But the first quarter of 2021 was different, thanks to an estimated $1.1 trillion in total volume for the period. While that was down from $1.3 trillion in the fourth quarter, it was nearly double the $563 billion in the first quarter of 2020, according to

The 2021 first quarter estimate included $320 billion in purchase originations and $774 billion in refinancings. In the first quarter last year, purchases made up $257 billion of the total volume with refis accounting for $306 billion. Rather than being the weakest three-month period, the first quarter should have the most originations this year, the MBA predicted.

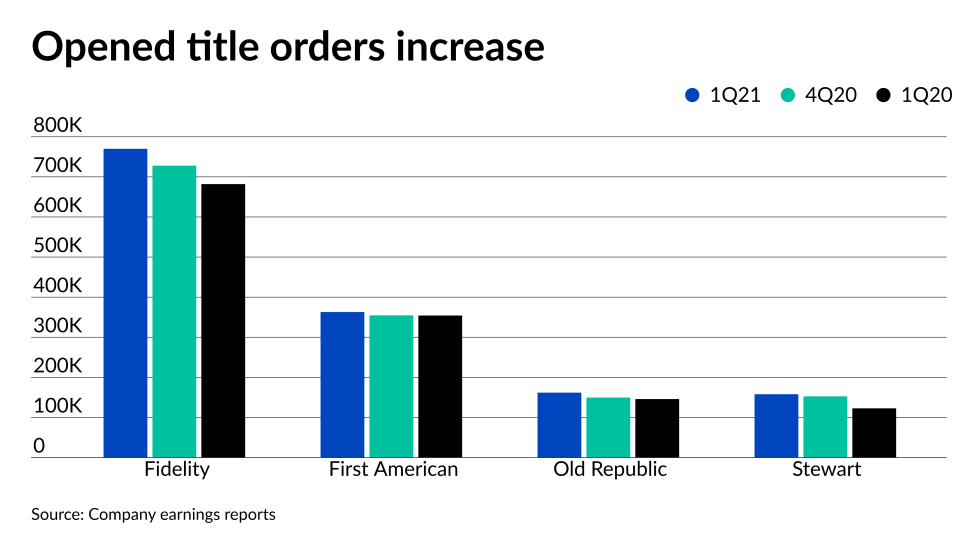

As a result of the increase in volume, title order margins were up at the three of the large companies that reported this information on a year-over-year basis. All four companies reported an increase in orders opened on a quarter-to-quarter basis as well. That is quite a different picture from one year ago, when the early stages of the pandemic shutdown

Below, we review first quarter performance of the title insurers.

Fidelity turns around its 1Q results

The title insurance segment had net earnings of $340 million in the first quarter compared with $705 million in the fourth quarter and a net loss of $37 million for the same period in 2020.

"I am very proud of our record first quarter title results in which we generated adjusted pre-tax title earnings of $512 million and an adjusted pre-tax title margin of 19.9% compared to adjusted pre-tax title earnings of $279 million and an adjusted pretax title margin of 14.4% in the 2020 comparable quarter," William Foley, FNF's chairman, said in a press release. "Total commercial revenues continued to rebound and were $257 million for the quarter, compared to $245 million in the first quarter of 2020, as total commercial orders closed increased 12%, as compared to the year ago quarter."

On an unadjusted basis, Fidelity had a pretax title margin of 17.4% in the first quarter, compared with 29.4% on a quarter-to-quarter basis and a negative margin of 3.3% one year ago.

Fidelity had 770,000 orders opened and 597,000 orders closed during the quarter, compared with 728,000 orders and 617,000 closed in the fourth quarter of 2020 and 682,000 opened and 377,000 closed during the first quarter of 2020.

On the other hand, the average fee per file shrank for both residential and commercial orders. For residential orders it was $1,644, down from $1,661 in the fourth quarter and $1,744 in the first quarter of 2020.

For commercial orders, the average fee per file of $7,400 was down from $8,200 in the fourth quarter and $7,900 one year ago.

Record Q1 margin at First American

In the fourth quarter, the margin was 18.9%, while one year ago it was 5.6%.

Net income of $233.6 million was down from the fourth quarter's $280.3 million, and much higher than the $63.2 million for the first quarter of 2020.

First American had 363,000 orders opened and 287,600 orders closed. This compares with 354,600 opened and 295,100 closed in the fourth quarter, and 354,200 opened and 202,700 closed in the first quarter last year.

Pretax income falls from record levels at Old Republic

The holding company — which also operates a general insurance business and manages a mortgage insurance business that is in run-off — earned $502.1 million, compared with $519.7 million in the fourth quarter and a loss of $604.8 million one year ago.

In the first quarter, Old Republic Title had 161,851 orders opened and 140,305 orders closed, compared with 149,626 opened and 139,010 closed in the fourth quarter and 145,815 opened and 104,774 closed one year ago.

The mortgage insurance segment earned $4.1 million, up from the fourth quarter's $1.8 million and down from $8.4 million one year ago as its book of business shrinks and generates lower premium income. Claims costs did increase because of the pandemic to $29.2 million from $21.5 million in the first quarter of 2020.

Stewart CEO touts success in improving performance

"This quarter was especially noteworthy given that these results came in the first quarter of the year, historically the most challenging for our company," said CEO Fred Eppinger in a press release.

Title pretax margin in the first quarter was 12.2%, down from 13.6% in the fourth quarter but up from 3.4% on a year-over-year basis.

Stewart had 157,918 opened orders and 115,701 closed orders in the first quarter, compared with 152,622 opened and 126,027 closed in the fourth quarter and 122,708 orders opened and 69,533 orders closed one year ago.