“Cash is king” when it comes to home buying, Fannie Mae chief economist

The evidence shows up in the rising number of

“Supply is very tight. Cash offers are what sellers prefer just because the deal will go through faster — you don't have to have an appraisal. And so that's what we've seen tracking at about 25%,” she said.

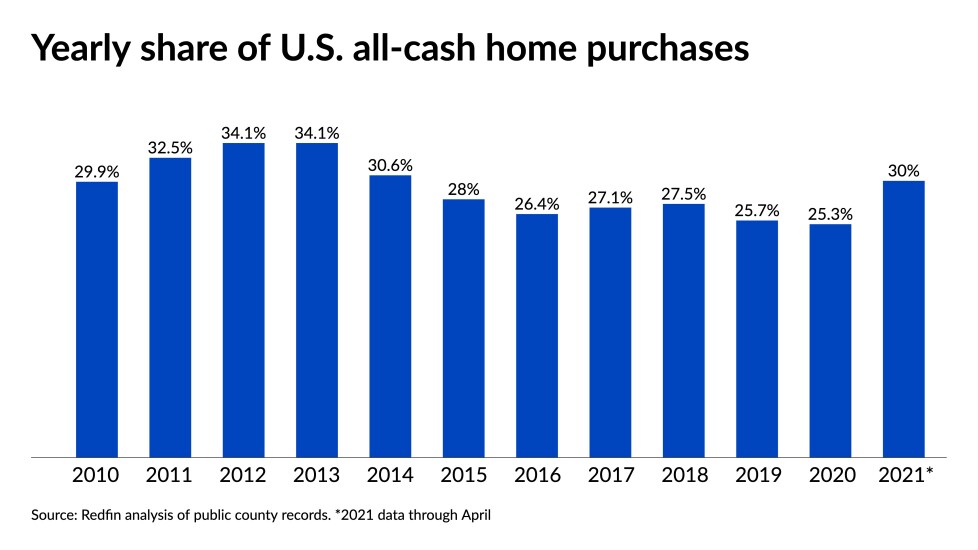

In another recently released analysis of public county records conducted by Redfin, the data similarly showed that all-cash offers accounted for over 30% of home purchases in the first four months of the year.

To assist buyers who lack sufficient equity to make an all-cash purchase, a number of businesses and programs have emerged, offering clients the opportunity to compete by purchasing homes on their behalf, and then reselling or transferring the properties to them at the exact same price. If current buying trends are sustained, these types of companies and products are likely to gain a larger piece of the market.

“I think that before you know it, every offer will have to be a cash offer. Sellers are going to demand that people bring cash offers because it reduces their risk,” said Tim Herman, cofounder and CEO of UpEquity, an Austin-based mortgage-technology platform providing funding for buyers to make these deals.

No two programs serve buyers in exactly the same way, but they were designed with similar goals. Here are a few things to know about the products and those who offer them.