Existing-home sales during May outperformed their potential by 11.5%, as the market comeback continued, fueled by low mortgage rates that increased affordability, First American said.

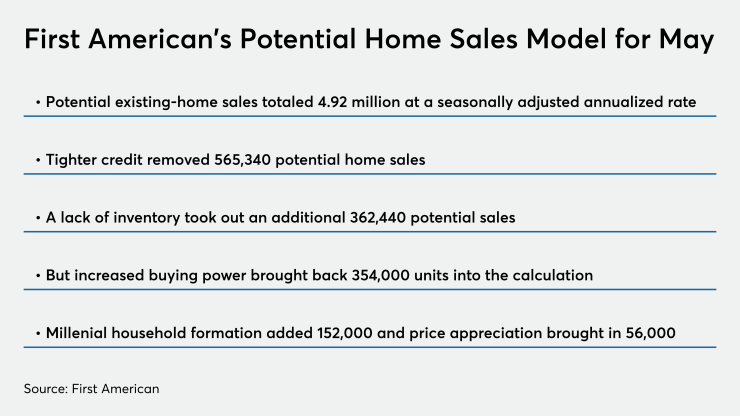

There was the potential for 4.92 million transactions on a seasonally adjusted annualized rate basis in May, which itself was an increase of 6.2% over April. The increase occurred even as stay-at-home orders impacted much of the U.S. economy.

First American estimated that actual existing-home sales during May outperformed that potential by an estimated 565,580 SAAR sales.

Still, on a year-over-year basis,

The increase in potential did not lead to an increase in actual sales; a report from Remax found

"The two biggest drivers of the increase in May are slightly loosening credit standards, which allow more potential home buyers to qualify for financing, and the increase in house-buying power due to

(First American's economists use the Chicago Federal Reserve's National Financial Conditions Credit Subindex to judge credit conditions. That number was higher on a year-over-year basis than the Mortgage Banker Association's

"The increase in house-buying power is also a major reason why market potential is not even lower compared with one year ago," Fleming said. "During economic downturns, the housing market benefits in one specific way —

"Relative to one year ago, the potential for existing-home sales declined by 368,120 SAAR, but it could've been worse were it not for the house-buying power boost from low mortgage rates," he continued.

Credit conditions last month, even when looked at compared with May 2019, took 565,340 potential home sales out of the market on a year-over-year basis, Fleming said.

Low inventory has

And because there were fewer new homes for sale — giving existing owners a place to move to — potential was cut by another 1,916 sales.

"Given these headwinds, the market potential for existing-home sales could have declined by nearly 930,000 sales. Yet, the 30-year, fixed-rate mortgage fell to its lowest level in nearly 50 years in May, boosting house-buying power by 15.3% relative to one year ago," said Fleming. "The increase in house-buying power resulted in a 354,000 increase in potential home sales, helping offset some of the impact from the credit and housing supply headwinds."

Millennial

Mortgage rates will continue

“Our Potential Home Sales Model indicates that even if mortgage rates climbed to 3.5%, all else held equal, the market potential for existing-home sales would decrease modestly from 4.92 million SAAR to 4.84 million SAAR," said Fleming. "Record low mortgage rates are proving to be a powerful motivator and benefit for home buyers in an otherwise challenging time."