Complimentary access to top ideas and insights — curated by our editors.

Gen Zers — those born between 1997 and 2012 — are as a group more positive than the slightly older millennial generation regarding what homeownership means for their future financial well-being.

Research and advisory firm Gen Z Planet founder Hana Ben-Shabat looked at 1,000 people in each group and studied the distinct postures regarding culture, work and commerce.

"The biggest difference that I see between the generations is really their reaction to the circumstances that they experienced during their formative years," Ben-Shabat said. "Somehow millennials ended up being more risk averse, and I believe that Gen Z have more risk-taking attitudes."

That might be because the millennial generation, defined as those born between 1981 and 1996, ended up with plenty of student loan debt and difficulties in finding suitable employment after their education ended.

87% want to own a home in the future

While 87% of Gen Z answered that they would like to own a home in the future, just 63% of millennials had the same aspiration.

Because of their negative experiences, millennials questioned if they needed to own a home, avoiding taking on debt and making equity investments, Ben-Shabat said. The next generation has the opposite view.

"Gen Z is no stranger to financial difficulties or challenges because they [lived through] the peak of the 2008 recession," Ben-Shabat continued. "And they are the graduates of the global pandemic, but still even with that, they actually are very determined to handle these experiences and secure their future by taking calculated risk."

Other factors contributed to Gen Zers homeownership desires. Low

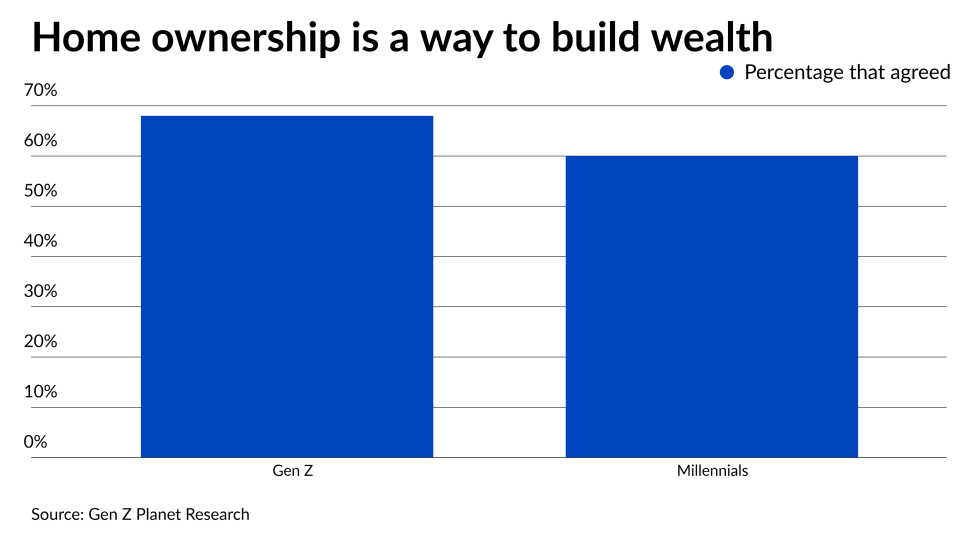

68% consider homeownership as a way to build personal wealth

Because financial security is a core value for Gen Z, they have an inclination towards saving money, thinking about home ownership, and investing money in the very early stages, Ben-Shabat said.

It also goes back to the American Dream. "There is a great portion of Gen Zers who are first generation Americans," she said. "So their parents immigrated and therefore they view home ownership as something that you should be proud of because their parents never owned a home."

They have $360B in disposable income

Meanwhile, most Gen Z-ers

Over three-quarters put their money into traditional savings accounts, while 26% play the stock market, 14% are already starting to save for retirement, 13% are putting funds into money market accounts and 6% are buying non-fungible tokens.

They may buy homes at a younger age than millennials

At the age of 30, 42% of millennials owned homes in contrast to 48% of Gen Xers who owned homes at that age and 51% of baby boomers, according to an ApartmentList.com study of Census Bureau data. Another study of Census Bureau data by iPropertyManagement.com found that in 2019, people under the age of 30 had a 3.9% share of all homes owned in the U.S., compared with 6.3% in both 2009 and 2001, and 5.7% in 1993.

"So [millennials] were very late in buying homes," Steinfeld said. "Gen Z, we believe that they will buy homes and exceed the Gen Xers at the age of 30."

Nearly

They do their homework

"They have extremely high expectations for a customer experience," said Winnie. "Specifically they are the first generation that's always had the cell phone and in the bulk of their formative years, they've had DoorDash and they've had Amazon, and those experiences for them form the basis for their expectations when they interact with anything."

When they come for a student loan to one of the companies that CampusDoor works with, Gen Zers already have researched things like rates and fees and now want an expeditious process for getting their loan, Winnie said.

Some of expectations may be inspired by 28-minute pizza delivery

"They don't want to say we got your order, your pizza will be there later, they want to know you got it, you got it right and they're going to have it in 28 minutes," said Winnie. "And so we find that we really had to make this process granular and transparent; otherwise they're used to so much information that if you give them a void they will call until they fill in the gaps."

Mortgage lenders are going to have to provide that same experience as more and more of Gen Z creates their own households.

While millennials are doing a fair amount of research and shopping online, they were not as likely to complete the mortgage transaction in that mode, added Berkshire Bank's Steinfeld.

"So we, in our preparation for the Gen Zers, are making sure that our customer facing portals are user friendly, we're providing them as much information online about our products and services, affording them the opportunity not only to apply online, but with many states approving eSign for closing documents, having the ability for them to sign their documents online if they want and then also having the ability to make their payments online," she said.

Their experience with getting student loans will set a high bar for mortgage lenders to meet when Gen Z looks to buy their home, Winnie added.

"They will have really high expectations for how easy it is to know what their rate is, to know what their fees are, to know how long it will take to get their money," he said. "Now this generation is also probably the most empathetic and progressive generation but they know what they want."