Rising costs, low availability push new-home apps down in February

“Builders continue to be confronted with rising input costs and a lack of available lots, causing them to slow production,” MBA’s Joel Kan said.

Read the full story

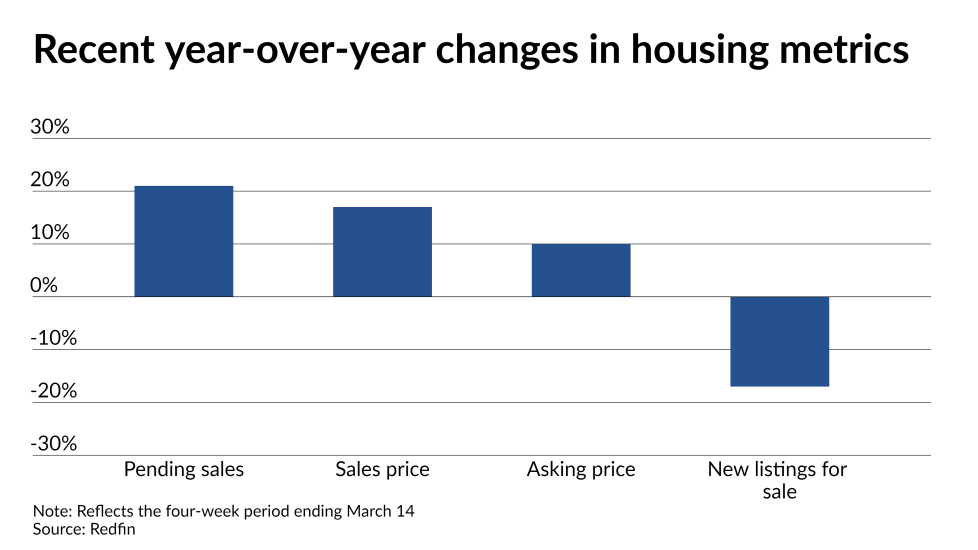

Home prices have hit a record high, but it’s not a bubble

That prompted renewed reassurance that the current rise in housing values won’t end with a crash like the one seen after 2006, because

Read the full story

Inflation jitters drive mortgage rates up

The increase comes despite the Federal Open Market Committee’s assurance that it will not raise financing costs

Read the full story

Ex-Freddie Mac CEO warns relief shortcomings could bedevil multifamily

Measures like the rental eviction moratorium and the temporary loan payment suspensions for landlords who provided tenant relief were necessary but imperfect solutions since they failed to get relief to renters in an expedient way, said Brickman, who is now the head of a

Read the full story

Black Knight turns to mortgage broker market with LOS purchase

The acquired LOS will be rebranded in the near future, the company said. It will be a standalone platform, although there will be integrations for wholesale mortgage lenders that use Black Knight’s existing product Empower LOS. Terms of the deal were not disclosed.

Read the full story

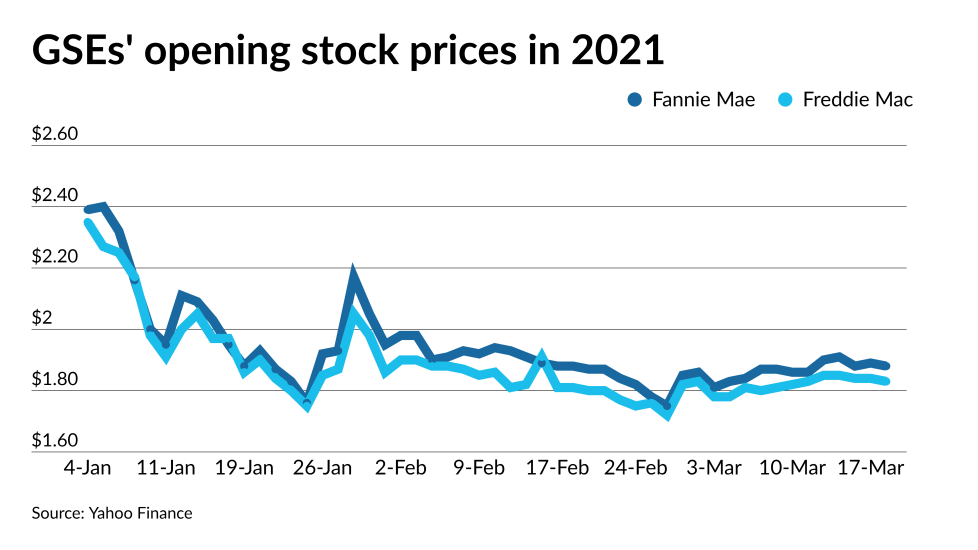

GSEs’ exit from conservatorship estimated to take 15 years

January's

Read the full story

Freddie Mac appoints Mark Grier as interim CEO

In the short term after Brickman's departure, Freddie Mac was headed up by Michael Hutchins, who was promoted to president on Dec. 28. Hutchins will remain as president under Grier.

Read the full story

Flagstar’s data breach and what lenders can learn from it

The hackers exploited a flaw in Accellion’s File Transfer Appliance software, which the bank was using to secure sensitive content. Dozens of other Accellion clients were affected by the incident, including the law firm Jones Day, Harvard Business School and the Reserve Bank of New Zealand.

Read the full story

Anti-competitive practices threaten innovation in the mortgage industry

As Peter Drucker said, business has only two basic functions: marketing and innovation. The competitive spirit that innovation inspires is how brands remain on top and how start-up, disintermediating companies dethrone leaders.

Read the full story

UWM's ban has provoked increased interest in Fairway, CEO says

"We appreciate the extra attention the last two weeks have provided and are thankful for the extra opportunities we’ve been given," Fairway's CEO Steve Jacobson said.

Read the full story

Blend’s move to buy Title365 from Mr. Cooper targets key fintech niche

Mr. Cooper plans to close on the sale of Title365 to Blend in the second quarter if the acquisition receives all required approvals. It will retain a 9.9% stake in the company.

Read the full story