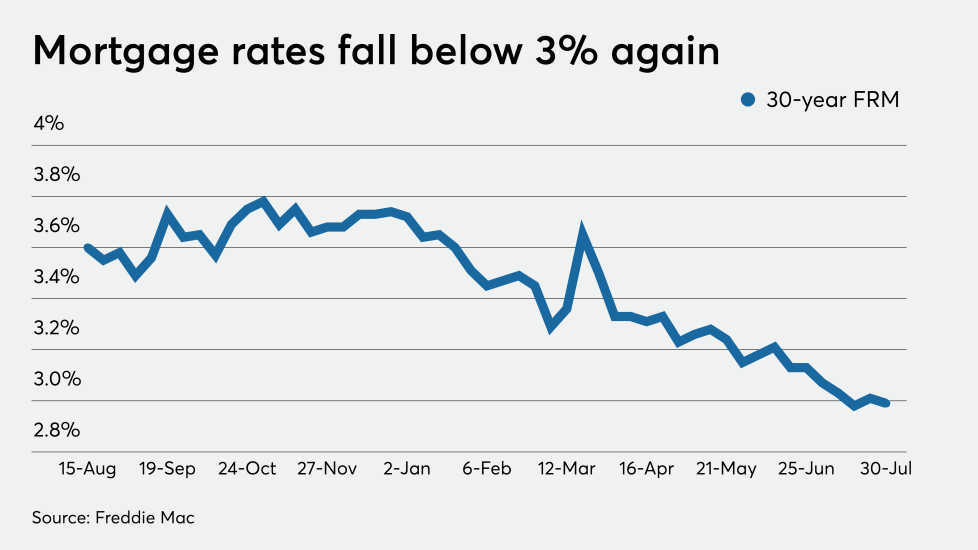

Mortgage rates slip back below the 3% mark

Fannie, Freddie to face banklike liquidity standards starting Sept. 1

Sens. Warren, Schatz press Wells Fargo on forbearance practices

Fannie Mae logs largest refinancing volume since 2003 in 2Q

CoreLogic bidders seek support to replace nine directors

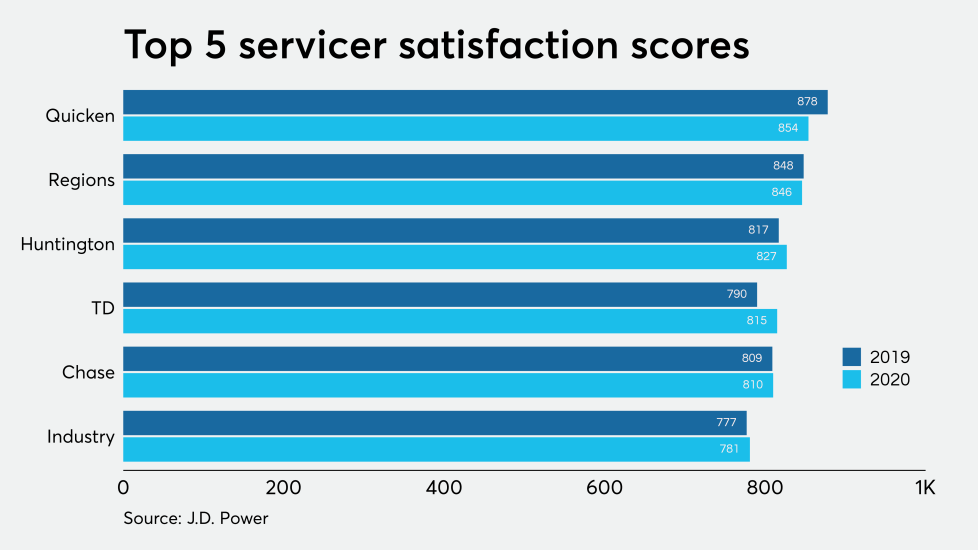

Coronavirus amplified existing customer service issues: J.D. Power

Freddie Mac's net income grows exponentially in second quarter

Arch and Genworth's higher default levels result in lackluster 2Q

Quicken Loans parent Rocket aims to raise $3.3B in IPO

CFPB chief welcomes GOP focus on restructuring of agency

Loan woes heighten risks to American Dream bonds

Senate confirms Wade as FHA commissioner

Wade is succeeding acting FHA Commissioner Len Wolfson, who took over when former Commissioner Brian Montgomery was confirmed as deputy secretary of the Department of Housing and Urban Development. (Full story