-

Ocwen Financial is receiving a lump-sum payment of $280 million from New Residential under the latest restructuring of the mortgage servicing rights sale.

January 19 -

Baltimore-area home sale prices continued to rise in December, even as the number of sales declined from the same time last year.

January 10 -

Baltimore-area home sales and prices continued to climb in November as the inventory of available homes sunk to a 10-year low.

December 12 -

Regulatory changes that would put an end to state and local tax deductions could prompt many homeowners in high-tax states to consider relocating, a Redfin survey shows.

December 11 -

Dozens of workers at the Frederick, Md., office of First Guaranty Mortgage Corp. will be out of work after layoffs were announced, but the office won't close as initially reported by a state agency.

December 5 -

Mortgage closing costs average nearly $4,900 nationwide. But in some states, those fees can reach or exceed five figures. Here's a look at the areas where it costs the most to close a mortgage.

November 21 -

Baltimore-area home sales and prices continued their upward climb in October, as inventory contracted for the 26th consecutive month.

November 13 -

Here's a look at the 12 housing markets with the largest percentages of mortgages over $500,000 — the new threshold House Republicans have proposed for the mortgage interest deduction in their tax plan.

November 8 -

Baltimore homeowners who sold their property last year didn't get much of a return on their investment — just $5,000 more than they paid, according to a new report from Zillow.

October 4 -

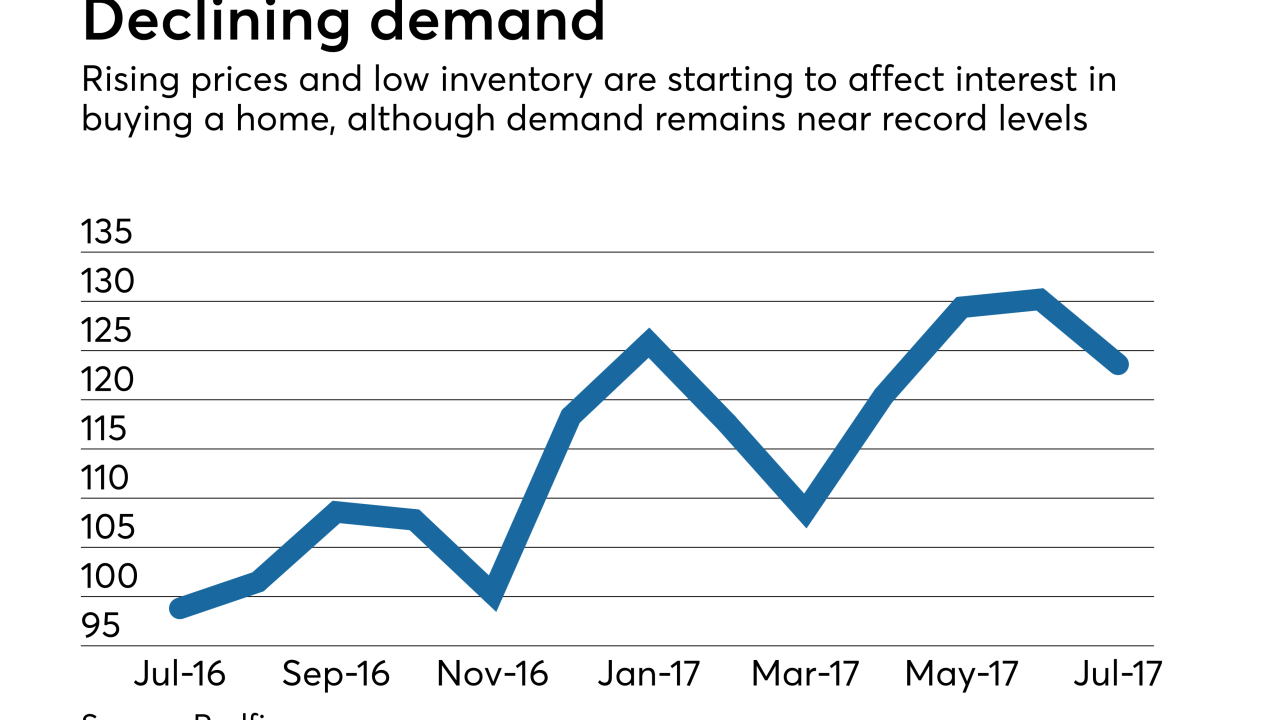

Rising prices are starting to keep potential purchasers from looking for homes and making an offer although interest remains near record levels, according to the Redfin Housing Demand Index.

September 5 -

Three years after guiding the Baltimore bank through bankruptcy, the group that recapitalized it found a similar institution eager to form a new partnership.

August 15 -

Home sales and prices in the Baltimore region rose in July as housing inventory continued to dwindle, limiting buyers' choices.

August 11 -

The Treasury Department will take a huge hit when Cecil Bancorp sells its bank, while 1st Mariner Bank in Baltimore will see its equity stake completely wiped out. Cecil opted for bankruptcy court when it was unable to resolve an impasse over its trust-preferred stock.

July 11 -

Home sales and prices in the Baltimore area continued to climb in May, as buyers vied for properties in a market with historically low inventory.

June 13 -

Deutsche Bank has reached a $95 million settlement with Maryland stemming from the housing crisis that will funnel $80 million to provide new mortgages or mortgage relief to eligible consumers as well as help finance affordable housing.

June 2 -

Maryland Gov. Larry Hogan has signed a bill that will expedite foreclosures of vacant and abandoned properties this fall.

May 26