-

While mortgage rates moved somewhat higher in the period before the election, after the results were known, the yield on the 10-year Treasury broke above 2%, according to Freddie Mac.

November 10 -

Farmer Mac's third-quarter net income increased 95% to $16.4 million over the same period one year ago due to a $5.4 million increase in the fair value of financial derivatives.

November 9 -

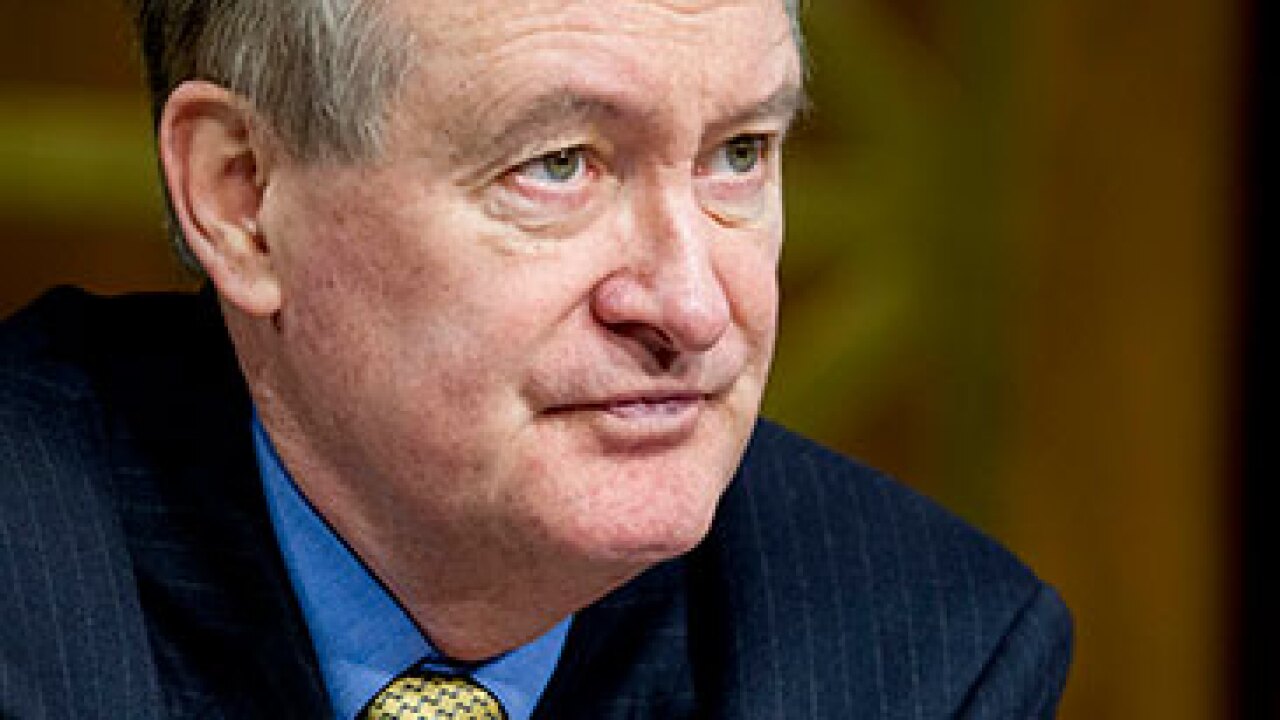

There was another surprise Tuesday as Republicans managed to keep a Senate majority following the elections, likely giving the gavel of the Banking Committee to Sen. Mike Crapo, a right-of-center Idaho lawmaker who has proven willing to reach across the political aisle in the past.

November 9 -

Many issues facing President-elect Trump and the 115th Congress will have far-reaching implications for the mortgage industry. Here's a look at five of those most pressing questions awaiting elected officials when they take office in January.

November 9 -

Housing was the talk of the campaign two presidential elections ago, but it stayed under the radar in the 2016 race, leaving plenty of room to speculate about President-elect Donald Trump's likely mortgage policy for the next four years.

November 9 -

A Florida hedge fund transformed risky Fannie Mae and Freddie Mac debt into investment-grade securities, and it could end up helping the mortgage giants' efforts to offload more of their risk.

November 8 -

Towd Point Master Funding, an affiliate of Cerberus Capital Management, was the winning bidder for two pools of reperforming mortgages with a balance of $789.2 million auctioned by Fannie Mae.

November 8 -

Lenders have the most consumer-facing role in the mortgage industry. By adopting three cultural adjustments, they can introduce more diversity into the workforce and create sustainable businesses and stronger communities.

November 8 New American Funding

New American Funding -

Home purchase sentiment fell for the third straight month in October, reflecting the uncertainty consumers face, according to Fannie Mae.

November 7 -

Since the government-sponsored enterprises began experimenting with both frontend and backend deals in which part of the credit risk is shared with third parties, investors have been watching carefully.

November 4 -

Hiring by independent mortgage firms accelerated in September after a slowdown in the prior month.

November 4 -

Fannie Mae's new representation and warranty relief offers lenders a long-awaited incentive to use its automated loan validation technology. But is it enough for lenders to make the necessary technology updates and process changes to implement the tools?

November 3 -

The agency released a plan last week that would stipulate that newly constructed homes financed by the Federal Housing Administration would have to be elevated two feet above the 100-year-based flood level.

November 3 -

Mortgage rates increased 7 basis points to their highest level since late June, the largest one-week gain in more than six months, according to Freddie Mac.

November 3 -

A new refinance mortgage offered by SoFi and Fannie Mae lets consumers tap into their home equity to pay down student loan debt at terms more favorable than a traditional cash-out refi.

November 2 -

Freddie Mac's credit risk transfers come with a hefty price tag, but are ultimately still worth it, according to Chief Executive Don Layton.

November 1 -

Freddie Mac's net income rose to $2.3 billion in the third quarter, a big turnaround from the same point last year, when it lost $475 million due to derivative hedging instruments.

November 1 -

Courting borrowers with past bankruptcies might not cross most loan officers' minds as the best strategy for building business, but Guaranteed Rate's Danielle Young doesn't let borrowers' past blemishes intimidate her.

November 1 -

Commercial mortgage originations increased 5% in the third quarter compared with the same period last year, driven by a huge increase in government-sponsored enterprise volume.

November 1 -

The mortgage industry is welcoming the Obama administration's possibly final word on housing finance reform, hoping it will serve as guidepost for the future.

October 28