-

The debate over housing finance reform appears to have new life as both Democrats and the next administration appear ready to take up the issue.

December 1 -

The Federal Housing Administration will increase loan limits across most areas in the United States in 2017 to reflect rising home prices.

December 1 -

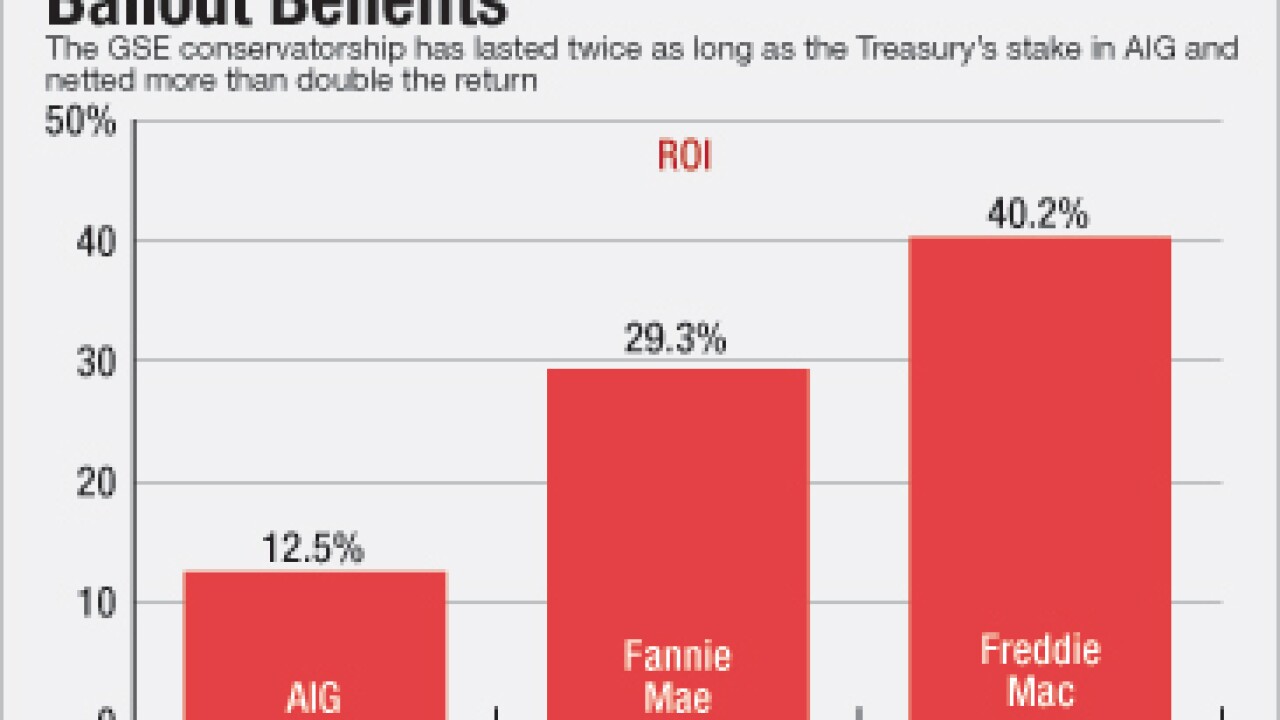

Privatizing the government-sponsored enterprises is a priority for Treasury Secretary-designate Steven Mnuchin. Here's a look at what it will take to pull off and the potential implications for the mortgage industry of unwinding the conservatorship.

December 1 -

Conforming mortgage rates are at their highest level this year after increasing 51 basis points since Election Day, according to Freddie Mac.

December 1 -

Treasury Secretary-designate Steven Mnuchin's plan to remove Fannie Mae and Freddie Mac from government control could mean increased competition for lenders' loans. But it could also prompt a rise in mortgage rates.

November 30 -

Even before taking office, Treasury Secretary-designate Steven Mnuchin has said he wants to return Fannie Mae and Freddie Mac to the private sector, a radically different vision of housing finance reform than that pushed by other Republicans.

November 30 -

Some banks are set to get a fourth-quarter earnings boost from their MSR portfolios, thanks to a sudden spike in yields on Treasury bonds. Add to that the prospect of further rate hikes and the potential dismantling of Basel III, and more banks could be encouraged to re-enter the servicing business.

November 30 -

Treasury Secretary-designate Steven Mnuchin wasted no time Wednesday wading into one of the thorniest debates in the financial services arena, saying the Trump administration would seek to end government control of Fannie Mae and Freddie Mac.

November 30 -

Mortgage bankers are anxiously waiting to see who President-elect Donald Trump will pick as the next Treasury secretary. Several prominent names have been floated for the job, though with every passing day, a new possible choice seems to pop up. Following is a look at the current crop of candidates and their chances.

November 29 -

Freddie Mac has published a list of companies that meet its requirements regarding the creation, signing and storage of electronic promissory notes.

November 29 -

Many big banks are backing away from the retail channel and FHA lending due to rising compliance costs. But U.S. Bank Home Mortgage President Tom Wind sees an opportunity to leverage those challenges to improve efficiency and transparency.

November 29 -

John Allison, a contender for President-elect Donald Trump's Treasury secretary, is a staunch opponent of the Federal Reserve Board, the Basel international accords, the government's support of the housing finance industry and the Dodd-Frank Act of 2010.

November 29 -

Tom Wind is once again leading a large bank's mortgage operation. As the new president of U.S. Bank Home Mortgage, he's set a course that embraces retail, regulation and the FHA.

November 28 -

The Federal Housing Finance Agency's choice to raise conforming loan limits in 2016 for the first time in a decade is being met with enthusiasm from the mortgage industry, as it should prove to be a positive for future origination volume.

November 23 -

The average for the 30-year fixed-rate mortgage this week topped 4% for the first time since 2015 as 10-year Treasury yields continued their post-election climb, according to Freddie Mac.

November 23 -

The maximum baseline conforming loan limit in 2017 is being increased to $424,100 by the Federal Housing Finance Agency.

November 23 -

The multifamily lending caps for Fannie Mae and Freddie Mac will stay the same as they were in 2016 next year, the Federal Housing Finance Agency announced.

November 22 -

The transition team for President-elect Donald Trump announced a series of names this week for people who will help facilitate an orderly transfer of power at the federal financial regulators.

November 22 -

Tight lending standards resulted in 1.1 million fewer mortgages being originated than if looser requirements were in place, according to the Urban Institute.

November 22 -

If President-elect Donald Trump selects House Financial Services Committee Chairman Jeb Hensarling as his Treasury secretary, it would be a clear sign that he intends to embrace a more traditional Republican agenda when it comes to financial services issues.

November 22