The number of entities capable of performing digital mortgage loan closings nearly doubled since last fall, marking an increase driven by the need for lenders to complete the origination process remotely during the coronavirus pandemic.

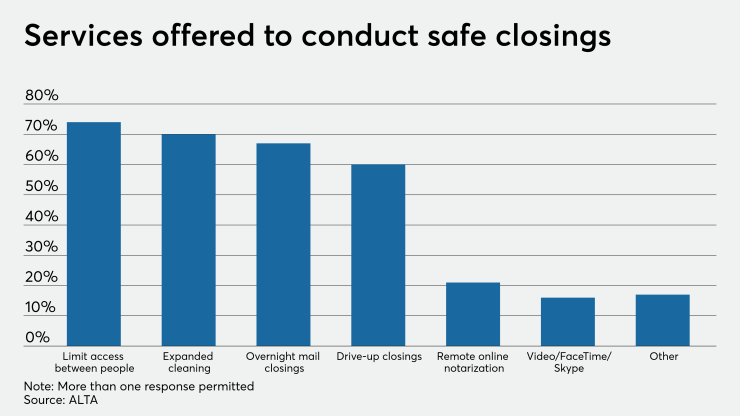

An American Land Title Association survey found that 21% of title and settlement agents were providing remote online notarization as one of the services offered to customers in order to conduct a safe closing. At the same time, 16% are doing emergency video notarization using services like FaceTime and Skype to watch the documents being signed.

This translates to about 30% of transactions being

"Throughout the pandemic, ALTA members have developed innovative and safe ways to continue to make the American dream come true," CEO Diane Tomb said in a press release. "From drive-thru closings to offering remote online notarization, the dedication to their customers is allowing families to close on new homes or take advantage of the low interest rates by refinancing their mortgages. As our survey shows, nearly 30% of title and settlement companies are offering some type of digital closing to help keep everyone safe and meet social distancing requirements. This is up significantly compared to the 17% of agents offering digital closings in 2019."

Tomb referred to an ALTA survey released last November, before the pandemic struck the U.S., which also found that 44% were interested in digital closings and another 19% researched vendors and applicable laws. At that time, 20% claimed not to be interested in digital closings.

Currently

Other safety measured include drive-up closings being done by 60% of respondents while 67% were having the documents signed and transported via overnight mail.

Among those that are using RON, respondents said 7% of their closings were completed with this technology. Meanwhile, agents performing emergency video notarizations were using it for 22% of their closings.

But doing an in-office closing was the favored option even in this period, with three quarters of the title agents surveyed said they closed 80% of their orders in this fashion.

Just under three-quarters of those surveyed said they are limiting access between customers and employees, while 70% expanded cleaning and notifications to customers.

Given that the Department of Homeland Security said that title and settlement companies were essential businesses, it was not surprising that 96% of respondents said their office remained open during the pandemic. Just 6% said they temporarily ceased operations at one or more of their locations.

Approximately 70% of the respondents said they are doing business by appointment only. There were 63% that had some or all of its staff working remotely, with the remaining 37% in their office only.