-

November rate locks fell seasonally but hit their strongest level since 2021, led by refis, while lenders shifted more loans to the GSE cash window.

December 10 -

The company's latest funding announcement caps off a year of tailwinds that propelled growth for home equity investment platforms and related lending products.

December 9 -

An influx of adjustable-rate and cash-out refinance mortgage programs during the month pushed the Mortgage Credit Availability Index 0.7% higher in November.

December 9 -

BTIG is waiting with "baited breath" for Fannie Mae and Freddie Mac to relist their common stocks, but if spreads widen, it could derail it from happening.

December 5 -

Declining issuances since 2022 led to a request for information regarding the future direction of the reverse mortgage program, and NRMLA and MBA responded.

December 3 -

Non-banks tracked by Morningstar DBRS reported combined net income of $367 million for the third quarter, down from $807 million three months prior.

November 26 -

An expanded data set based on the third quarter annual price changes is what the Federal Housing Finance Agency uses to calculate next year's conforming loan limits.

November 25 -

Social media posts point to a 40% to 100% price hike this year, the latest in a series of hikes started in 2023, when for some lenders prices rose 400%.

November 24 -

While some international purchasers are reluctant to buy in the U.S. right now, interest in investment properties still abounds, the CEO of Waltz said.

November 21 -

Finance of America is buying Onity's MSRs and loan pipeline in this niche as PHH retains its role as a subservicer and remains involved in buyout securitization.

November 20 -

Rocket enters the crowded DSCR market with a product for experienced investors, joining rivals as non-QM lending grows and demand for single-family rentals stays strong.

November 19 -

Independent mortgage bankers were in the black for each loan originated during the third quarter, as low rates brought an application surge in September.

November 18 -

Application error findings rose over 15%, the second quarter in a row they have moved higher, the post-closing file review from Aces Quality Management found.

November 18 -

Quality Control Advisor Plus is an integrated system which brings together previously separate units, cutting months off of Freddie Mac's current QC process.

November 17 -

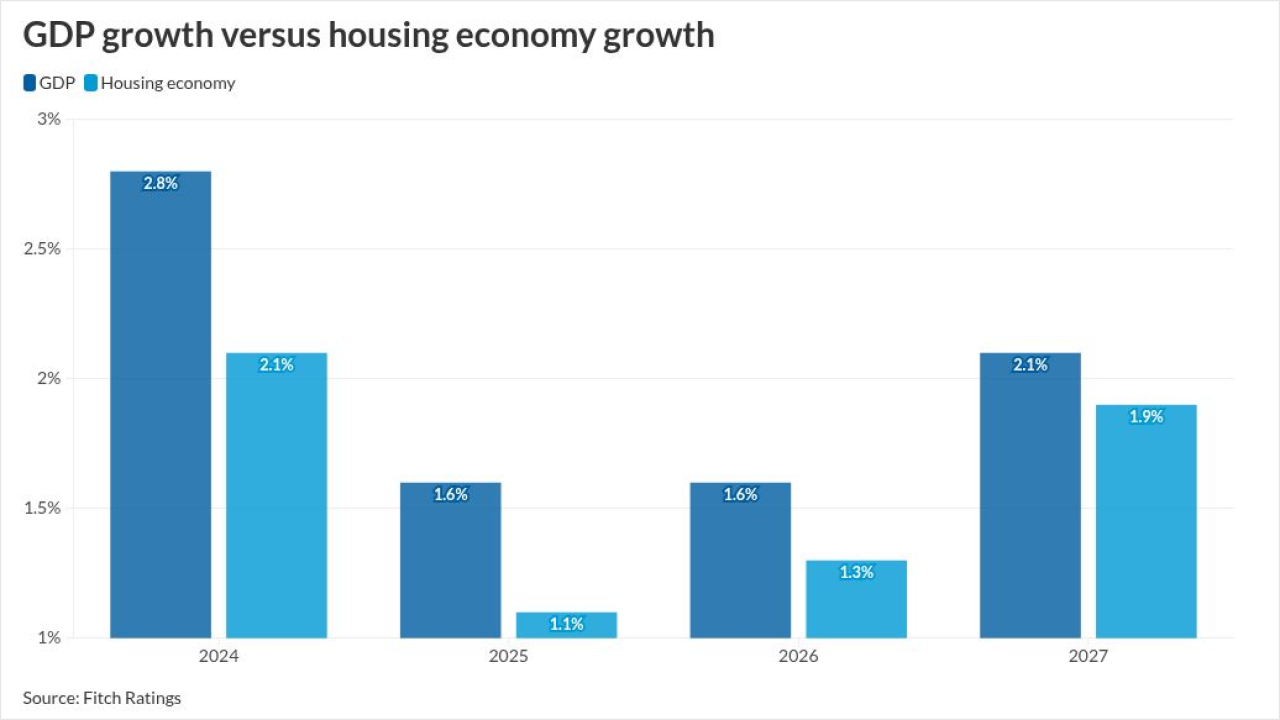

While Fitch and Kroll have differing views on mortgage rates next year, both are looking for mortgage delinquencies to rise in their rated portfolios.

November 14 -

The fintech had over $2 billion in home equity line of credit volume in the third quarter and reported growing production in its crypto and non-QM offerings.

November 14 -

With the increase in investor-owned properties, the risk of undisclosed real estate fraud, including occupancy misrepresentation, rose 9% in the third quarter.

November 14 -

The mortgage company, even though it is owned by a bank, has been profitable for the last two years, when considering its originations operations, as it does.

November 13 -

Two government-sponsored enterprises are looking into expanding mortgage transfers between borrowers, according to the head of their oversight agency.

November 11 -

While the program is still going strong in spite of the shutdown, many misconceptions about its rules, even in normal times, are holding back use.

November 11