-

The Delaware company, best known for issuing prepaid cards, has ramped up commercial real estate securitizations. The shift promises to deliver big fees, but it could also cause headaches if defaults spike.

July 30 -

While regulation and nonbank competition are spooking some banks, others believe low funding costs and the right relationships can help them succeed.

May 21 -

Americans continued to take on debt in the first quarter, though new mortgage borrowing slowed to the weakest level since late 2014, according to a Federal Reserve Bank of New York report.

May 14 -

Gateway Mortgage Group’s dream of being a national, diversified financial services player will hinge on its effort to turn a community bank into an online-only platform.

April 9 -

The Federal Reserve Bank of New York is streamlining its Ginnie Mae holdings by combining mortgage-backed securities with similar characteristics into larger pass-through instruments.

February 25 -

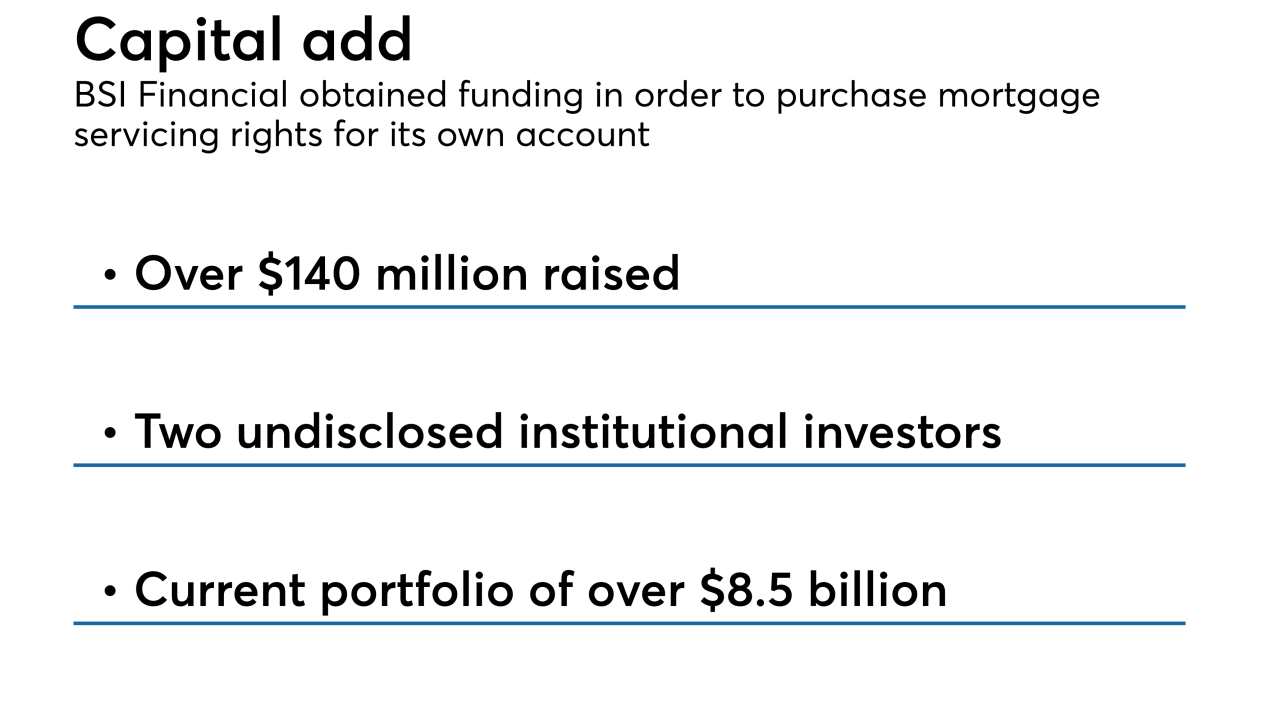

BSI Financial Services received a capital infusion for the subservicer to acquire mortgage servicing rights for its own account in order to offer its clients more liquidity for this asset.

February 22 -

The industry's largest acquisition in more than a decade will create the sixth-biggest bank in the country, with assets of more than $442 billion.

February 7 -

The tricky part: raising awareness without appearing to take advantage of borrowers at a time when agencies like the SBA are out of commission.

January 11 -

Bank OZK's George Gleason, one of our community bankers to watch in 2019, needs to rein in the Arkansas bank's commercial real estate exposure to placate nervous investors.

December 31 -

Challenges will likely increase as interest rates rise and investors grow more concerned about a downward turn in the economic cycle.

November 16 -

Mutual of Omaha Bank company Synergy One Lending is preparing to acquire certain assets of BBMC Mortgage, a national mortgage company and division of Bridgeview Bank, which will expand its Midwest footprint and improve its strategic direction.

November 1 -

First Foundation sold loans to Freddie Mac to free up space for higher-yielding credits. It then bought the securities that were formed to replace other, lower-yielding assets through an often overlooked program.

October 1 -

Bemortgage, currently a division of Chicago's Bridgeview Bank formed last November by a former Guaranteed Rate executive, will become a part of CrossCountry Mortgage.

September 26 -

Level One Bank in Farmington, Mich., has hired a team of mortgage bankers from MB Financial, which previously announced it was shutting down this business line.

July 10 -

The deal is designed to improve capital ratios and reduce risk at the Seattle company.

July 3 -

Ruoff Financial will make its first push into banking with the purchase of SBB Bancshares.

June 19 -

Remax Holdings is focused on "what it does best" with its Motto Mortgage business and in facing off against Zillow's new home buying and selling initiative, a company executive said.

May 31 -

Costs rose at the global bank, profit in North America fell 16% and questions are mounting for new CEO John Flint ahead of the release of his strategic plan.

May 4 -

The Chicago company said its decision was largely based on intense competition, very low margins and economic changes.

April 12 -

A "three-pronged" internship and management program at HUD Federal Credit Union is helping professionals across all stages of their careers, and the initiative has garnered notice from HUD Secretary Dr. Ben Carson.

April 5