-year Treasury-indexed adjustable-rate mortgage swung higher as well, to an average of 2.7% compared to 2.6% a week earlier. In the same week of 2021, the 5-year ARM stook at 2.8%.