-

The summer of 2018 is stacking up to be the most competitive on record for Twin Cities homebuyers.

July 19 -

Homebuilders in the Twin Cities are having their best summer in more than a decade as permits to build single-family houses outpaced last year for the second month in a row.

July 5 -

House listings in the Twin Cities posted a rare increase last month, a slight shift in the long-running sellers' market.

June 20 -

While mortgage application defect risk declined overall in March, at the local level it varied considerably, according to First American Financial Corp.'s Loan Application Defect Index.

April 27 -

Timid sellers are making for a tepid spring for Twin Cities home sales.

March 23 -

Developers built nearly 24,000 apartments in the Twin Cities since 2010 in what's been seen as a booming market. But the action this year and next will blow all that away.

March 20 -

A recently released report explores some of Duluth, Minn.'s housing challenges, including the high cost of building a single-family home in the city.

March 19 -

The foreclosure rate in Minnesota is now at the lowest level in more than a decade, and far below the national average.

December 29 -

New house and apartment construction soared in December, ending a year to remember in Twin Cities residential real estate.

December 28 -

On the cusp of a new year — and winter — Twin Cities housing construction posted stellar late-season gains.

December 6 -

Nonprofit agencies looking to purchase unsubsidized affordable housing properties can use a new impact gap financing program from Freddie Mac to fund the acquisition.

November 28 -

Potential first-time home buyers can save money for a down payment if they are able to use a special account just for that purpose.

November 17 Bilt Rewards

Bilt Rewards -

A flurry of new townhouses and suburban starter homes is helping boost homebuilding in the Twin Cities metro.

October 30 -

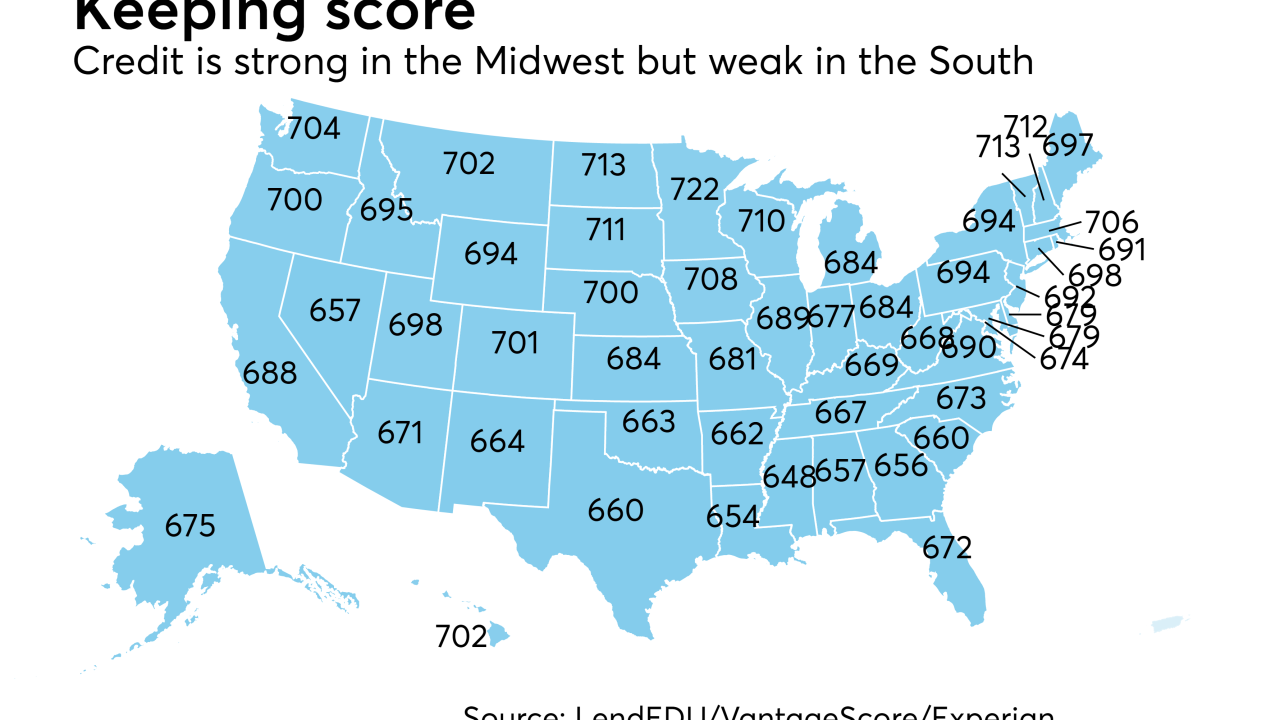

Consumer credit varies nationally due to regional variations in income and the cost of living. To get a sense of where it's strongest and weakest, here's a look at the five best and worst states for consumer credit scores.

October 23 -

A shortage of entry-level houses is putting a chill on the housing market in the Twin Cities.

October 18 -

Ocwen Financial Corp. is settling allegations by Alabama and Minnesota that it engaged in improper mortgage activities, bringing the total of states it has settled with to 17.

October 13 -

As distressed inventory dries up and home prices soar, more investors are borrowing to buy flip houses. Here's a look at the 12 states with the largest share of financing for flipping houses.

September 20 -

Along with the temperature, the housing market in the Twin Cities is beginning to cool.t

September 19 -

A midyear report says the average vacancy rate across the Twin Cities metro during the second quarter was just 2.4%, down slightly from last year and the previous quarter.

August 28 -

Housing construction in the Twin Cities metro rose nearly 17 percent in July, but most of that gain was apartments.

August 3