President can fire FHFA director at will, Supreme Court says

In a split decision written by Justice Samuel Alito, with several of the other justices concurring and dissenting on several components of the case, the court also dismissed a claim brought by shareholders of Fannie Mae and Freddie Mac, who argued that a 2012 profit sweep agreement between the FHFA and the U.S. Treasury violates the law.

The plaintiffs had also argued that the provision in the 2008 law establishing the FHFA, which said a president can only fire the director for cause, was unconstitutional. While the court left in place the so-called net worth sweep in Wednesday’s opinion, the justices agreed that a sitting president should have the ability to fire the FHFA director at will. Previously, a president had only been able to fire the director “for cause.”

Read the

Biden fires FHFA director Mark Calabria

Read the

Biden administration launches new round of distressed mortgage relief

The Centers for Disease Prevention and Control also extended the eviction moratorium through the end of next month, and the White House announced that the ban for properties with federally-backed apartment loans in particular will be enforced. (The courts have delivered varying opinions on the legality of the CDC’s ban. The matter is still in litigation.) The Biden administration will also push to distribute $42 billion in federally-authorized rental assistance through state housing agencies.

Read the

Blend Labs makes its IPO registration statement public

Back in April, the company disclosed it had

The Securities and Exchange Commission filing does not include any amounts except a placeholder number for the size of the offering. However, Blend disclosed it is establishing a multiclass structure for its common stock that will give the Class B stock, which only company co-founder and Chair Nima Ghamsari will hold, 40 votes per share.

Read the

Why a multifamily foreclosure tsunami is unlikely

Until now, most of the distressed debt funds for commercial mortgages raised early in the pandemic have

Read the

Biden appoints Sandra Thompson acting FHFA director

Thompson, who was most recently the deputy director of the FHFA’s Division of Housing and Mission Goals, has been at the agency since 2013. Before joining FHFA, she worked for 23 years at the Federal Deposit Insurance Corp., ultimately serving as the director of risk management supervision.

Read the

Why servicers may not need to staff up for forbearance outcomes

However, a recent Fitch Ratings’ analysis of first-quarter residential mortgage-backed securities servicing trends suggests that so far companies are primarily planning on using roughly the same number of employees as they shift from handling forbearance to assessing borrowers who have seen long-term declines in their incomes.

The average number of full-time equivalent workers employed by banks that are Fitch-rated servicers was down slightly at 2,949 in the first quarter, compared with 3,004 the previous quarter, according to the rating agency’s U.S. RMBS Servicer Metric Report. For nonbanks, there was only a small increase to 1,006 from nearly 928.

Read the

Critical defects in mortgage files highest in years

Such issues, which are indicative of manufacturing process errors, were second last year to income and employment as sources of critical defects found in post-closing reviews of mortgage files conducted by Aces. Loan documentation problems were found in 16.6% of the files examined, up from just under 15% for 2019.

This increase was driven by pandemic-related difficulties and are symptomatic of manufacturing-related defects overall, Aces said.

Read the

Serious delinquencies fall as foreclosure ban decision looms

There were almost 1.67 million mortgages that had gone unpaid for 90 days or more in May, down from almost 1.77 million

Read the

Mortgage execs begin lobbying FHFA to lift lender sales cap

Immediately after Thompson’s appointment, Community Home Lenders Association’s executive director Scott Olson sent a letter to her and Treasury Secretary Janet Yellin calling for the suspension of the January amendments. The CHLA, which consists primarily of small and mid-sized nonbank mortgage lenders,

“The Administration has made as a centerpiece of its housing policy the pursuit of racial equity in homeownership,” Olson wrote. “The PSPA volume caps are completely contradictory to this policy.”

Read the

More home buyers used cash rather than taking financing last year

Approximately 43% of all respondents to a ServiceLink survey said they used cash on hand or savings to purchase their home, while 42% went to a traditional lender to finance it. That gap widens when the question was asked of those who purchased in the last year, to 50% using cash or savings, and 32% financing from a traditional lender.

Among all respondents, 14% said they went to a digital or online lender; that increased to 32% among those that bought in the last year.

Read the

National remote online notary bill reintroduced in Congress

Use of RON increased 547% during 2020 compared with 2019, an American Land Title Association vendor survey found.

Read the

Acting CFPB Director Dave Uejio nominated for HUD post

Uejio remains the CFPB’s acting director until Rohit Chopra, the president's nominee to lead the bureau, is confirmed by the Senate. Uejio, who would become assistant secretary for fair housing and equal opportunity if confirmed by the Senate, was on a list of White House

That Uejio was nominated to HUD could be an indication that Chopra will be confirmed soon by the Senate. Chopra sits on the Federal Trade Commission, and some analysts have attributed

Read the

Biden nominates Julia Gordon to be FHA commissioner

Gordon’s nomination, which must be approved by the Senate, is one of many moves the Biden administration has made this week in its effort to chart its own path on housing policy. Biden on Thursday also nominated acting Consumer Financial Protection Bureau Director Dave Uejio

Read the

Loan modifications are up for the first time in a year, FHFA finds

There were 11,434 loan modifications as 130,014 deferred payments in the first quarter, as compared to 9,347 and 185,112 (respectively) during the previous fiscal period, the Federal Housing Finance Agency reported Tuesday. Mods haven’t been this high since the first quarter of 2020, when they totaled 16,773.

Read the

Homeowners are staying put for longest stretch in 20 years

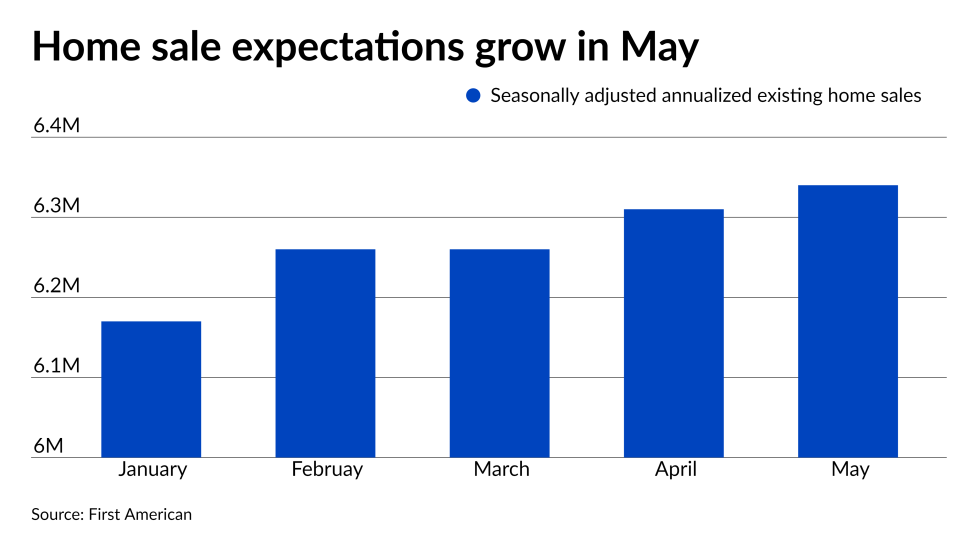

Actual home sales outpaced the company’s Potential Home Sales Model by 4.3% in May, the equivalent of about 272,588 units. The model had predicted a

The sales increase drove the seasonally adjusted annualized rate of existing home sales to 6.34 million from April’s 6.31 million. Gains in household income and

Read the