For PKL Homes owner Pamela Loveless, “what is happening now in the Black Lives Matter movement ... [is] just a piece of the larger conversation that needs to be happening in this country.”

Loveless and members of her family are Black, and some of them have experienced being taken into police custody after having been mistakenly identified as suspects. This happened even though they complied in each instance and have family members that serve on the force. One young man was tazed, another was thrown down on the ground with his date after being stopped on their way to dinner.

“Someone judging you negatively when they don’t even know you is awful. Once you experience that feeling, you never forget it,” said Loveless, who previously worked in the mortgage industry for over two decades.

The police killings of George Floyd, Breonna Taylor and Ahmaud Arbery have kicked off protests on racial injustice across the country and ignited a national conversation about social and economic inequalities that are the result of deeply ingrained racist attitudes and institutional practices in American culture.

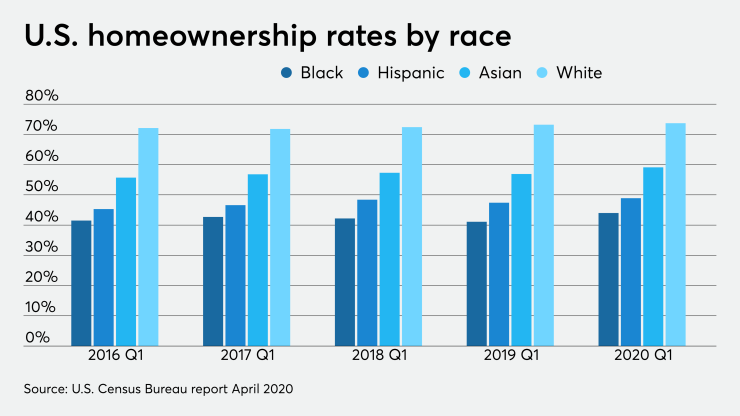

As the country reckons with centuries-long discriminatory systems and policies, housing and homeownership are under the spotlight as a sphere of severe inequity for people of color. Data from the first quarter of 2020 shows homeownership rates of 73.7% for whites and 44% for Blacks, according to the Census Bureau. Such discrepancies, which also show lower homeownership rates for Hispanics at 48.9% are a sign that federal civil rights laws banning housing discrimination are not working as intended.

The housing and mortgage industries can and should respond to these deaths and other issues the Black community faces, according to the

"Black Americans are simultaneously battling COVID-19, as well as the virus of racial injustice, the virus of discrimination, the virus of prejudice and the virus of inequality,” said Donnell Williams, president of NAREB. "This is a historic time. A new birth is taking place. In the future, you will be asked, ‘what’d you do?’ What’d you do when the homeownership gap between Blacks and whites hovered around 30 percentage points? What’d you do when Black men were shot and killed for jogging in Georgia or physically restrained to death in Minneapolis?”

Those in the mortgage industry offer some thoughts on how we got here, what's being done to fix it and how much further we need to go.

The inherent problems

Homeownership is a foundation for building wealth. Purchasing a home is a sound investment, boosts net worth and becomes an asset to be passed down generationally. Over time, the effects of that compound. Intrinsically,

"Within the past few years, if a Black family was at the poverty line, the average net wealth was $0. At the same point in time, a white family under the poverty line typically had $18,000 in wealth," said James Ryan, president of Time For Homes, an advocacy group that aims to combat homelessness in New York. "This isn’t necessarily the work of some racist politicians from the deep south with redneck ideas making nefarious legislation. It's a continuum of what's happened previously. The majority of white families passed down some kind of wealth."

Those gaps can be blamed in part on the

And even though

Credit issues create another obstacle for potential buyers of color.

"You can't get a mortgage without at least halfway decent credit," Ryan said. "Again, it's disproportional to communities of color. You also have a disparity in the criminal justice system. If you go to apply for an apartment to get on track to be fully housed and a step closer to buying a home, most will require credit check and background checks, which could be problematic. Indiscretions with the law shouldn’t matter if you served your time and are no longer on probation or parole."

Predatory lending also targets Black and Latino borrowers, leading to financial devastation. During the housing boom prior to the Great Recession, Black and Latino borrowers were twice as likely as whites to receive high-cost subprime loans. Black and Latino families making over $200,000 annually were more likely to be given a subprime loan than a white family making $30,000 a year, according to a report from Bloomberg.

The dearth of minority representation within the industry also points to why rules and regulations are shaped disadvantageously for people of color. Getting more diversity, especially with top positions would help level the playing field.

"We have to work to get more people of color into the mortgage business. We’re going to do employment outreach efforts, starting at the college level," said Patty Arvielo, president of New American Funding, a mortgage lender based in Tustin, California. "My personal goal is to interface with communities of color to let them know about the opportunities in the mortgage business. Color matters. Representation matters. And we’re going to make sure that that message never gets lost."

Loveless, who founded PLK Homes to address short-term workforce housing and student rental needs, said greater representation within the real estate and mortgage communities is a crucial way to help the Black community at large.

“Most of the mortgage companies have programs for inclusiveness, and they are constantly tweaking those,” she said. But the recurrence of regulatory and legal actions suggest the industry could still do a better job when it comes to engaging in equitable practices as required by law.

She advises lenders to be particularly careful bias or discrimination does not come into the picture when it comes to manual underwriting used to make exceptions.

“Where you can override or make a manual decision, that’s when companies can get into a little bit of a gray area,” Loveless said.

Programs for the people

Releasing a statement of solidarity is merely lip service until a company actually puts action behind it. Myriad ways exist for the

At the beginning of June,

However, New American is one lender that kept its low FICO, FHA, manual underwriting and bond programs going through these uncertain times.

Because many homeowners of color can't rely on their parents to borrow money, coming up with down payments presents a great challenge, particularly in high-end markets, sources said. While some see down payment assistance programs as controversial — HUD wants

"People forgot that we've had great success with programs with very high LTVs — namely VA loans and FHA loans — and have done so historically," said Gary Acosta, cofounder and

Through its Chenoa Fund, the South Jordan, Utah-based

However, government policy in recent years has discouraged the use of DPA in part because of the potential risks of foreclosure.

Breaking long-held and possibly outdated beliefs surrounding homeownership could be another factor in closing the gaps. As with wealth, if Black borrowers don't have the generational

Located in the nation's capital, the MBA represents every facet of real estate finance. The association's affordable housing initiative provides strategies and tactics to bridge the homeownership divide.

"We are collaborating around and addressing key gaps in homeownership in the minority community, mainly the knowledge gap where people have misinformation about what's required to become homeowners, like they need 20% down and perfect credit," O'Connor said. "So how do we get reliable information into their hands? Because they're self-selecting out of the market right now."

Change at the top

No silver bullet exists to close the chasm in homeownership. However, making numerous equitable policy additions and adjustments could combine to tip the scales.

In the near term, how the government and

"With the unemployment rate still high, and that affecting mostly people making under $50,000 a year, they are

Williams wonders whether loan-level pricing adjustment fees could be removed. The GSEs implemented these fees after the housing crash. The LLPAs exist more to protect the U.S. government, the GSEs and the MBS investors than the lender. And they cost already-strapped borrowers more money.

Government-sponsored enterprises shouldn't operate at a hindrance to any segment of society, particularly those already at a financial detriment, said

"I've always felt the federal government does not need to be in the mortgage lending business, unless they're going to be there to reach segments of the population not being reached adequately," NAHREP’s Acosta said. "So if you look at Fannie and Freddie and their book of business, my sense is — this is just my opinion — that they probably do more business than they need to in the affluent segments of the marketplace and a lot less business than they probably should be doing in the first-time home buyer, less affluent segments of the business."

Ridding the industry of the stigma surrounding down payment assistance would pave the way for many. If the majority of minority borrowers do not possess the upfront means to purchase a home, they should not be excluded from doing so, advocates say.

"HUD should stop attempting to restrict creditworthy, mostly minority, borrowers from having the ability to acquire DPA from a governmental entity," said Tai Christensen, director of governmental affairs at CBC Mortgage Agency. "Any restrictions to DPA programs should be viewed as a direct attack on Black homeownership. If we as a society wish to close the racial wealth gap and bring healing to our communities of color, HUD must not enter into any rulemaking that decreases equitable access to government-backed down payment assistance."

In this vein, the government can look at expanding programs like

"I can’t tell you how much help that would be to amend that section and add African Americans," Williams noted. "What a stimulus that would be."

Advocates like PLK Homes' Loveless are hopeful that the activism that has sprung from this historic moment will lead to positive change. She's gotten some community support to that end, but she also noted instances in which she has faced compounded discrimination and hostility from strangers making false assumptions that anyone Black was part of a multiethnic group of rioters that damaged property during the protests.

With the spread of the coronavirus having a disproportionate effect on the Black community, things could get worse before they get better, Loveless said. But her experience of prevailing after facing multiple hardships makes her hopeful that things can get better even when times are tough, with persistence.

"I look at things now and say where do we go from here? How do we address this?" Loveless said. "You start with inclusive practices and training, and go from there."