What Election 2020 uncertainty means for mortgage lending

FHA launches an automated underwriting system for mortgage lenders

Forbearance rate hits seven-month low

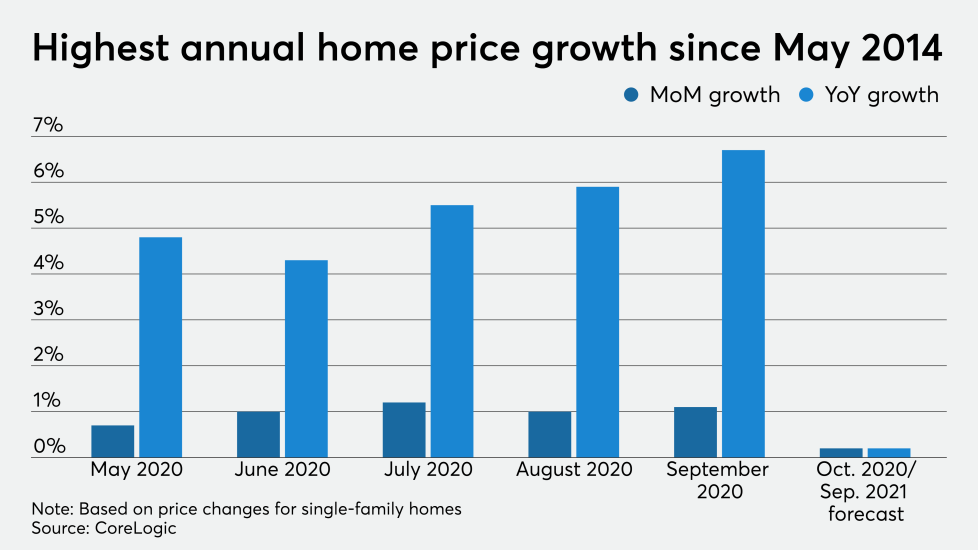

Home prices surge to 6-year high, but declines are predicted for 2021

Waterstone hires Jeff McGuiness to head the mortgage unit

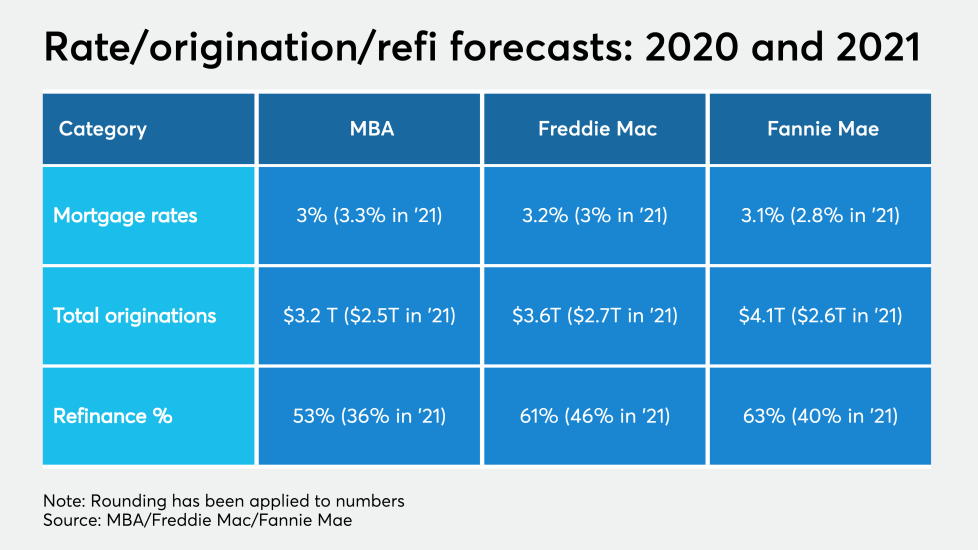

Annual mortgage origination volume to hit record-breaking $4 trillion

Fannie Mae and Freddie Mac exceeded most 2019 housing goals

Who would craft regulatory policy in a Biden administration?

Mortgage rates hit record low as election roils market, forecasts vary