-

Issuers approved for the program will receive written authority to use "digital collateral" for a limited number of securitizations.

July 20 -

Any intention that Ginnie Mae may have had to slow prepayment rates by changing the rules on RPLs seems to be thwarted by the grim economic reality facing the big banks.

July 15 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The number of loans going into coronavirus-related forbearance fell for the fourth consecutive week, as the growth rate plummeted 21 basis points between June 29 and July 5, according to the Mortgage Bankers Association.

July 13 -

The amount far surpassed that of any other servicer required to purchase Ginnie Mae-backed loans that were 90 days past due.

July 13 -

The number of loans going into coronavirus-related forbearance dropped for the third consecutive week, as the growth rate fell 8 basis points between June 22 and June 28, according to the Mortgage Bankers Association.

July 7 -

FHFA, HUD and Ginnie Mae should let the rate of prepayments on MBS dictate bond prices and market rates.

July 1 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The government agency's restrictions on issuer options for pooling loans go into effect immediately. Here's one thing it could mean for the secondary market.

July 1 -

The number of loans going into coronavirus-related forbearance edged down slightly, with the growth rate dipping 1 basis point between June 15 and June 21, according to the Mortgage Bankers Association.

June 29 -

Nonbank servicers have been seeking more sources of cash since the coronavirus disrupted markets and elevated forbearance rates. These are some strategies they may be able to use.

June 26 -

The number of loans going into coronavirus-related forbearance dropped, with the growth rate falling 7 basis points between June 8 and June 14, according to the Mortgage Bankers Association.

June 22 -

The Federal Housing Finance Agency was supposed to finalize its original proposal this month, but will redraft it because it was drawn up before the coronavirus emerged as a concern.

June 15 -

The number of loans going into coronavirus-related forbearance ground down to a growth rate of 2 basis points between June 1 and June 7, according to the Mortgage Bankers Association.

June 15 -

The Federal Housing Administration's move to insure loans with forbearance could help support homeownership opportunities constrained by the coronavirus if one change was made to it, trade groups said.

June 10 -

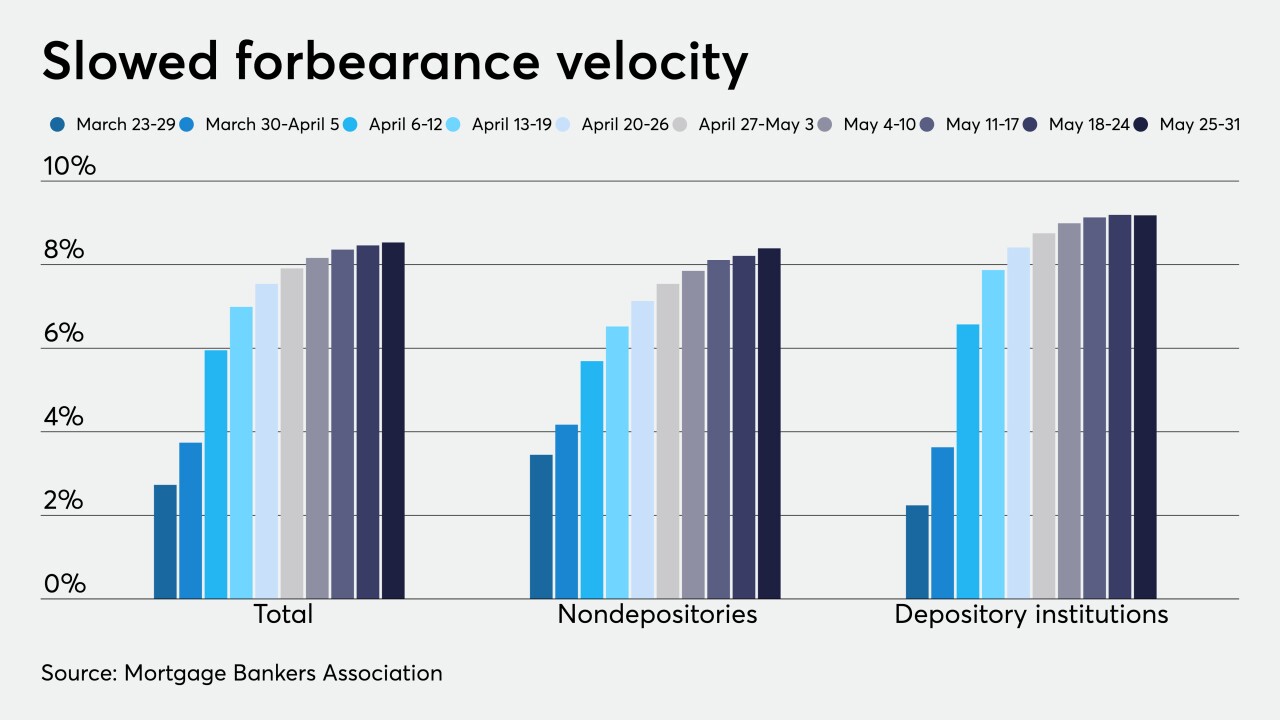

The number of loans going into coronavirus-related forbearance slowed to a rate of 7 basis points between May 25 and May 31, according to the Mortgage Bankers Association.

June 8 -

Self-service portals fielded at least half of coronavirus-related forbearance-plan requests and made it possible to handle an influx at a challenging time, but the GSEs recommend circling back to borrowers.

June 3 -

Coronavirus-related mortgages in forbearance grew 10 basis points between May 18 and May 24, according to the Mortgage Bankers Association.

June 1 -

Steps have been taken to manage coronavirus-related liquidity risks to the housing finance system, but some remain, according to Mortgage Bankers Association President and CEO Robert Broeksmit.

June 1 -

Aggregate numbers for coronavirus-related payment suspensions are showing more consistency as organizations clarify how they handle them, and some consumers' incentives to use them may be declining.

May 29 -

Coronavirus-related mortgages in forbearance grew 20 basis points between May 11 and May 17, according to the Mortgage Bankers Association.

May 26 -

Total forbearance driven by the coronavirus rose by 25 basis points, which suggests it is still growing but at a slowing pace, according to the Mortgage Bankers Association.

May 18