This downturn has not stopped industry participants from looking to expand their operations

At the same time,

Still, of the six holding companies, five were profitable, with the other, Doma, yet to report positive earnings since it

Doma says it's getting closer to profitability

"As discussed on

Still, he is confident Doma will be profitable this year as "we expect to recognize significant continued expense reduction as we realize the full benefit of actions implemented last year and as we continue to emphasize profitable execution in our local division and profitable deployment of our underwriting technology."

Doma lost $109.4 million in the fourth quarter, compared with a loss of $43.7 million one year prior. For all of 2022, it lost $302.2 million, versus the 2021 loss of $113.1 million.

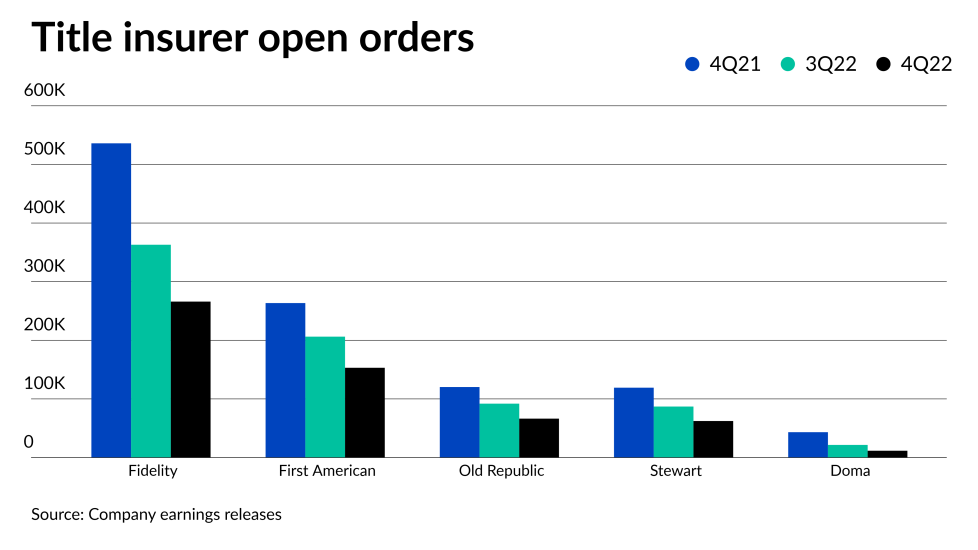

Open orders for the fourth quarter declined significantly year-over-year, to 11,602 from 43,247, while for 2022, they fell to 93,534 from 178,689 for the prior 12 months.

It had a similar decline in closed orders, to 10,505 from 37,042 for the fourth quarter and to 71,953 from 136,428 for the year.

Stewart continues acquisition spree

The latest is its subsidiary Informative Research's purchase of the

AccountChek provides verification of borrowers' assets, income and employment.

In conjunction with the sale, FormFree promoted

FormFree going forward will focus on blockchain and other types of decentralized Web3 technologies under Lapin's stewardship, CEO Brent Chandler said in a press release.

Just prior to the end of the fourth quarter, Stewart bought BCHH, which offers title services to institutional real estate investors and lenders.

Stewart earned $13.3 million in the fourth quarter, down from $85.5 million for the same period in 2021. For all of 2022, it made $162.3 million, compared with $323.2 million in the prior year.

Fourth quarter open orders declined by almost half, to 62,307 from 119,135 year-over-year. Closed orders went to 53,632 from 108,438.

Fidelity completes F&G spin-off

"F&G's spread based income delivers a steady and growing source of earnings which is countercyclical to our title business as F&G benefits from the rising rate environment," William Foley, Fidelity's chairman, said in the earnings release. "This provides a competitive advantage for our company, and we remain committed to F&G's long-term success."

Fidelity had a steep drop in its fourth quarter earnings, to just $68 million from $533 million in 2021. For the full year, it had net income of $1.34 billion from $2.42 billion in the prior 12 months.

"While the steep rise in interest rates pressured our results through the fourth quarter, we continued to take decisive steps to position FNF for the eventual turn in the housing cycle," Foley said. "Central to our strategy is a focus on managing our cost structure to the trend in open orders to maximize our profitability and cash flow."

Open orders for the fourth quarter shrunk to 266,000 from 536,000 year-over-year, while closed orders similarly moved to 216,000 from 477,000.

"Looking forward, we will continue to manage our business to the trend in open orders while evaluating opportunities to strategically expand our operations given the strength of our balance sheet which puts us in an advantageous position," added CEO Mike Nolan.

First American's 4Q earnings drop 80%

It reported $54 million of net income for the period, compared with $260 million for the fourth quarter of 2021. For all of 2022, First American earned $263 million, down from $1.24 billion in 2021.

Its pretax title margin in the fourth quarter was 7.1%, down from 16.3% one year prior.

But its fourth quarter open order count declined less on a percentage basis than its large competitors, to 153,100 from 263,500 one year prior. The number of closed orders fell to 125,300 from 239,300 during the same period.

For the full year 2022, open orders totaled 895,500 compared with 1.275 million in 2021. Closed orders slipped to 695,900 from 1.05 million.

"Although current market conditions remain difficult, we are seeing early indications of stabilization in the purchase market and we believe the company is well positioned to emerge even stronger when the current down cycle ends," CEO Ken DeGiorgio said in the earnings release. "Our strong balance sheet allows us to continue to invest in strategic initiatives and pursue acquisitions to deliver long-term growth, as well as return capital to shareholders."

Commercial drives Old Republic's title earnings

"While increasing mortgage rates, refinance decline and a softening housing market impacted our residential activity, our commercial activity remained strong in the fourth quarter, with commercial premiums up 13% over fourth quarter 2021 and represented 26% of our total premiums compared to 18% in the fourth quarter of 21," Carolyn Monroe, president of Old Republic Title, said during the call. "Commercial premiums reported for full year 2022 represented an all-time high for the title group."

It plans to continue to focus on the commercial title segment this year, Monroe added.

Direct orders opened fell to 66,350 in the fourth quarter from 120,251 the prior year, while closed orders dropped to 60,375 from 113,577.

It had 402,463 open orders for all of 2022, down from 577,860 the prior year. Closed orders slipped to 350,259 from 515,808 during the same period.

Meanwhile, its run-off mortgage insurance business reported a 29% decline in net premiums earned as policies leave its book of business.

Combined with a 44% decline in investment income, pretax earnings fell to $3.9 million from $11.9 million in the fourth quarter of 2021.

On a full-year basis, however, pretax income increased for 2022 to $35.2 million from $32.8 million.

Investors’ net income down 60%

Full year income was down 64% to $23.9 million for 2022 from $67 million during 2021.

Net premiums written in the fourth quarter were $49.2 million and the full year were $248.6 million, compared with $72.5 million and $273.9 million for the comparable periods in 2021.

Going into the fourth quarter, Investors' underwriting units had the ninth largest market share based on premiums written among industry participants, according to the American Land Title Association.

"The level of claims activity remained low, and we are seeing a partial offset to Fed policy in the opportunity to earn a higher level of return on our investment portfolio from the highest level of interest rates available in over a decade," said J. Allen Fine, chairman, in the earnings release. "Operationally we are also benefiting from growth initiatives of the last several years."