-

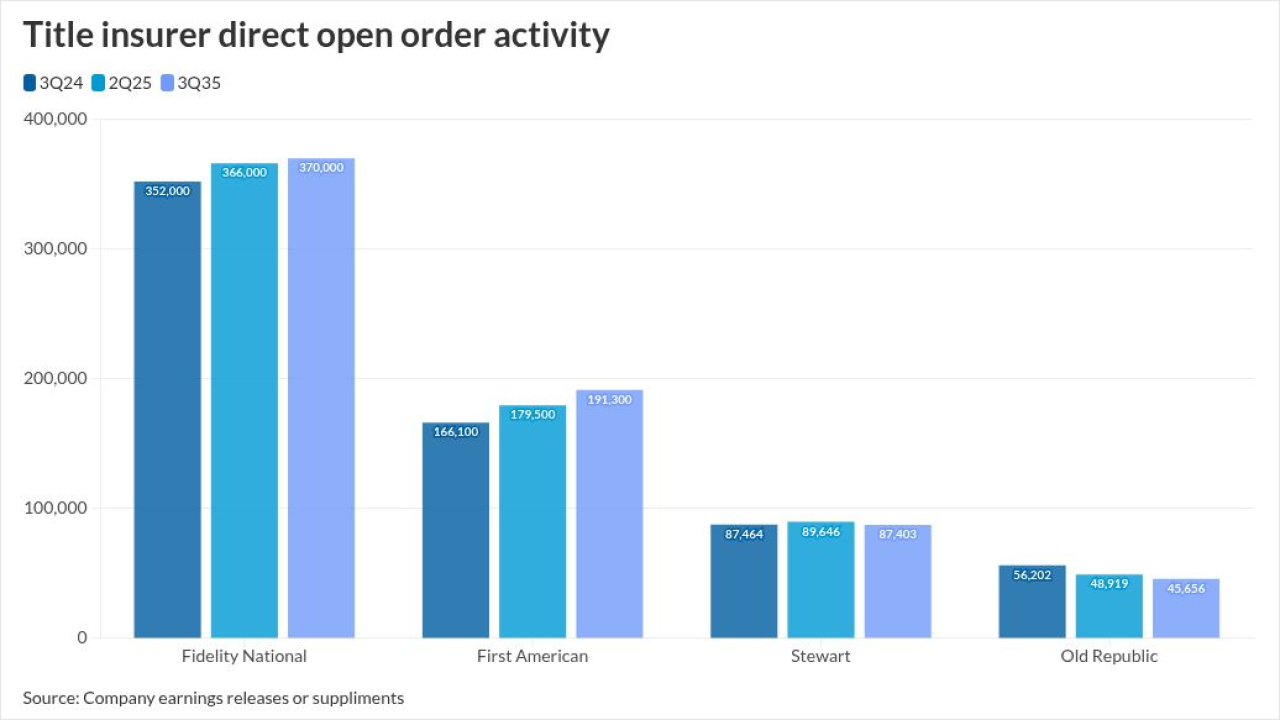

All five publicly traded title insurance companies reported a year-over-year increase in earnings during the third quarter, but only two had higher orders.

November 10 -

The impacts of the federal government shutdown are hitting both originators and servicers, and as things drag out, the disruptions will increase.

November 9 -

A successful summer pilot led to wider rollout of a program, whereby Robinhood Gold subscribers will be able to find discounted rates and closing costs.

November 3 -

Bill Pulte's X post has the industry excited that loan level price adjustments could change, but the impact would not be as beneficial as some think, KBW said.

October 27 -

While purchase volume is up 20% from last year, it was 5% lower than one week ago, although a 4% increase in refinance activity helped pick up the slack.

October 22 -

The NRMLA/Riskspan Reverse Mortgage Market Index set a new high of 502.42, with the dollar amount of home equity for those 62 or over reaching $14.4 trillion.

October 21 -

The lender, which reported over $200 million in home equity line of credit volume in the recent quarter, suggests the business can deliver massive scale.

October 21 -

The rollout comes as the company looks to build out offerings for originators, launching after PHH returned to the proprietary reverse-mortgage arena this year.

October 20 -

The appointment of the mortgage veteran comes as the lender undergoes marketing and branding pivots, including its recent name change from Nexa Mortgage.

October 20 -

While borrowing activity increased from a year ago, seasonal patterns and economic concerns suggest near-term slowing, the Mortgage Bankers Association said.

October 17 -

The new platform already counts two businesses as embedded partners, with the rollout coming as mortgage leaders see rising demand coming for DSCR loans.

October 15 -

Rate-and-term transactions leaped by 154% from August to September, while cash-outs and purchase loans also increased, according to Optimal Blue.

October 14 -

Growth in multifamily and investment property mortgage originations, the highest risk segments, drove the 6% rise in the National Fraud Index, Cotality said.

October 9 -

How did Pennymac grow into a leading TPO player? Wholesale chief Kim Nichols describes the lender's rapid rise, and weighs in on the impact of trigger leads, LO

-

Former Mr. Cooper CEO Jay Bray will become Rocket Mortgage's president and CEO as the $14.2 billion transaction closes in just six months after announcement.

October 1 -

Different markets for home equity products emerge, plus technology changes make it easier and quicker for traditional offerings to reach consumers.

September 30 -

The bipartisan bill, previously brought up in Congress' lame duck session, got the Mortgage Bankers Association and Broker Action Coalition's support.

September 22 -

A fintech sourcing shared ownership of second homes is getting a revolving credit line to fund loan sales into the secondary market for non-qualified mortgages.

September 19 -

Intermediary automation has increased the immediate availability of product, pricing and eligibility information to both sides of the mortgage business.

September 18 -

Most lenders said they had already priced in the widely-anticipated decision to cut short-term rates for 30-year home loans but other products will benefit.

September 17