Even in the mortgage industry, which is normally

Zillow and Redfin

While policymakers have warned lenders they will be on the lookout for potential fair lending violations, the lack of current rules means many companies are trying to determine best practices on their own.

Below we compare the most prominent of these bots to ChatGPT by testing how well they give a quote to a prospective borrower.

Here's ChatGPT's answer:

Dwelly by DwellWell

Best use: fast answers to general questions

Like ChatGPT: quick speed, good conversational quality, hallucinations

Unlike ChatGPT: failure to respond at times

Homebuying platform DwellWell announced Dwelly, their Chat-GPT powered AI tool, on June 1. It's embedded in the website's homepage and gives several suggested prompts below the text box, like 'How do I find a real estate agent?' and 'How do I get pre-approved?'

DwellWell developed the tool to answer their customers' home buying questions. Sam Carow, the company's chief technology officer said it's meant to serve as an alternative to Google, where many mortgage and real estate search results lead to company blog pages.

"That can lead to biased information," she said. "You can feel like you're not really getting the full story and you have to end up doing a lot of that research on your own."

And though Dwelly is powered by ChatGPT, it uses more accurate home buying information because the DwellWell team embeds the bot with information from their website. DwellWell doesn't use it internally yet, but Carow said that's where she wants to bring it next: "assisting with a lot of the nitty gritty, boring paperwork that comes with home purchases."

The software has some quirks though. Because it was developed using GPT-3, it struggles with hallucination: when asked about its privacy policy, Dwelly sent back a link that led to a

Now, when asked the same question, it sends the correct link and key points from the policy. Carow and Mario Pena, their senior software engineer, said this is because they closely monitor Dwelly, flagging any incorrect responses.

"We're very quick to try to mediate that and just embed more information," Pena said. "So that way, next, any other user will be able to get the right information each time, and we do a lot of testing ourselves."

KAI-GPT by Kasisto

Best use: reading large documents, finding specific information on websites

Like ChatGPT: quick speed, good conversational quality

Unlike ChatGPT: fails on first response, uses one source of information at a time

Kasisto, a financial digital service provider, launched their own large language model, KAI-GPT, on May 31. They launched KAI Answers, a chatbot-like tool that uses the LLM to answer questions, along with it. Kasisto is releasing the LLM to

Rohit Goyal, head of generative AI strategy at Kasisto, said they're limiting use because of hallucinations: "any GPT technology can make up answers."

To use KAI Answers, bankers first select a source, either a website or a document, and upload it. Then, they ask a question and KAI pulls an answer from the selected source. Users can also turn on a side-by-side source view to see exactly where each answer came from.

KAI is "using its knowledge to go read these documents with a question in mind, and then give you an answer that's specifically from the document," Sasha Caskey, the company's CTO and cofounder said.

The tool's major issue right now: it consistently can't answer the first question asked of it. On the second try, it works fine. Kasisto's engineers are working on the problem, Caskey said.

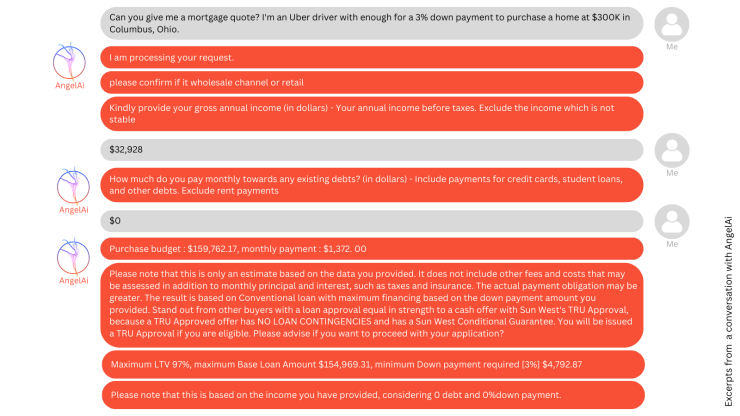

AngelAi by Sun West Mortgage Company

Best use: giving loan quotes that are backed by Sun West

Like ChatGPT: multiple chat windows

Unlike ChatGPT: slower response time, poorer conversational quality, backed by Sun West, empathetic technology

Sun West Mortgage debuted AngelAi, their AI personal assistant tool,

He changed MORGAN's name after expanding its capabilities to do non-mortgage tasks, taking inspiration from customer feedback that said the tool was like a "guardian angel." Now, it can create property listings, check interest rates and walk buyers through their loan application, according to a Sun West press release.

AngelAi opens in an orange window with a main screen and a column on the right for errands, or separate chats. Before using the free tool, users must agree to a disclaimer that gives Sun West the right to record your data.

It also says that AngelAi's credit and income analysis, loan scenario guidance and document review are warranted when submitted or originated by Sun West. This is unique for a LLM — most other chatbots come with several warnings about false information and inaccurate financial advice.

"We stand behind everything, every decision it makes," Agarwal said. "If it gave you bad instructions and you submit that loan to Sun West, Sun West will honor whatever it told you, and we'll proceed forward with it… I'm putting my money where my mouth is."

AngelAi is also estimates how the user feels based on their responses and adapts accordingly, a concept called empathetic technology, he explained.

The downside is longer-than-normal wait times. Although AngelAi allows users to input multiple different errands at the same time, it still takes several minutes to come up with an answer. Angel's wait times are two or even three times longer than other mortgage tools on this list.

Bob by Beeline

Best use: fast answers to general questions, estimated quotes

Like ChatGPT: quick speed, good conversational quality

Unlike ChatGPT: gives an estimated quote after a series of questions

In early July, digital lender Beeline

"60% of our applications come in after hours or weekends, so that means people are shopping for mortgages when everyone's sleeping or on the weekend," Luizza said.

Like Dwelly, Bob appears on Beeline's home screen along with a list of suggested questions. It looks more like ChatGPT than Dwelly, though, with a blinking black cursor and text that appears letter by letter.

But here's what makes Bob unique: it's "not a single AI but an AI orchestration system that ties together several AI's, with each specifically trained to do one task very efficiently to create one natural, rich experience," Luizza said.

Beeline says the bot can answer mortgage-related questions and give a pre-application quote, but can't answer any questions that require a mortgage license. Unlike AngelAi, Beeline warns that Bob's advice might be inaccurate and "does not constitute a credit decision or commitment to lend."

This gives Bob strict guardrails, which means the bot often tells users to meet with a human instead of answering their question.